Market Cycle Trend Trading Strategy is based on the proprietary Market Cycle indicator and the reversal pin bar pattern. The strategy is discussed on the forexfactory.com forum.

Entry Parameters

- Currency pairs: any.

- Timeframe: H1.

- Trading time: any.

- Risk management: after calculating the stop-loss, choose a lot size so that the risk does not exceed 2-5% of the deposit per trade.

Chart Setup

- Unpack the archive.

- Copy the template to the templates folder.

- Copy the indicators to the MQL4 -> indicators folder.

- Restart the terminal.

- Open the chart for the desired currency pair.

- Apply the template named Market Cycle.

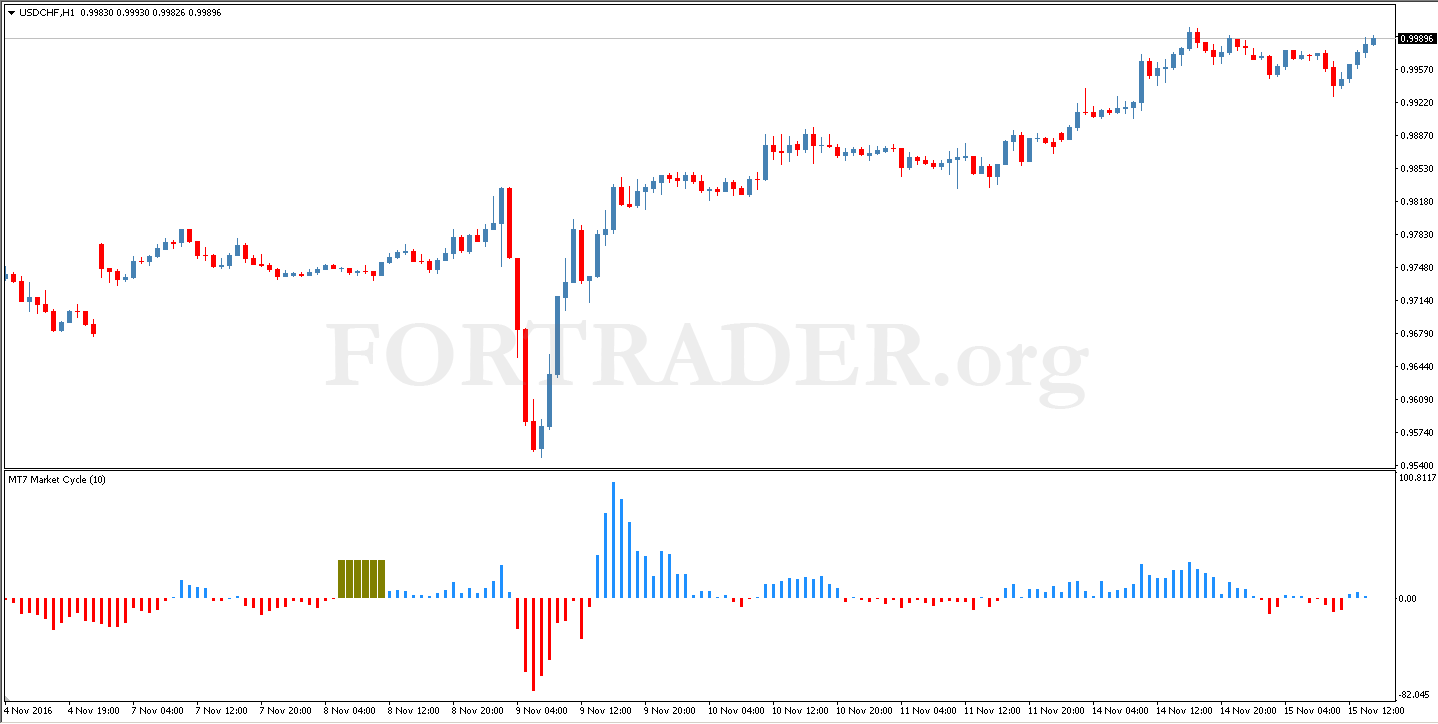

The chart should look like this:

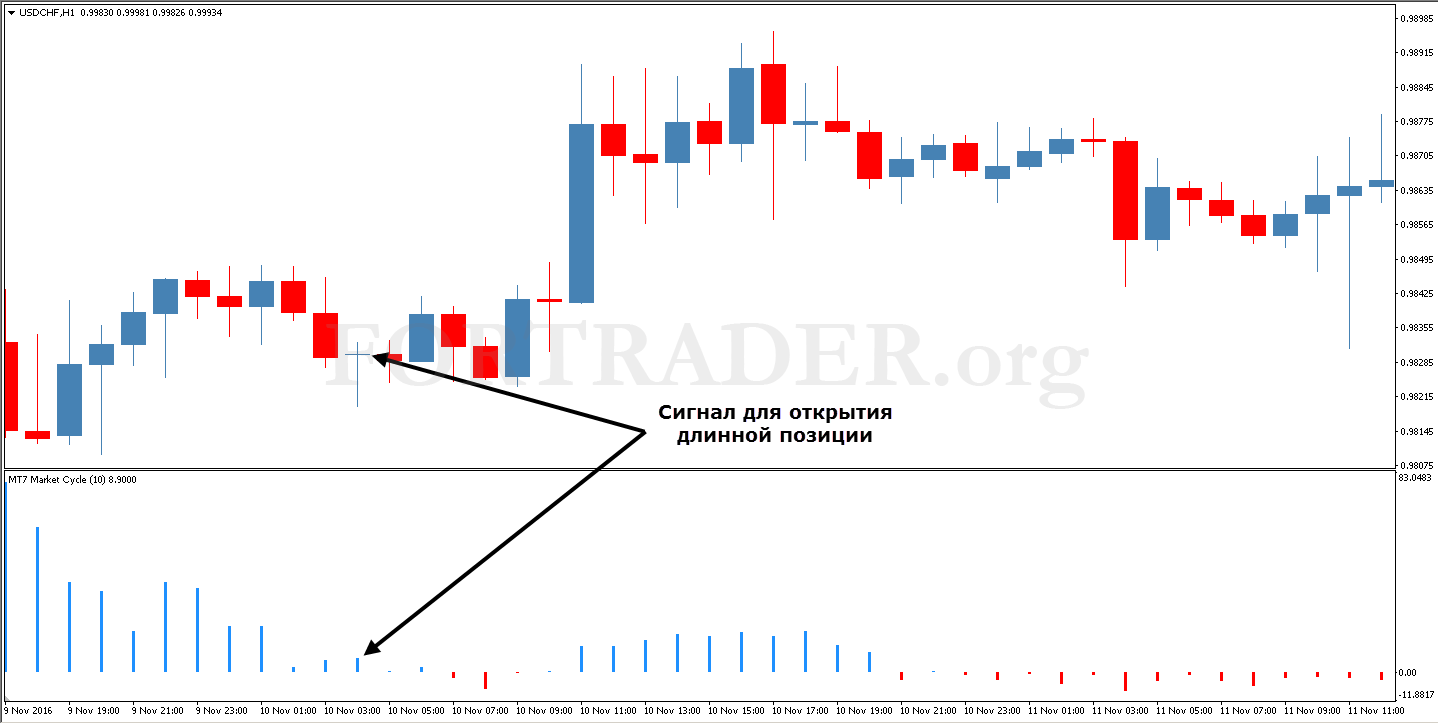

Signals for Opening a Long Position (Buy)

- The Market Cycle indicator is above the zero level and blue.

- A bullish pin bar has formed: a candle with a small upper shadow and a large lower shadow; the body is several times smaller than the lower shadow; the candle itself can be either bullish or bearish.

- The candle before the pin bar is bearish.

- The pin bar’s low is lower than the previous candle’s low.

- Place the stop-loss just below the pin bar or the nearest local minimum.

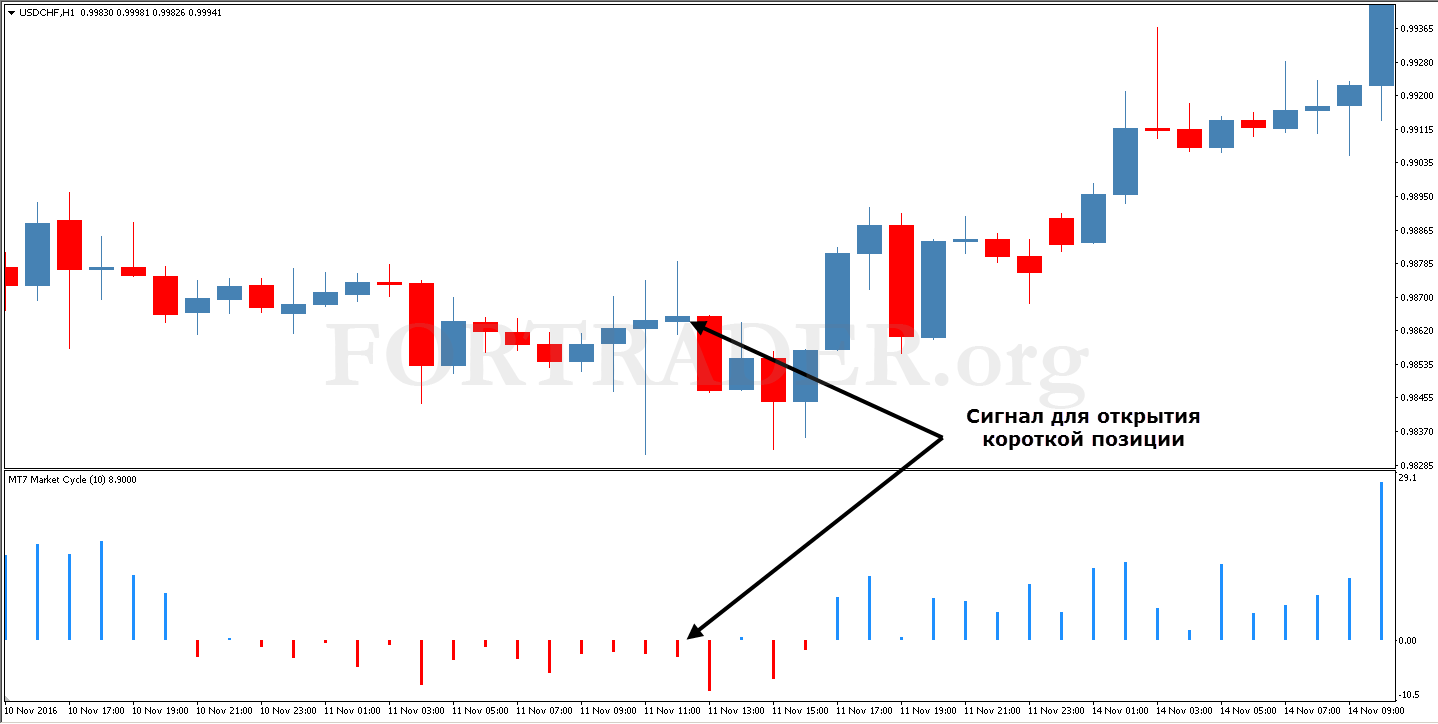

Signals for Opening a Short Position (Sell)

- The Market Cycle indicator is below the zero level and red.

- A bearish pin bar has formed: a candle with a large upper shadow and a small lower shadow; the body is several times smaller than the upper shadow; the candle itself can be either bullish or bearish.

- The candle before the pin bar is bullish.

- The pin bar’s high is higher than the previous candle’s high.

- Place the stop-loss just above the pin bar or the nearest local maximum.

Market Cycle trading strategy looks quite interesting and unusual. However, it may cause difficulties, especially for beginner traders, since not everyone is familiar with the Price Action method, of which the pin bar is a key element. Therefore, to use the Market Cycle strategy effectively, it is necessary to study Price Action techniques in advance. It is possible that the accuracy of the strategy’s trading signals can be improved by adding additional trend indicators and tools designed to identify pin bars.

Download the template and indicators