Dollar off lows but remains weighed by recession risks

Markets were mired in a risk-averse theme on Monday as there was little prospect of the United States and China ending their worsening trade row. In fact, relations between the two global powers hit new lows over the weekend as China’s Vice Commerce Minister said the country won’t cave in to external pressure from Washington, while the US upped geopolitical tensions after the acting US Defence Secretary indicated the US would no longer “tiptoe” around China’s behaviour in the South China Sea.

Investors now see the chances of President Trump and President Xi using the G20 summit in Japan later this month to resolve their differences as fairly remote. The deepening gloom looks set to weigh on riskier assets for some time yet with stocks in Asia struggling near 4-month lows, while US and European equity futures were pointing to another red day.

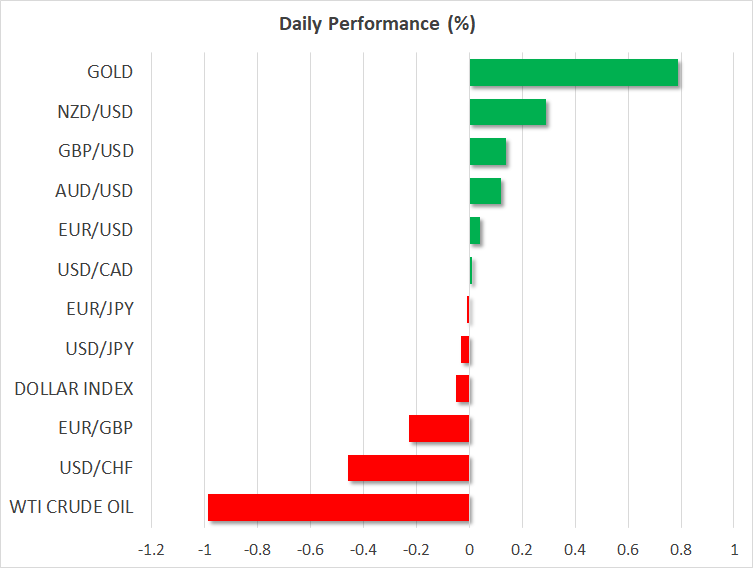

In forex markets, the dollar was last trading marginally above its 4½-month trough of 108.05 yen touched earlier today. Dollar weakness helped the euro extend its gains for a second straight session, climbing to around $1.1170. Safe-haven currencies like the yen and the Swiss franc stood firm, with the franc hitting 2-month highs versus the greenback, though the yen eased slightly against the risk-sensitive aussie and kiwi.

US-Mexico talks eyed for glimmer of hope

As if the increasingly damaging trade war with China wasn’t bad enough for markets to contend with, Trump opened up a new front in the trade fight last week by threatening to impose tariffs on all Mexican imports. The US will slap 5% duties on all Mexican imports on June 10, to rise by 5% a month until it reaches 25%, unless Mexico takes action to stem the flood of illegal immigrants entering the US across the Mexican border.

But there have been encouraging signs that such a destructive move can be averted. Mexican President Andres Manuel Lopez Obrador signalled on Saturday that he is ready to tighten his country’s borders with Central American nations, which are the main source of the immigrants, and expects “good results” from talks with the US that are due to start today in Washington.

His comments did little to bolster the battered Mexican peso, however, which was slightly weaker on Monday near Friday’s 5-month trough. Lower oil prices also weighed on the peso, as the weakening demand outlook drove WTI and Brent crude to 4-month lows, with both benchmarks plummeting below key technical levels.

Aussie shrugs off risk-off tone to head higher

The sharp escalation in trade tensions over the past week has heightened fears that the US and global economy are heading towards a recession. The surging expectations of a global downturn have been devastating for risk-free sovereign bond yields, with 10-year US Treasury yields plunging to near 21-month lows. Traders have now fully priced in two rate cuts by the Fed this year and all eyes will be on Fed Chairman Jerome Powell when he speaks at a Fed event in Chicago tomorrow. The dollar could suffer another sell-off if Powell signals a possible easing in monetary policy.

Central banks will be the focus for the euro too as the European Central Bank will hold a policy meeting on Thursday, while pound traders will be watching PMI releases out of the UK this week, starting with the manufacturing PMI today. The pound tumbled to 5-month lows on Friday but has managed to reclaim the $1.26 level, aided by a weaker dollar.

Things appear to be looking up for the Australian dollar, however, as, despite, intensifying trade tensions, the aussie is benefiting from positive data out of both China and Australia today. China’s Caixin manufacturing PMI for May and Q1 business inventories numbers from Australia beat expectations, prompting investors to pare back some of their bets of an overly dovish Reserve Bank of Australia tomorrow when it announces its latest policy decision at 04:30 GMT.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold