A scalping trading strategy based on Renko charts. This system can also be used with range bar charts. The conditions are highly flexible and the rules are straightforward, making this trading system applicable even for beginner traders.

Input Parameters

To start trading, you will need:

- Currency pairs: any

- Timeframe: Renko charts are used

- Trading hours: London, New York

- Risk management: after calculating your stop-loss, select a lot size so that your risk does not exceed 2-5% of your deposit per trade

Price Chart Setup

To quickly and correctly install the indicators on your chart, use the template that can be downloaded in the archive at the end of the article. For installation:

- Extract the archive.

- Copy the expert advisor to the MQL4 → experts folder.

- Copy the indicators to the MQL4 → indicators folder.

- Copy the template to the templates folder.

- Restart the terminal.

- Open the chart of the desired currency pair.

- Switch to the timeframe.

- Activate “Auto-trading” mode.

- Attach the RenkoLiveChart_v2 expert advisor to the chart (a smiley face should appear in the upper right corner). In the RenkoBoxSize parameter, set the value to 5 or higher.

- Go to File → Open offline and select the chart of your instrument created by the expert for the M timeframe.

- Apply the template named renkoscalpsystem.

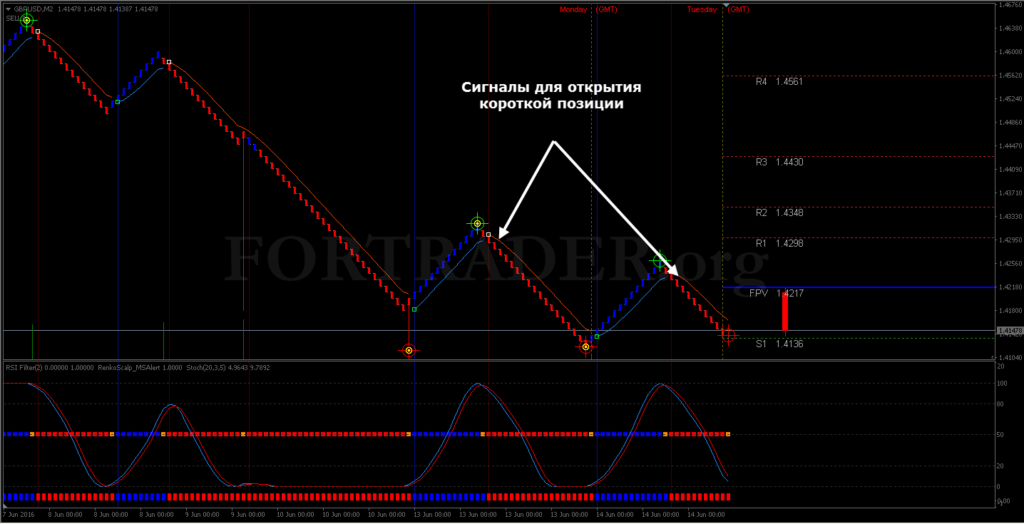

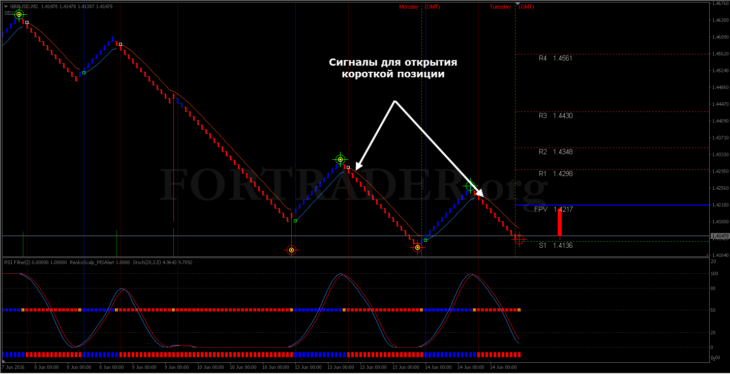

The chart should ultimately look like this:

Renko Scalping trading strategy template

Renko Scalping trading strategy template

Buy Signals

To open a Buy order, wait for the following conditions to be met:

- The current daily candle is bullish.

- The RenkoScalp_Signal indicator signals a buy.

- The Stochastic is just beginning to exit the oversold zone.

- Blue squares appear on the RenkoScalp_MSAlert and Filter indicators (lower window).

- Place the stop-loss below the nearest local minimum.

Examples of buy trades

Examples of buy trades

Sell Signals

To sell, you need the following trading signals:

- The current daily candle is bearish.

- The RenkoScalp_Signal indicator signals a sell.

- The Stochastic is just beginning to exit the overbought zone.

- Red squares appear on the RenkoScalp_MSAlert and Filter indicators.

- Place the stop-loss above the nearest local maximum.

Examples of sell trades

Examples of sell trades

Trade Closure Signals

In this forex trading strategy, you can close a trade in three ways:

- Fixed take-profit.

- Signal in the opposite direction.

- At the Pivot level.

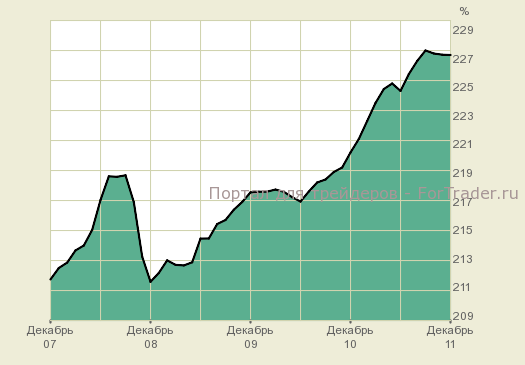

The advantage of the Renko Scalping forex trading strategy is undoubtedly the use of Renko charts, which eliminates price noise and provides traders with more accurate trading signals. The strategy rules are simple and clear, making it accessible even to beginner traders. We recommend opening positions exclusively in the direction of the current trend.

Download template and indicators