Gadi Scalping Trading Strategy is designed for scalping in the forex market. Trading uses moving averages and volume indicator confirmation on low timeframes M5 and M15. Trades can be made on any currency pairs, but preferably during periods of sufficient volatility.

Input Parameters

- Currency pairs: any

- Timeframe: M5, M15

- Trading time: London, New York

- Risk management: after calculating stop-loss, choose lot size so that risk is no more than 2-5% of deposit per trade

Indicators Used

For analysis on the chart, install the following standard and custom indicators:

- EMA (21)

- 2MA Crossover

- Fib pivot 2

- JE bar Trend

- Spread Indicator

- Gadi Tick Volume

They can be downloaded in the archive at the end of the article.

Installing Indicators and Strategy Template

To simplify installing indicators on working charts, use the template also in the archive at the end of the article. For this:

- Unpack the archive with templates and indicators.

- Copy indicators to the MQL4 -> indicators folder.

- Copy the template to the templates folder.

- Restart the terminal.

- Open the chart of the desired currency pair.

- Apply the template named Gadi Scalping.

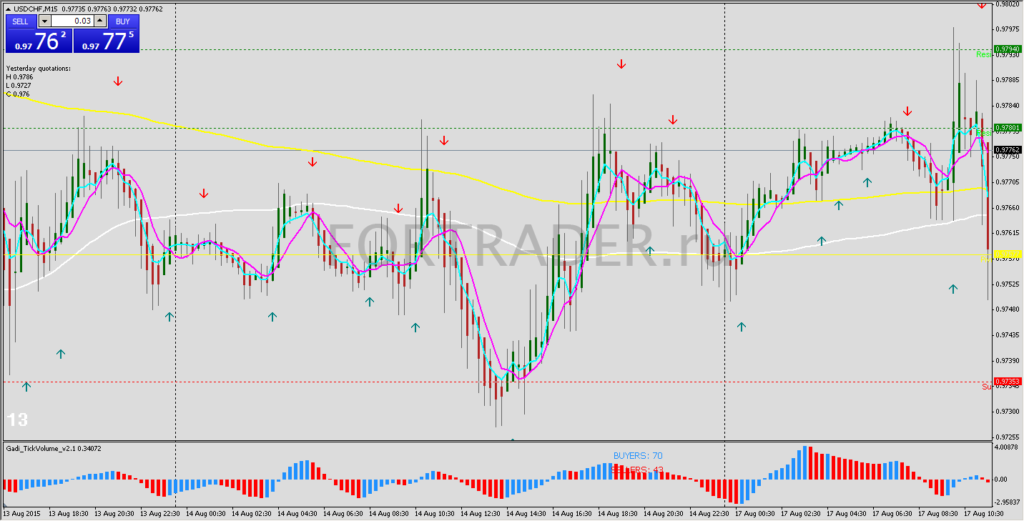

The chart after correct installation should look like this:

Template of the Gadi Scalping trading strategy

Template of the Gadi Scalping trading strategy

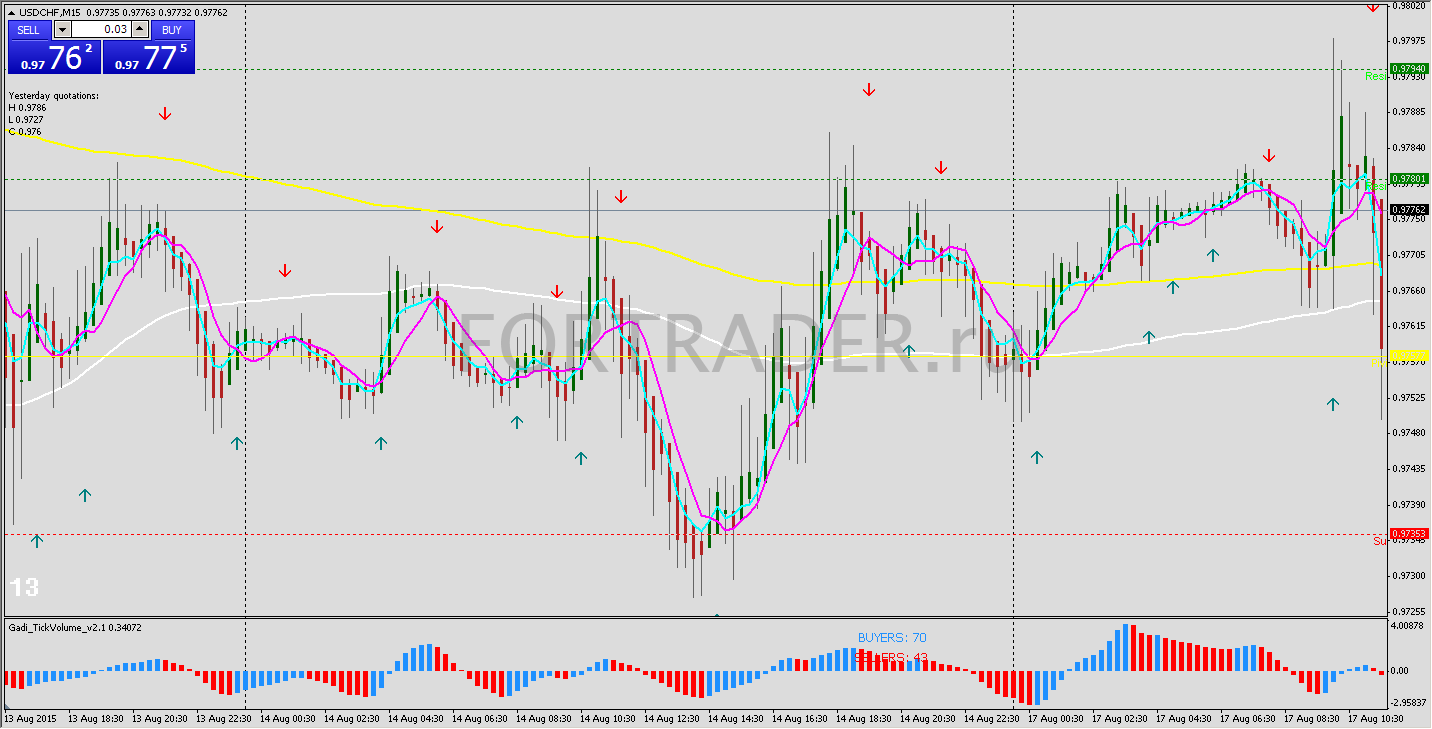

Buy Signals

To open a Buy trade, wait for the following signals from the indicators:

- Price is above the yellow and white moving averages.

- A green upward arrow appears.

- On the volume indicator (bottom window), a blue bar is displayed.

- Stop-loss is placed slightly below the nearest local minimum.

