Oil prices are rising early in another September week. Brent is growing and trading at 65.07 USD, because the oil market has more “bullish” catalysts than “bearish” ones, at least from the fundamental point of view.

The report on the rigs number in the USA over the previous week published by Baker Hughes showed 719 oilrigs, which is 14 units less than the week before. The total number of rigs in the country lost 5 units and is currently equal to 868. As a result, the current reading is the lowest since May of 2017. As for this year, the indicator reduced by 166 units, which is 18.8%, since January.

At the same time, it should be noted that this decline has no negative influence on oil extraction in the USA, rather the opposite in fact. Starting 2019, the daily production rate in the country added 700 thousand barrels. Right now, it’s 12.4M barrels per day; it didn’t change last week despite the decline in the numbers of rigs. Oil stock added 1M barrels, while gasoline stock – 0.8M barrels.

Among the news that is important for the commodity market, we should pay attention to the information relating to dispatching American troops to support Saudi Arabia and help it with antiaircraft defenses. It’s quite unusual, but may well be explained by the comments from the White House about its readiness to help Saudis recover after drone attacks. High oil prices are very unprofitable for the USA, especially around pre-election time, that’s why they are ready to act to cheapen the cost of oil down to a more or less acceptable range.

EURUSD technically

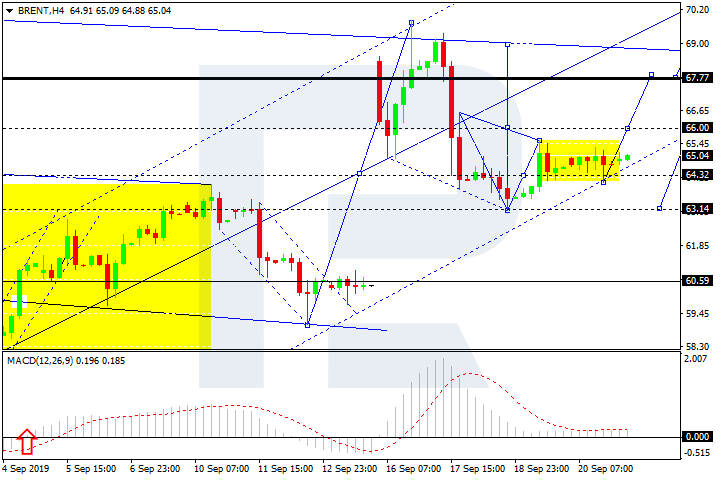

In the H4 chart, Brent is forming another rising wave with the target at 71.30; right now, it is forming the ascending structure to reach 68.95. Later, the market may correct towards 66.00 and then resume trading upwards to reach 70.00. After that, the instrument may start another correction towards 68.00 and then form one more ascending structure to reach the above-mentioned target. This entire structure may be considered as half of another rising wave. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving away from 0 to the upside.

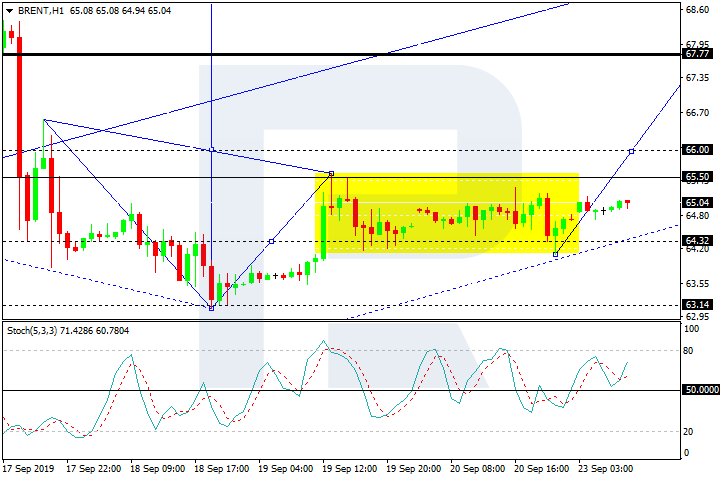

As we can see in the H1 chart, Brent has finished the rising impulse at 65.56; right now, it is consolidating above 64.32. If later the price breaks this range to the upside, the instrument may grow to break 66.00 and then continue trading upwards with the target at 67.77. However, this scenario may no longer be valid, if the price breaks the range to the downside. In this case, the instrument may continue the correction towards 63.44 and then resume trading upwards to reach 71.30. From the technical point of view, this scenario is confirmed by Stochastic Oscillator: its signal line is moving above 50, thus confirming further growth up to 80.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold