cTrader has established itself as one of the most intuitive and technologically advanced platforms for forex trading. Traders appreciate its sleek interface, rapid execution, and powerful charting tools that cater to both novices and seasoned professionals.

Unlike traditional legacy platforms, cTrader delivers a modern terminal experience: user-friendly, visually appealing, and highly adaptable.

What Makes cTrader Unique

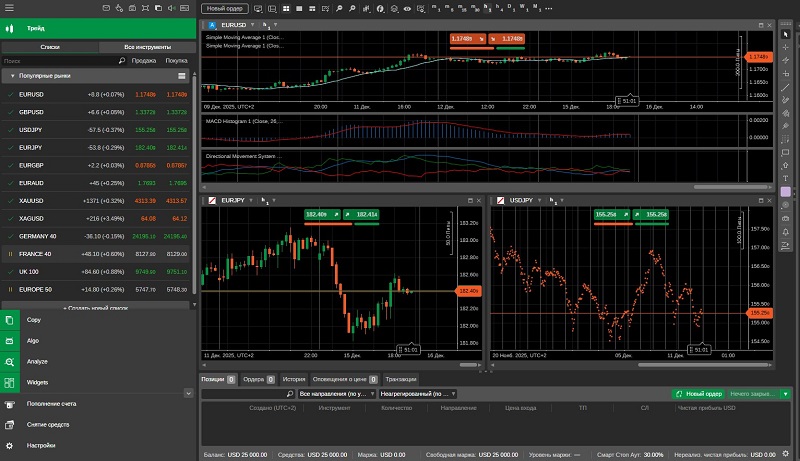

The platform excels through its precise attention to detail. Its interface minimizes time spent navigating functions, allowing more focus on market analysis. Features like customizable charts, streamlined window management, multi-monitor compatibility, a comprehensive order book, and swift order execution position cTrader as a professional-grade trading solution.

Much of the platform’s analytical strength stems from cTrader indicators—built-in and custom technical tools for evaluating trends, momentum, volatility, and reversal opportunities. Every indicator offers full customization, including periods, colors, calculation methods, and templates, which can be saved in personal setups to enhance technical analysis.

Working with Charts and Strategies

cTrader’s charting capabilities are remarkably user-friendly. Traders can seamlessly switch chart types and timeframes, while adding price levels, trendlines, and other annotations with ease. Indicators are applied in one click and configured just as simply.

This setup supports thorough visual analysis and forms the backbone of a robust trading system. For example, a trader could use a moving average for trend direction, RSI for entry signals, and MACD for reversal confirmation—all within a fluid, uncluttered workflow.

Algo Trading

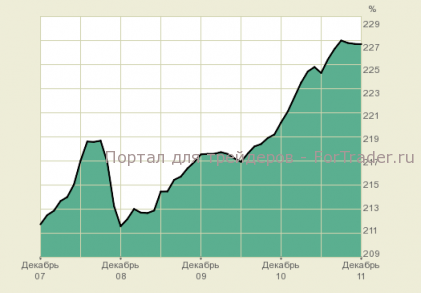

The platform also shines in automation via the cTrader Automate module (previously cAlgo), where users create trading robots and custom indicators in C#, backtest them on historical data, and fine-tune parameters.

This functionality supports not just fully automated strategies but also hybrid approaches blending manual and algorithmic elements. Numerous traders build algo systems around signals from cTrader indicators, transforming ideas into operational strategies.

Risk Management, Execution, and Some Details

A key strength of cTrader is its robust risk management features. Stop-loss and take-profit orders are set intuitively and accurately. Tools include precise position sizing, a Smart Stop-Out to safeguard accounts, and a clear trade history, simplifying capital protection.

ECN execution ensures fast fills without requotes, crucial for day traders.

Ultimately, cTrader transcends a basic terminal—it’s a comprehensive ecosystem for analysis, trading, and automation. Its appeal comes from blending ease of use, rich features, and adaptability. Mastered properly, it serves as a trader’s go-to environment: dependable, speedy, and highly efficient.

Success with cTrader hinges on systematically leveraging its tools, particularly those providing the most precise, actionable signals.