Fundamental analysis identifies various factors influencing the exchange rate. The significance of these factors in justifying market fluctuations varies. At the end of the last century, investors closely monitored indicators of money supply and budget deficits; in the first half of this century, they were replaced by the state of the trade balance and the dynamics of interest rates; currently, the world’s attention is focused on external debt and the volume of government borrowing.

Nevertheless, it should be considered that all fundamental factors are closely interconnected, and to forecast exchange rate dynamics in the medium or long term, it is necessary to understand this interrelationship. The interest rate differential can help with this.

It represents the difference between the key interest rates of central banks, which are an important tool of monetary policy. For example, if the European Central Bank changes the refinancing rate, it directly affects the levels of interest rates on loans, deposits, and other money market instruments.

Impact of Interest Rates

To understand the mechanism of such a regulator’s decision on the exchange rate under normal conditions, one can draw parallels with real life. If we have savings placed in one commercial bank, and another bank nearby increases its deposit interest rate, making it higher than our current deposit rate, it makes sense to close it and switch to the neighboring bank. It is assumed that the reliability of the banks in question is the same.

International investors are just like regular people, so under normal conditions, if one of the central banks raises the interest rate, increasing the yield on money market instruments, they start prompting capital flows from one country’s economy to another. But to purchase more profitable assets, it is necessary to buy the national currency.

Thus, an increase in the interest rate differential, all else being equal, leads to an appreciation of the country’s currency. The phrase ‘all else being equal’ means the comparability of the main macroeconomic indicators of the two economies being analyzed, primarily inflation and unemployment levels. It is known, for example, that in many developing countries, a significant rise in the consumer price index necessitates raising the refinancing rate. And this does not indicate increased interest from foreign investors in investing in such a country’s economy. After all, ‘the banks must have the same degree of reliability.’

Nevertheless, even in countries at comparable levels of development, an increase in the interest rate differential does not always lead to an appreciation of the national currency. For example, during an economic crisis, a decrease in the differential can lead to currency appreciation. The reason is investors’ desire during this economic cycle phase not to multiply but to preserve their capital. Reduced ‘risk appetite’ increases demand for low-yield currencies characterized by low central bank interest rates. After all, the lower the yield, the lower the risk.

We observed such a situation in 2008 when the mortgage crisis forced investors to seek ‘safe havens’ in US Treasury bonds, which are characterized by high reliability. As a result, demand for the dollar increased, and the euro rate sharply declined.

Thus, to understand the mechanism of the interest rate differential’s impact on the exchange rate, it is necessary to realize what stage of the economic cycle the global economy is in. So, during a downturn and recession, lowering interest rates can lead to an appreciation of the national currency, and conversely, during recovery and expansion, an increase in the differential will contribute to higher quotes.

Looking deeper, one can understand the close interconnection between central banks’ interest rates and key macroeconomic indicators. For instance, in a recent speech by the US Federal Reserve Chairman, issues were raised about the need to keep key interest rates low until 2014.

Republicans criticized the Fed for this decision, which stimulates inflationary processes.

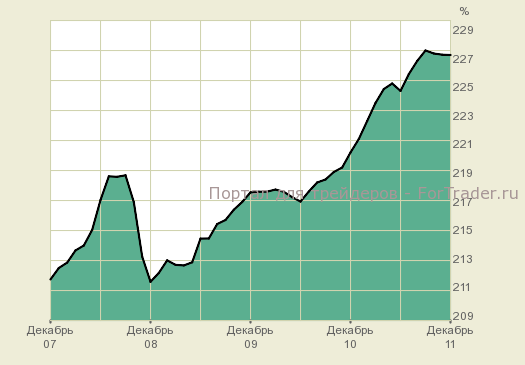

Dynamics of the US Consumer Price Index,%

Indeed, low interest rates on loans are good for consumers, who increase demand for goods and thus stimulate price growth.

However, Ben Bernanke was unwavering: the prevailing federal funds rates are necessary for the economy getting back on its feet; cheap credit is much more important for American businesses that need to increase production volumes. And for that, not only ‘cheap money’ but also labor is needed. Therefore, the conducted monetary policy can positively impact the labor market, whose condition still causes concern. Moreover, a low interest rate reduces government debt servicing costs, which in the US reaches 93-94% of GDP.

Thus, the interest rate differential is closely linked to such macroeconomic indicators as inflation, unemployment, industrial production, and many others.

How Can an Average Investor Use This Knowledge?

The point is that based on the dynamics of fundamental factors, one can predict the central banks’ further actions aimed at stimulating the economy.

The upper chart shows the dynamics of the euro/dollar currency pair, the lower one shows the difference between the interest rates of the European Central Bank and the Fed. As seen from the charts, there is a fairly close relationship between them.

Given that the Federal Reserve plans to keep the key interest rate unchanged until 2014, the further movement of the euro/dollar pair will directly depend on the measures taken by the European Central Bank. And if the issued and planned three-year loans are not enough to stimulate the economy, the regulator will be forced to lower the refinancing rate. I would be interested to hear readers’ opinions on the question ‘what could this lead to?’ and ‘how might this affect the exchange rate?’.

Undoubtedly, building forecasts based solely on the interest rate differential is not advisable, so in my further materials, we will continue studying the fundamental factors affecting the exchange rate.