Fundamental market analysis reveals that Bitcoin has faced a notable deterioration in investor sentiment across the United States. The Bitcoin premium on Coinbase, traditionally reflecting demand from retail traders, turned negative in late October and early November. This means that cryptocurrency on the largest American trading platform was trading cheaper than the average global price, a rare occurrence that signals a significant decline in risk appetite. This trend coincided with a four-day period of negative premium—the longest since mid-August—and was accompanied by capital outflows from Bitcoin exchange-traded funds traded in the United States.

October Broke Bitcoin’s Course

October events proved to be a turning point: following a volatility spike at the beginning of the month and a brief sharp decline in Bitcoin quotes, the cryptocurrency lost approximately 5%, breaking a seven-year streak of gains in “Uptober,” when October has historically been a month of positive dynamics for cryptocurrencies. Even after the conclusion of a trade deal between the United States and China, cryptocurrency prices remained under pressure, and signals about a possible tightening of Federal Reserve policy intensified investor caution. Against this backdrop, Bitcoin traded around $107,636, demonstrating weakness compared to riskier assets.

A similar picture was observed in the altcoin market: Ether fell 4.2% to $3,739.94, BNB declined 4.7% to $1,040.79. XRP, Solana, and Cardano lost between 4% and 7% of their value, while meme tokens, including Dogecoin, fell nearly 7%. Even individual tokens, such as $TRUMP, demonstrated extremely volatile movement, failing to maintain recent growth impulses.

Technical Analysis

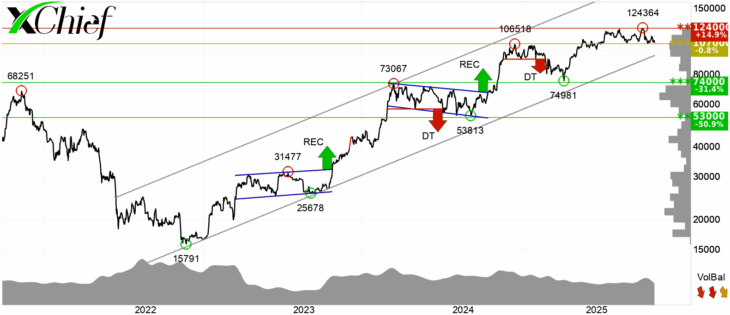

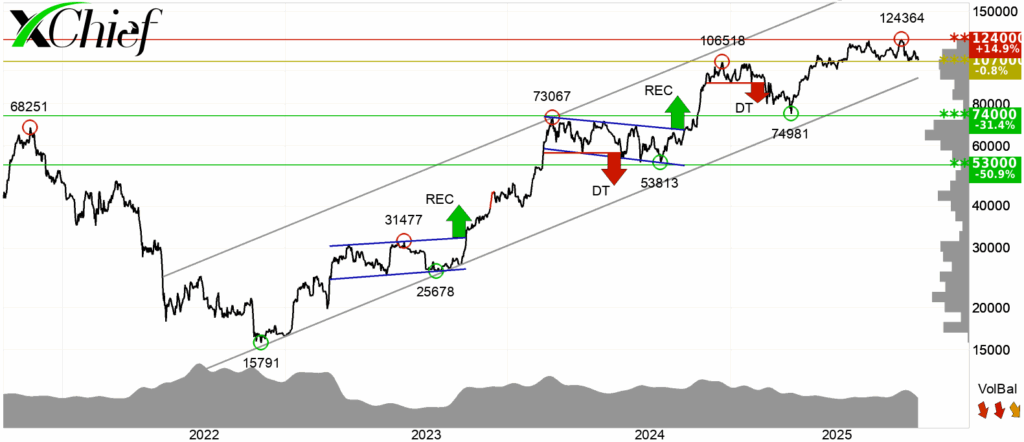

Technical market analysis remains ambiguous for now. On one hand, Bitcoin’s price is holding within a long-term ascending channel, which preserves the scenario of potential growth. On the other hand, two unsuccessful attempts to break through resistance at the $124,000 level and intensifying bearish pressure on the $107,000 support create risks of further decline.

A breakdown of the lower boundary of this range could open the path to more significant corrections in the $74,000 area. Thus, the market demonstrates contradictory signals: investors are forced to balance between maintaining their position in the long-term trend and caution before possible escalation of downward pressure.