On financial markets, it’s not so important how many indicators you have installed or how advanced your trading terminal is. What matters much more is how quickly you can make decisions amid a constant flow of information. That’s why trading signals have long become one of the most popular tools among beginner traders: they provide clear guidance, filter out unnecessary noise, and help focus on the most important things—timing your entry and managing risk.

However, there are many myths surrounding external forecasts. Some consider them a “quick way to make money,” while others see them as risky. As usual, the truth lies somewhere in between. Trading signals can help newcomers accelerate their learning and structure their trading… but only if you understand how they work, where they come from, and why each signal is just a part of a strategy, not a ready-made recipe for profit.

In this article, we’ll explore what lies behind Forex signals, how to distinguish quality recommendations from random alerts, and how to use others’ advice to improve discipline rather than trigger impulsive trades.

Contents

- What are Forex trading signals

- What are trader-based Forex signals based on

- Types of trading signals

- Where to get trading signals

- Why signals can be unprofitable

- How signals can become a learning tool

- What makes Forex signals special

What are Forex trading signals

Forex trading signals are timely recommendations for buying or selling currencies (opening or closing positions) provided by experienced traders. Usually, speculators receive Forex signals from individual professionals or broker companies, either for free or for a fee.

A good signal always rests on three pillars: idea, risk, and statistics.

- The idea explains what the author sees: a breakout of a level, the emergence of a trend, or a strong pullback.

- Risk defines where the trading idea stops making sense and where the trade should be closed.

- Statistics show that such entries, on average, perform better than random ones.

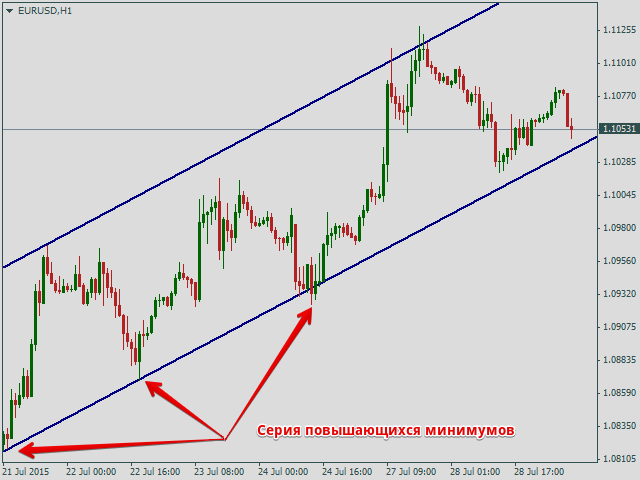

What are trader-based Forex signals based on

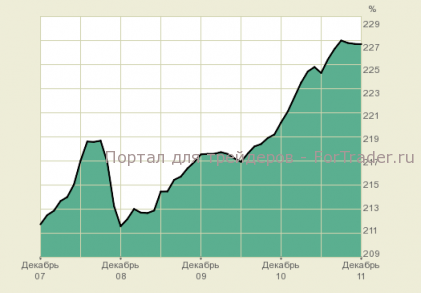

Trader-based Forex signals are built on a specific trading strategy that has delivered a certain percentage of profit over time for the author. When offering their trading system, the provider usually shares their results in the form of a statement or monitoring.

The author can generate recommendations manually, the traditional way, or rely on an automated advisor. Algorithmic signals work differently: they are based on a set of clear rules that do not change under the influence of fear or greed. The machine doesn’t worry, doubt, or second-guess itself. But it can still make mistakes—there are no 100% profitable trading strategies.

Types of trading signals

All trading signals can be divided into two categories:

- Signals for manual market entry

Providers can send manual signals via email, Skype, SMS, or similar methods. The main drawback of this type is that a significant amount of time may pass between receiving the signal and opening the order, during which the price may move far from the “signal” entry point. This is especially inconvenient when trading with market orders rather than pending orders. On the other hand, manual signals are good because you can skip them if you disagree with the provider’s forecast.

- Signals for automatic position opening

Signals for automatic position opening are the most popular and convenient. The subscriber sets up certain parameters once, such as order volume, and then everything happens automatically: when the signal provider opens an order, the same order is opened on the subscriber’s account. The downside is the need for a stable internet connection and uninterrupted power supply. Otherwise, signals may be missed, which will undoubtedly affect trading results. This issue can be solved by using a VPS server.

Where to get trading signals

Forex trading signals can be delivered in various ways: on public websites, news feeds, forums, blogs; individually via email, messengers, or signal copiers. There are also specialized services for signal distribution. There are free trading signals published by active traders on forums for discussion purposes.

Why signals can be unprofitable

Signals start to erode deposits when traders stop thinking for themselves. A beginner sees a recommendation and treats it as a promise of results. They don’t analyze the context, don’t pay attention to risk management, and don’t check the quality of the level. But the market doesn’t care who gave the signal—the only thing that matters is that the price can go anywhere.

Successful speculators, on the other hand, use signals as a source of ideas. They don’t blindly copy entries but check them through the lens of their own system. A signal becomes a reason to open the chart and notice something that might otherwise have been missed. Only then do they make their own decision, not one imposed from outside.

How signals can become a learning tool

If you treat signals not as a “get rich quick” button but as material for analysis, their value increases dramatically. You see someone else’s logic, observe where the author sets stops, which levels they consider important, and why they chose a particular entry point. Over time, you start to notice patterns: which setups work more often, which pairs perform better at certain times of day, which models break down under news pressure.

In this way, trading signals transform from a crutch into a growth tool. When you don’t just repeat someone else’s trade but analyze it before and after, you grow as a trader. Gradually, someone else’s perspective stops being your main guide. Instead, you start giving yourself signals.

What makes Forex signals special

The best trading signals are those published in real time and quickly delivered to the trader, as the profit percentage in the Forex market directly depends on the speed of decision-making.

When using signals, it’s important to remember the time delay between the signal provider’s trade and the user’s execution, which arises during information transmission. A significant lag can affect trading results.