Trades on all financial markets—whether exchange-based or over-the-counter—are conducted with specific standardized volumes for available assets. These can be units of stocks, currency amounts, barrels, grams, and other options. Generally, these standardized volumes are called trading lots.

Contents

- What is a Trading Lot?

- Standard, Mini, and Micro Lots

- 1 Pip and 1 Lot

- How to Calculate a Trading Lot

- Lot on the Stock Market

What Is a Trading Lot?

For example, a long position of 1 lot on the EUR/USD pair means buying 100,000 euros for dollars, while a short position of 2 lots on the USD/CAD pair means selling 200,000 dollars for Canadian dollars. Similar to the stock exchange, the trading lot on the Forex market is the standard contract size.

Types of Trading Lots on Forex

It should be noted that standard lots are not used in interbank practice. Banks buy and sell currencies in any volume, so the concept of a “trading lot” is relevant only for Forex.

Forex brokers offer traders three types of lots:

- Standard lot = 100,000 units of currency;

- Mini lot = 0.1 of a standard lot or 10,000 units of currency;

- Micro lot = 0.01 of a standard lot or 1,000 units of currency.

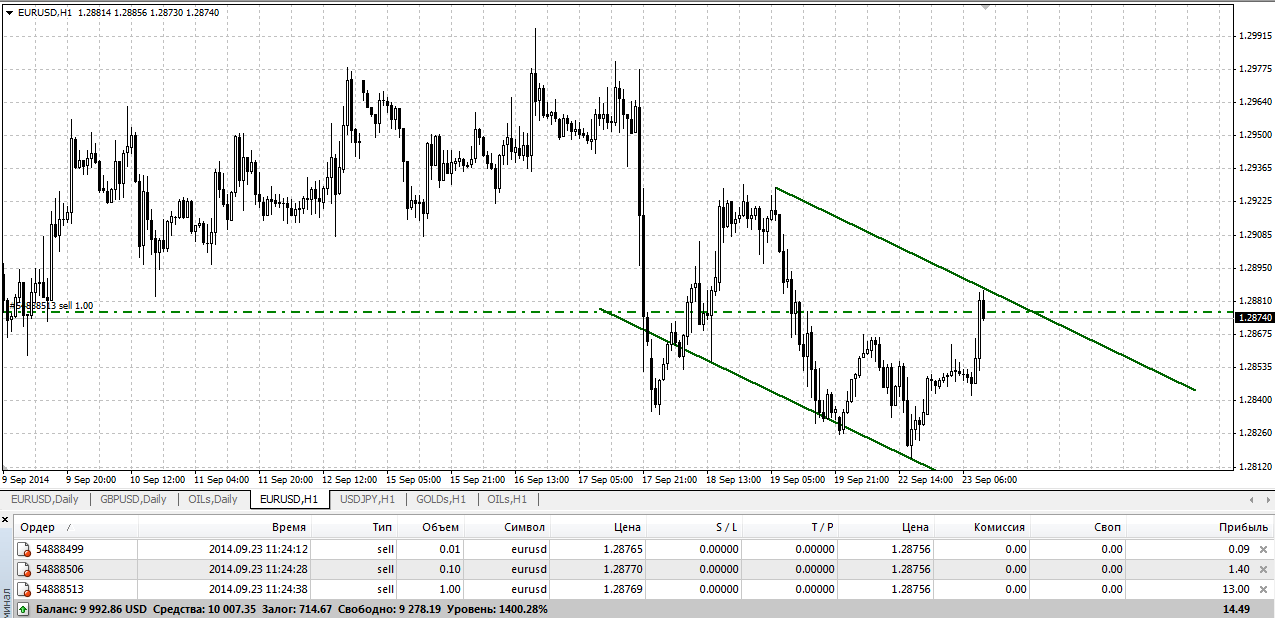

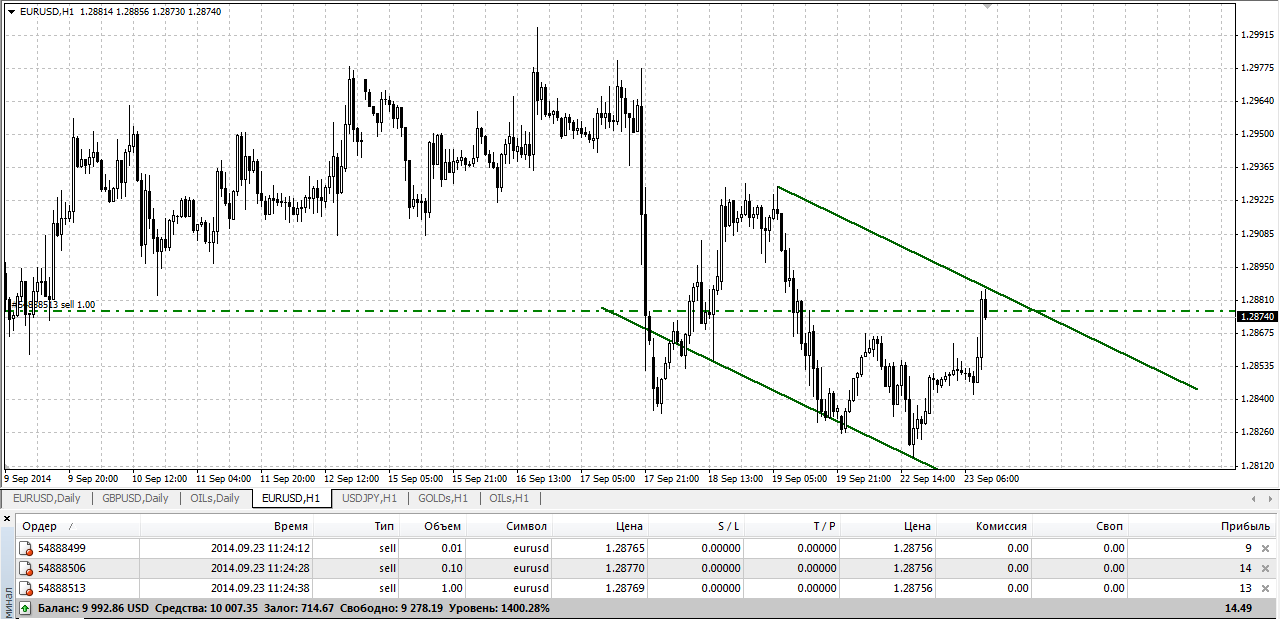

For example, a sell position on the EUR/USD currency pair is opened with lot sizes of 0.01, 0.1, and 1, with a five-digit quote.

- For an order with a lot size of 0.01, the value of 1 pip is $0.01;

- For an order with a lot size of 0.1, the value of 1 pip is $0.1;

- For an order with a lot size of 1, the value of 1 pip is $1.

For a four-digit quote, this would look as follows:

- For an order with a lot size of 0.01, the value of 1 pip is $0.1;

- For an order with a lot size of 0.1, the value of 1 pip is $1;

- For an order with a lot size of 1, the value of 1 pip is $10.

Depending on lot size, Forex brokers offer different types of trading accounts: classic or standard, cent accounts, and others.

On the Forex market, traders can open positions with fractional lots, meaning a portion of a full lot. For example: 0.25 lot = 25,000 units of currency.

The size of the position opened is of primary importance, as the lot size determines the value of one pip, which directly affects the amount of profit or loss. When making a trade on Forex, the trader chooses a position size that is a multiple of the standard trading lot, thus determining how much currency is involved in the transaction.