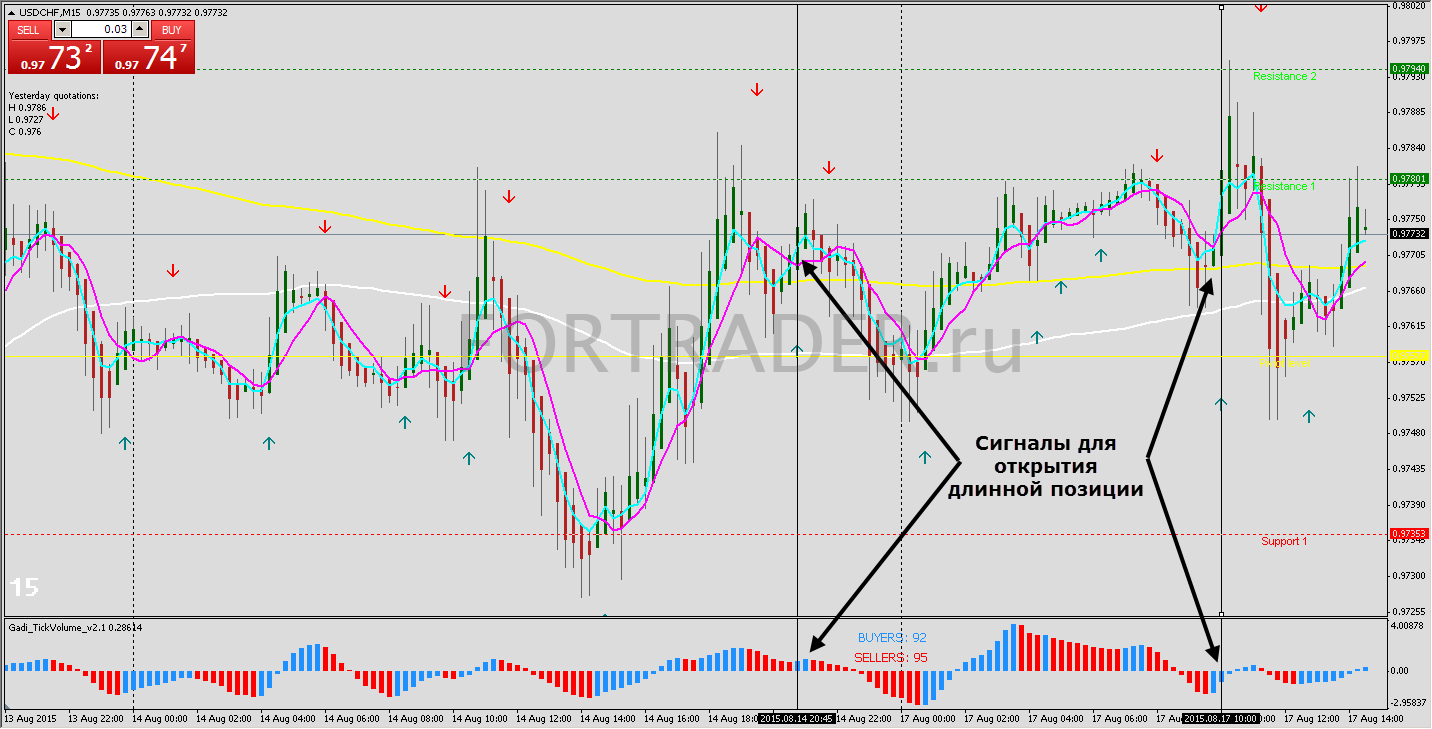

Examples of long trades

Examples of long trades

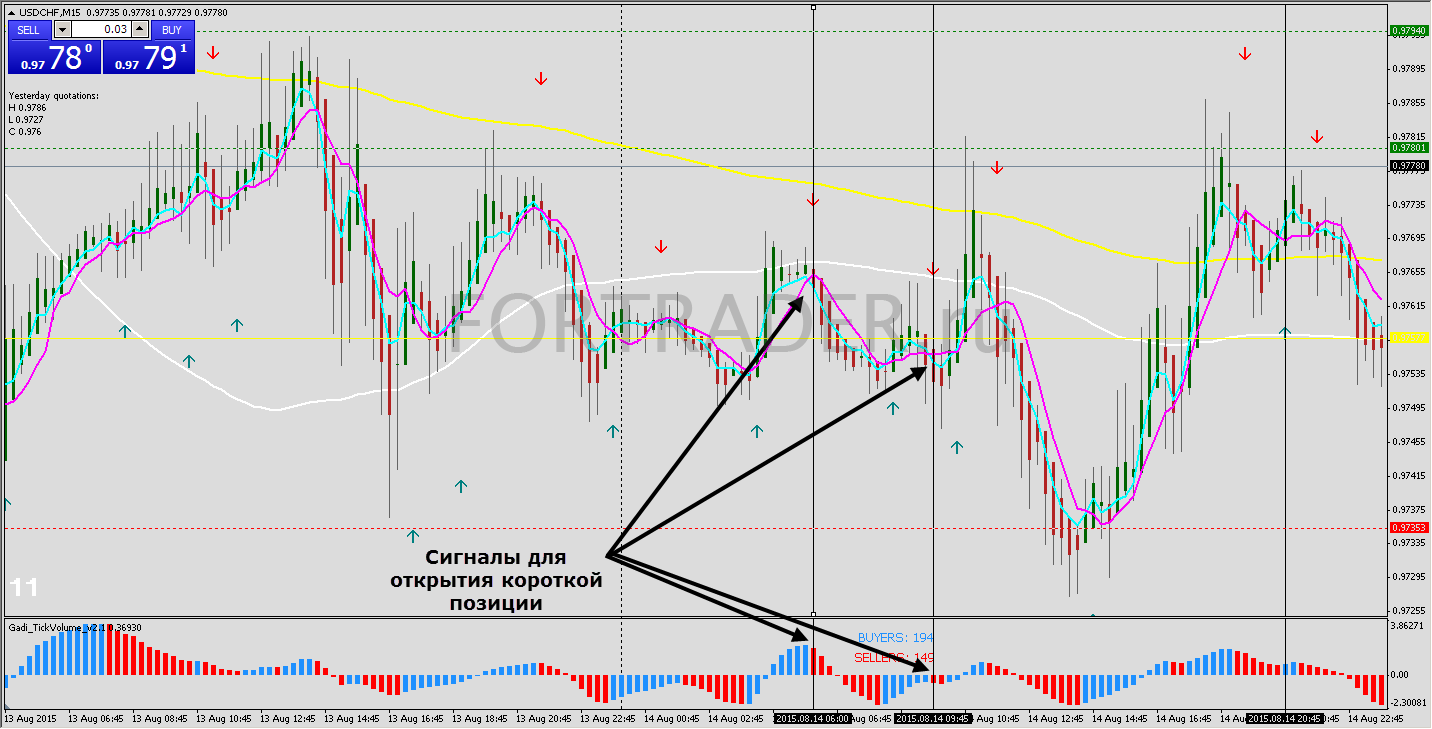

Sell Signals

For opening Sell trades, the following signals must be present:

- Price is below the yellow and white moving averages.

- A red downward arrow appears.

- On the volume indicator, a red bar is displayed.

- Stop-loss is placed slightly above the nearest local maximum.

Examples of short trades

Examples of short trades

Trade Closing Methods

- Fixed take-profit.

- Trailing stop.

- Closing the trade at a significant support/resistance level.

According to ForTraders.org experts, the Gadi Scalping trading strategy is a fairly balanced system for scalping, using modified versions of standard MetaTrader 4 terminal indicators. You can also experiment with replacing them with other modifications for even greater efficiency.

Download template and indicators