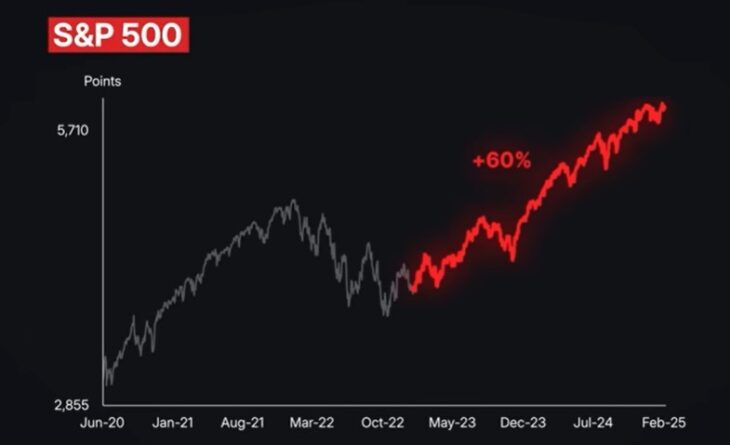

Over the past two years, the U.S. stock market has surged by 60%. By comparison, achieving such returns took 20 years between 1965 and 1985, and 15 years between 1996 and 2011. This marks one of the most powerful rallies in the history of the American market.

However, despite this unprecedented growth, 30% of Americans still live paycheck to paycheck—a record high. Consumer sentiment in the country is at one of its lowest points in 30 years, comparable to levels seen during the financial crisis. Yet, this is not a banking crisis but rather a wealth inequality crisis.

Today, money is flowing at record speeds from the real economy into financial assets, fueling the stock market’s rise.

What’s Next? Can the Market Keep Rising?

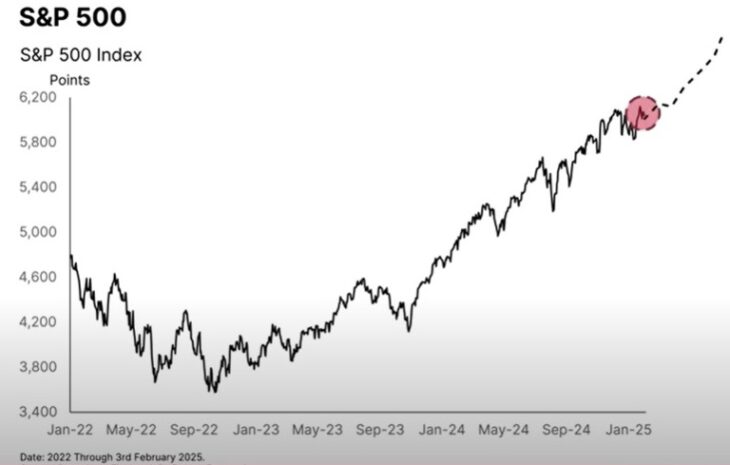

A 60% stock market increase over two years has only happened a few times in U.S. history—in 2021, 2011, 1996, and 1987. In three of these four cases, the market was at a peak, followed by a correction of about 20%.

If the market dropped 20% now, it would return to the late 2021 peak. However, major market corrections don’t happen without an economic trigger.

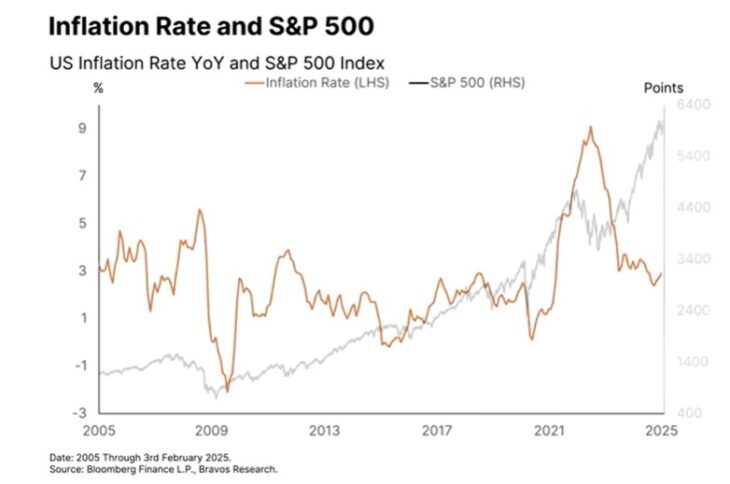

The key factor determining whether the market continues to rise or reverses is inflation.

In 2021, 2011, and 1987, inflation sharply rose from low levels to 4% or higher, after which the stock market corrected. Conversely, in 1996, inflation was falling, and the market continued to climb until 2000.

Currently, inflation in the U.S. is also trending downward, supporting further stock market growth. Many analysts predicted another surge in prices, but recent data indicates inflation is continuing to decline.

This trend is especially evident in rent prices, which are falling for the first time since the financial crisis. This is significant because rent payments make up a large portion of the Consumer Price Index (CPI), the main measure used to calculate inflation.

Therefore, if the current trend persists, low inflation could allow the stock market to keep rising at least until mid-2025.

Why Is Inflation Low and What Does It Mean for the Economy?

It’s important to understand that low inflation does not mean the economy is healthy. On the contrary, experts at Bravo’s Research believe it signals problems in an economy suffering from high inequality.

- American consumers have low confidence in the economy.

- Household savings are shrinking while debt levels are rising.

- People simply cannot afford higher payments without massive government support, like the aid provided after the COVID-19 pandemic.

What’s Happening with Corporate Earnings?

While the average American faces financial struggles, corporate profits are at historic highs. Currently, 133% of U.S. GDP growth is driven by corporate earnings. In other words, all economic growth is turning into corporate profits, which are then reinvested into financial assets, pushing the market upward.

How Should Investors Trade in This Environment?

According to Bravo’s Research, as long as inflation remains low, the stock market can continue to rise. They have already opened new long positions in U.S. stocks with high growth potential in the coming weeks.

Key Takeaways

- The U.S. stock market has grown 60% in two years—a rare occurrence in history.

The main factor influencing continued growth is inflation. If it stays low, the market could rise at least until mid-2025.

Low inflation is not a sign of a healthy economy but a consequence of inequality: household savings are falling while corporate profits grow.

Continued stock market growth is expected in the coming months, with new positions already opened. - As long as inflation remains controlled, the U.S. stock market has a strong chance to keep rising despite fundamental economic challenges.

The original video is presented by Bravo’s Research: