cTrader has long earned a reputation as one of the most user-friendly and technologically advanced environments for the forex market. Traders value it for its modern interface, fast execution speed, and sophisticated charting tools suitable for both beginners and experienced professionals.

Unlike many legacy platforms, cTrader feels like a next-generation terminal: intuitive, visually clean, and technically flexible.

What Makes cTrader Unique

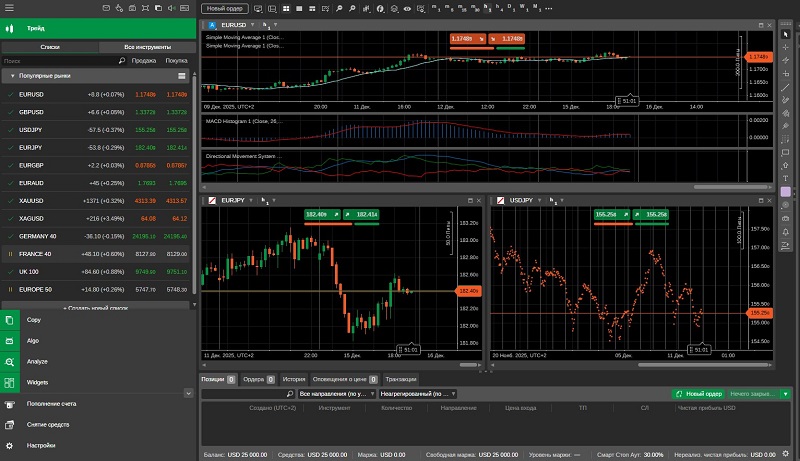

The platform’s strength lies in the meticulous attention to detail. The interface is designed so that traders spend less time searching for functions and more time analyzing the market. Highly customizable charts, efficient window management, multi-monitor support, a deep order book, and fast order execution — all these elements make cTrader a truly professional trading tool.

A significant part of the platform’s analytical power comes from cTrader indicators — built-in and custom technical tools used to analyze trends, momentum, volatility levels, and potential reversal points. Each indicator can be fully customized: periods, colors, calculation methods, and templates can all be adjusted and saved as part of personal study sets. This greatly expands the platform’s technical analysis capabilities.

Working with Charts and Strategies

Charting in cTrader is exceptionally convenient. Users can easily switch between chart types, timeframes, and add price levels, trendlines, and other technical annotations. Indicators are added with a single click and are just as easy to configure.

The platform enables effective visual analysis and supports building a complete trading framework around it. A trader might use a moving average to define trend direction, apply RSI to identify entry points, and rely on MACD to confirm potential reversals. The entire workflow is smooth, logical, and free from unnecessary clutter.

Algo Trading

Another strong aspect of the platform is its automation capabilities. Through the cTrader Automate module (formerly known as cAlgo), traders can develop trading robots and custom indicators using C#, test them on historical data, and optimize their parameters.

This unlocks opportunities not only for fully mechanical strategies but also for partial automation of manual approaches. Many traders rely on signals generated by cTrader indicators as the foundation for algorithmic trading systems, turning conceptual ideas into fully functioning strategies.

Risk Management, Execution, and Some Details

One of cTrader’s major advantages is its thoughtful approach to risk management. Stop-loss and take-profit levels can be placed intuitively and precisely. The platform includes accurate position size calculations, a Smart Stop-Out mechanism that prevents the account from being wiped out, and a clear, well-structured trade history — all of which make capital management substantially easier.

Fast execution and the use of an ECN model help avoid requotes and ensure efficient trade handling, which is particularly important for intraday traders.

So, cTrader is more than just a trading terminal — it is a complete ecosystem for market analysis, trading, and automation. Its power lies in the combination of usability, deep functionality, and flexibility. When used correctly, it can become a trader’s primary working environment: reliable, fast, and exceptionally convenient.

And the key to successful trading with cTrader is the ability to use its features systematically — especially the tools that deliver the most accurate and actionable signals.