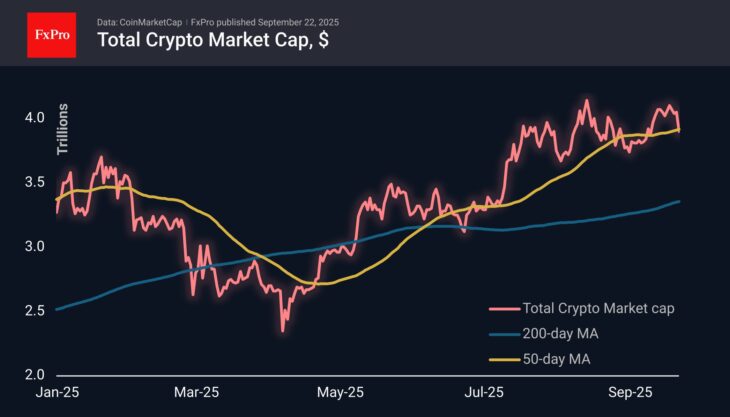

The cryptocurrency market capitalization plunged below $3.9 trillion on Monday morning, marking a 4% drop compared to the previous day. Among the top altcoins, Bitcoin is losing value the least, while the biggest losers include SushiSwap (-13%) and Dogecoin (-11%). This contrasts with gold reaching new highs and silver surging in the morning, indicating investors’ shift toward safe-haven assets after a period of reduced volatility.

On Monday, Bitcoin failed to hold support near $115K, a level bears had been testing since September 13. In recent days, several signals have emerged in the leading cryptocurrency pointing to a shift toward a downward trend. BTCUSD broke out of the upward channel that had been in place since early September, fell below horizontal support, and sharply declined after dropping below the 50-day moving average. This combination of negative technical signals suggests further declines unless there is a fundamental change in financial market sentiment.

By the start of active trading in Europe, Ethereum had fallen to $4000, down from $4500 at the beginning of the day. The price broke below the 50-day moving average for the first time since early July — a troubling technical warning, as the second-largest cryptocurrency tends to react strongly to signals from this indicator.

News Background

According to SoSoValue, the net weekly inflow into spot Bitcoin ETFs dropped to $886.7 million, though it remains substantial. Total inflows since the approval of Bitcoin ETFs in January 2024 have reached $57.72 billion.

In the U.S., inflows into spot Ethereum ETFs decreased to $556.9 million, bringing total inflows since July 2024 to $13.92 billion.

Glassnode reports that the share of Bitcoin supply held by holders for more than seven years has reached a record 14.3 million BTC, up 3% since the start of the year, reflecting growing confidence in Bitcoin’s long-term prospects.

A survey by the crypto exchange MEXC showed that the proportion of investors using cryptocurrencies as an inflation hedge rose from 29% to 46% in the second quarter. Macroeconomic instability, weakening national currencies, and inflationary pressures are driving people worldwide to seek alternative ways to preserve the value of their savings.

The Fusaka hard fork is scheduled to launch on Ethereum’s mainnet on December 3, following deployments on testnets Holesky, Sepolia, and Hoodi, ETH developers announced. A key upgrade will be the implementation of the PeerDAS protocol, which could double the network’s throughput.