- Dow Jones lifted by Boeing, aussie and kiwi follow stocks higher

- Sterling edges lower as Brexit worries persist

- Gold does its own thing again – swims against the risk-on tide

US stocks close at fresh records; aussie and kiwi climb as well

Another day, another record close for all three major US equity indices, this time with the Dow Jones (+0.34%) leading the pack. The price-weighted index was propelled higher by some gains in Boeing (+2.9%), which has the highest share price in the Dow, and can therefore move the overall index more than any other single stock.

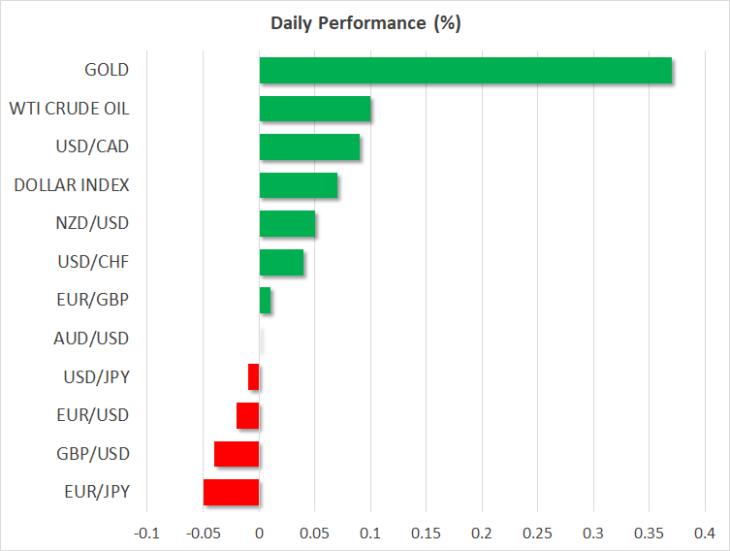

The positive mood also manifested in the FX market, where the aussie and the kiwi charged higher, both of these commodity currencies trying to recover some of their heavy losses from earlier in the year.

The main loser was the British pound, which retreated on what seems to have been a combination of profit-taking on prior long positions after the spectacular rally since October and renewed worries about how the Brexit process will shape up next year. While nothing much has happened since the election, investors are likely looking into 2020 and concluding that the drama and brinkmanship will make a comeback, as it’s almost unfathomable the two sides will reach a full trade deal in just eleven months – with or without good will.

Gold the ‘odd one out’ again

Continuing to defy the broader risk-on atmosphere, was gold. The yellow metal broke above a downtrend line drawn from the September peaks and cruised higher to come just shy of the $1492 per troy ounce level, a six-week high. Some headlines overnight that North Korea is thinking about developing new weapons may have helped the move, but the real catalyst is likely that portfolio managers are increasing their defensive exposure.

After such a strong year, when almost every single asset class was up double digits, this is probably a prudent time to ‘play some defense’ and hedge your risk heading into 2020, especially with gold prices trading at a minor discount relative to recent months.

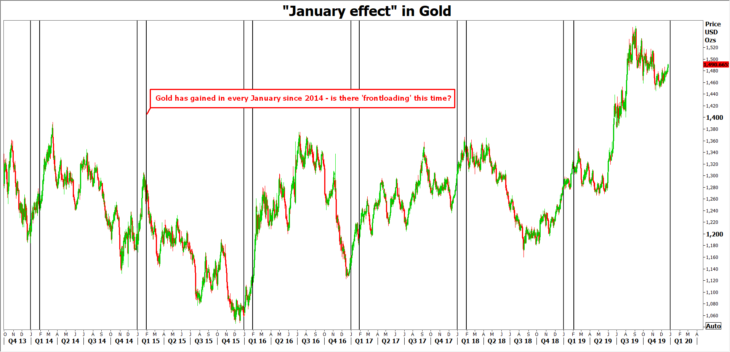

Separately, there’s also the ‘January effect’ in gold to consider. The precious metal has logged gains in every January since 2014, something attributed to seasonal factors, such as increased jewelry demand ahead of the Chinese Lunar New Year. This time around, investors may be frontloading some of that, further helping to explain the recent gains.

Empty calendar – mind the liquidity and ‘flash crash’ risk

The economic calendar is absolutely empty today. Liquidity conditions will probably be very thin once again with many markets closed, a factor that could exacerbate any moves in currencies, as a single order could have a disproportionately large impact on prices.

In particular, many Asian centers will be closed tomorrow alongside European and American ones, so liquidity will be almost non-existent, implying a heightened risk of freak events like ‘flash crashes’.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold