The Japanese yen holds a special place in the currency market. For some traders, it represents stability and a “safe haven,” while for others, it means sharp movements and unexpected reversals. Currency pairs with JPY trade differently from most major instruments and require a separate approach. Understanding these features helps avoid typical mistakes and use the yen as a powerful trading tool.

Brief History of the Japanese Yen

The Japanese yen was introduced during the Seiji era and initially equaled 1.5 grams of gold. The gold standard was abolished and reintroduced several times depending on Japan’s economic situation. In May 1953, it gained international currency status, with the IMF setting its parity at 2.5 mg of gold. From 1949 to 1971, the yen’s rate was fixed to the US dollar: 1 US dollar equaled 360 Japanese yen. Through several revaluations linked to the dollar and other world currencies, the yen’s value significantly increased.

As a reserve currency, the Japanese yen traditionally ranked second after the dollar, but its role has somewhat diminished recently. The yen’s share in countries’ gold and foreign exchange reserves is about 4%.

The Japanese Yen on Forex

Since the yen is a freely convertible currency, its Forex rate is determined by supply and demand levels. On Forex, the yen successfully competes with the British pound and Swiss franc, accounting for 12% of total currency market turnover.

Several reasons explain the yen’s popularity on Forex:

- Low Bank of Japan interest rate of 0.1%, allowing the yen to be used as the quote currency in Carry Trade strategy.

- Main yen movements occur during the Asian trading session, which corresponds to nighttime in our time zone, eliminating European news influence on yen dynamics.

- Relative affordability. Buying 1 standard lot of USD/JPY with 1:100 leverage at current quotes costs about $1000.

- The yen’s volatility during the Asian session is high enough for profit.

- Japan is a major global exporter. Accordingly, the Japanese government pursues a policy to lower the yen’s value.

The Japanese yen is traditionally considered a safe-haven currency. During global instability, investors often shift capital to the yen, strengthening it. This is due to Japan’s stable economy and status as one of the world’s largest creditors. Unlike emerging market currencies, the yen is seen as a relatively safe asset, especially during rising stock market risks.

Features of Trading Currency Pairs with the Japanese Yen

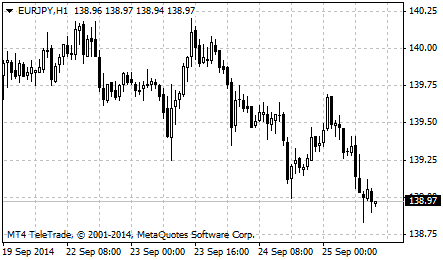

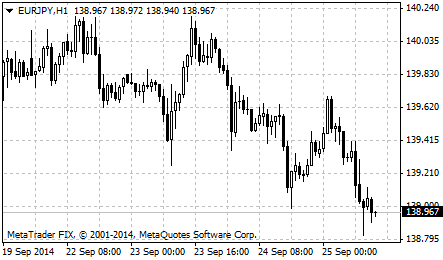

Unlike standard quotes of 0.0001 (four-digit) and 0.00001 (five-digit), yen quotes have two fewer decimals. For example, EUR/JPY quote appears as 138.97 for a four-digit broker and 138.970 for a five-digit broker.

- In currency pairs, the Japanese yen is the quote currency. Positive yen events and economic releases lead to a decline in pairs with this currency, and vice versa.

- The most common Forex pairs with yen: USD/JPY, EUR/JPY, GBP/JPY, and AUD/JPY. All are highly volatile. GBP/JPY price changes can reach 200 pips per session.

- The best time for trading yen pairs is the European session. First, it’s daytime in Europe, Russia, Ukraine, and Belarus—working hours. Second, traders are protected from sharp price changes as the Bank of Japan never conducts currency interventions then.

- When trading yen pairs, focus primarily on export/import volumes, energy prices, inflation indicators, and economic/political events in Japan.

Other Features of JPY Trading

The yen is especially sensitive to global market sentiment shifts. During panic and stock index declines, it typically strengthens. When investors are risk-on and buy stocks and commodities, the yen may weaken. This makes JPY pairs ideal for trading “risk-on” and “risk-off” phase changes.

Technically, yen pairs often show clear impulses and prolonged trends alternating with consolidation. They respond well to support/resistance levels and trend indicators. However, news-driven sharp moves require wider stop-losses and careful position management.

A common mistake among yen traders is underestimating volatility, especially in crosses. Traders often ignore macro factors and Bank of Japan statements, relying solely on technical analysis. Incorrect position sizing due to quoting specifics also leads to unnecessary losses.

Trading JPY pairs suits traders ready to consider both technical and fundamental contexts. These instruments are good for intraday and medium-term strategies but challenging for beginners without volatile market experience. Discipline and clear risk management are crucial here.

Conclusion

Currency pairs with the Japanese yen form a unique Forex segment where macroeconomics, central bank policy, and global sentiments intersect. They offer great opportunities but demand deep understanding of their specifics. For traders willing to study the yen, these pairs can become a reliable and engaging trading direction.