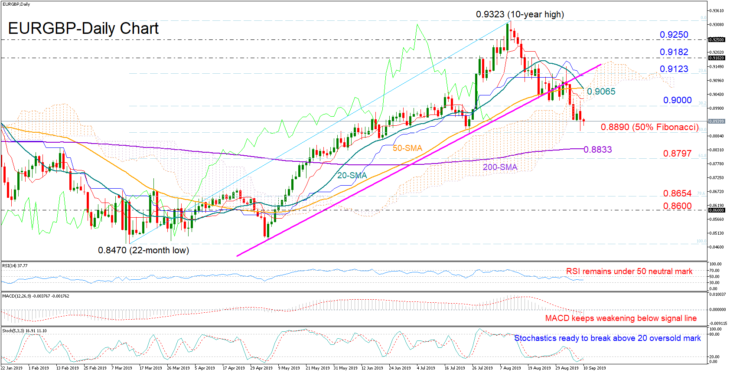

EURGBP registered losses for the fourth consecutive week and bearish signals became stronger as the price failed to return above the upward support line, crossing instead under its shorter-term simple moving averages (SMA) and the Ichimoku cloud.

The 50% Fibonacci of the upleg from 0.8470 to 0.9323 managed to confidently curb downside movements on Monday and although the Stochastics are currently preparing to exit the oversold territory, the short-term bias remains skewed to the downside as the MACD maintains negative momentum under its red signal line and the RSI shows no clear direction in the bearish area.

A closing price under the 50% Fibonacci of 0.8890 could spark selling orders, shifting the target towards the 200-day SMA and the 61.8% Fibonacci of 0.8797. Moving lower, the decline could next stall somewhere between the 78.6% Fibonacci of 0.8654 and the 0.8600 round-level.

Alternatively, if the bears soon get exhausted, immediate resistance to upside corrections could be detected within the 0.9000-0.9065 area, which encapsulates the 38.2% Fibonacci, the 20-, and 50-day SMAs. Jumping back above the cloud and the 23.6% Fibonacci resistance of 0.9123, the bulls should knock down the wall between 0.9182 and 0.9250 in order to rechallenge the 10-year top of 0.9323.

Meanwhile in the medium-term picture, the positive sentiment has weakened but not faded yet as the pair continues to trade above the 61.8% Fibonacci of 0.8796.

Summarizing, EURGBP is likely to remain under pressure in the short-term, though losses could be limited as the market looks to be trading near oversold levels. In the medium-term picture, a drop under 0.8796 would shift the outlook from bullish to neutral.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold