Bollinger Band Squeeze Reversal System — is a clear example of a channel trading strategy, whose main idea is trading the bounce off one of the Bollinger Bands boundaries. Signals are supported by Moving Average readings. This is a tactic based on standard indicators with straightforward rules, suitable for both beginner and professional traders.

Input Parameters

- Currency pairs: any

- Timeframe: M30 and higher

- Trading time: any convenient

- Risk management: after calculating the stop-loss, choose a lot size so that the risk does not exceed 2-5% of the deposit per trade.

Indicators Used

For market analysis, the author recommends using the following indicators with these parameters:

- Bollinger Bands (120, 1);

- Bollinger Bands (120, 2);

- Bollinger Bands (120, 3);

- Bollinger Band Squeeze;

- Exponential Moving Average (4);

- Exponential Moving Average (8).

Indicator and Strategy Template Setup

To speed up indicator installation on the chart, use the template from the archive at the end of the article. To do this:

- Unpack the archive with templates and indicators

- Copy the indicators into the MQL4 -> indicators folder

- Copy the template into the templates folder

- Restart the terminal

- Open the chart of the desired currency pair

- Apply the template named Bollinger Bands Rebound

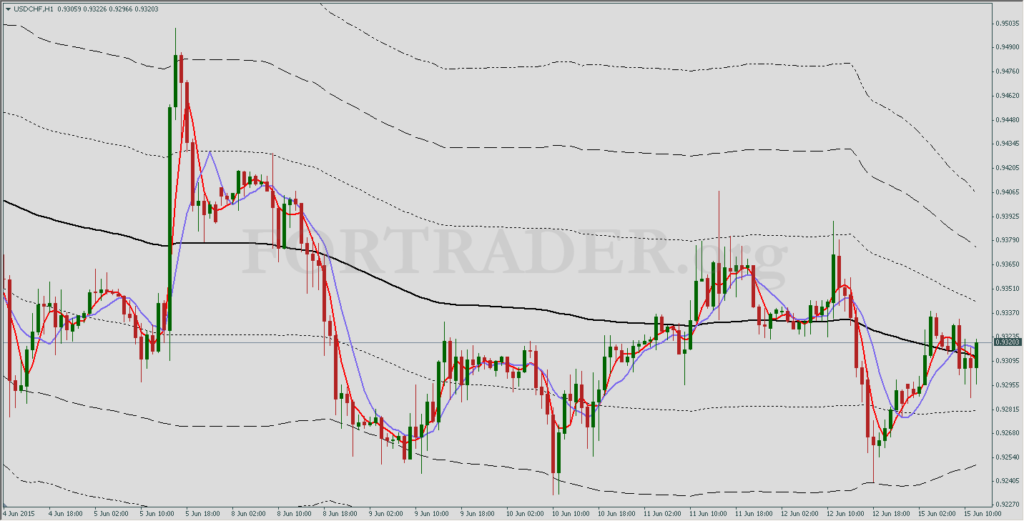

The chart should look like this:

Buy Signals

- Price has bounced off one of the three lower Bollinger Bands boundaries (even better if there is a double bounce)

- The red moving average crosses the middle one from bottom to top

- Stop-loss is placed below the nearest local minimum

Sell Signals

- Price has bounced off one of the three upper Bollinger Bands boundaries

- The red moving average crosses the middle one from top to bottom

- Stop-loss is placed above the nearest local maximum

Trade Exit Options

You can exit a profitable trade using a protective order in different ways:

- Fixed take-profit calculated at a 1:2 ratio (twice the stop-loss size)

- Take-profit at the nearest Bollinger Band boundary in the direction of the trade

In the second case, the stop-loss can be set at half the actual profit-taking order size.

Download strategy templates and indicators