Following the most significant single-day cryptocurrency market crash triggered by new US tariff threats against China, Bitcoin is once again demonstrating its capacity for recovery. On Monday, the world’s leading cryptocurrency surged above $114,000, recouping some losses after a liquidation event totaling nearly $19 billion. This volatility serves as a stark reminder of how closely digital assets are now intertwined with global economic and political developments.

The crash was caused by a fresh escalation in tensions between Washington and Beijing. US President Donald Trump announced plans to impose tariffs of up to 100% on Chinese goods and tighten export controls on key technologies. This announcement triggered a mass exodus of investors from risky assets across both traditional and cryptocurrency markets. More than 1.6 million trading accounts were liquidated within a single day, marking an unprecedented event in cryptocurrency market history. Exchanges including Binance, Bybit, and Hyperliquid recorded record liquidation volumes, while Bitcoin momentarily fell below $104,000, losing nearly 20% from local highs.

Nevertheless, within just a few days, the situation stabilized. More moderate statements from Trump over the weekend temporarily calmed markets: he stated that there was “no need to worry about China” and that an immediate escalation was not planned. Against this backdrop, Bitcoin managed to bounce from local lows and return above the key $114,000 level. Investors once again noted that cryptocurrencies are increasingly responding to macroeconomic news and behaving like traditional risk assets, losing their former independence from external factors.

Interestingly, amid the general turbulence, institutional players continue to increase their positions. Strategy (formerly MicroStrategy) announced the purchase of an additional 220 BTC worth $27.2 million at an average price of $123,561 per coin. The total volume of its Bitcoin portfolio now stands at 640,250 BTC, valued at approximately $73 billion. According to co-founder Michael Saylor, the average acquisition price of all the company’s coins is around $74,000, and total investments including fees have exceeded $47 billion. This move confirms that long-term investors continue to believe in Bitcoin’s growth despite short-term market turbulence.

Alongside BTC’s recovery, altcoins also came back to life. Ethereum gained nearly 8%, rising above $4,100, XRP grew by 6.3%, and Cardano showed more than 9% gains. Even meme tokens like Dogecoin and $TRUMP posted significant rebounds, indicating an overall improvement in market sentiment.

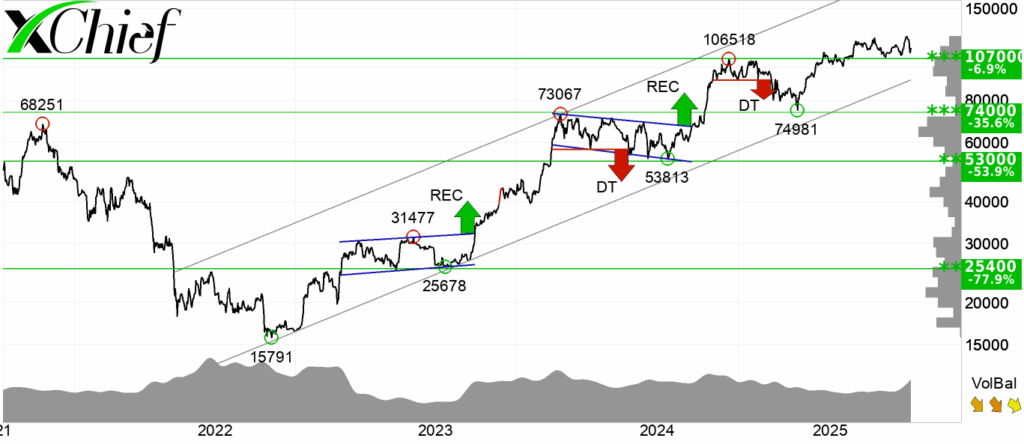

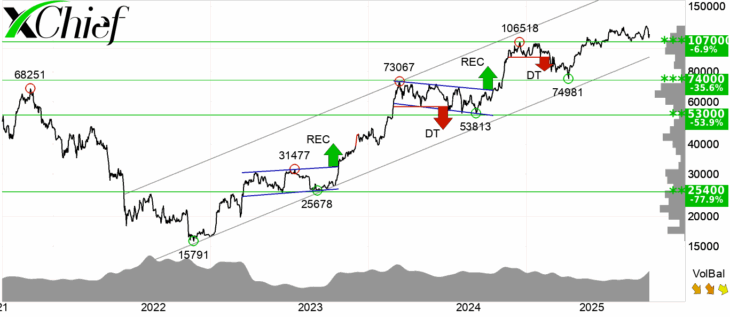

Technical Analysis of BTCUSD

From a technical perspective, despite the local decline, the uptrend structure on the BTCUSD pair remains intact. Quotes continue to hold within the boundaries of a rising channel and above key support around $107,000. The current pullback appears to be more of a corrective move within the broader bullish impulse. If the asset manages to consolidate above $115,000, the next target will be the $120,000–122,000 zone.

Thus, fundamental factors have temporarily increased volatility, but the long-term bullish outlook for Bitcoin remains intact. Geopolitical risks continue to influence price action, however, strong hands continue to accumulate the asset, which only confirms the resilience and maturity of the current market cycle.