Depending on the chosen lot, risks and potential profit change. A standard lot equals 100,000 units of currency. Knowing this, you can calculate the profit from one pip.

Dependence of Pip Value on Trading Lot Size

A pip represents the smallest price movement of a trading instrument. Without the ability to correctly calculate pip value, it is impossible to forecast profits and losses, and therefore, to follow proper money management rules on Forex.

Pip value for four-digit and five-digit quotes is calculated as 1 pip (4-digit) = 10 pips (5-digit). For example, the value of 1 pip in the EUR/USD pair with a volume of 1 lot at a four-digit quote is $10, and at a five-digit quote is $1.

Today, every trader has access to Forex scripts that display pip value, recommended lot size, and other necessary information for planning a trading deal in a separate window or directly on the price chart.

For convenience, trading terminals display profit or loss on an open trading position in both deposit currency and order currency, as well as in pips.

Despite its apparent simplicity, profitable trading is unlikely without understanding the significance of trading lot size and pip value, as these concepts play a key role in proper money management on Forex.

Example

Remember, one Forex lot equals 100,000 units of the base currency. For example, in the popular EUR/USD currency pair, you can buy 100,000 euros for, say, 133,750 dollars at a rate of 1.3375—this is one lot.

Based on the information above, you need 133,750 dollars to buy one lot. If the euro rate rises favorably, one lot will cost, for example, 133,760 dollars (rate increased from 1.3375 to 1.3376), and by selling your one lot, you make a profit of $10.

Of course, not every private trader can afford over 133,000 dollars to make a $10 profit from a trade. Such amounts are usually handled by investment funds, banks, and large corporations. Private traders use leverage and margin trading, which is now available with many brokers.

How to Calculate a Trading Lot

The most important question is how to correctly calculate a trading lot so that a 10-pip loss doesn’t wipe out your entire deposit, while profit is not minimal. Trading has existed for a long time, and traders have found through experience that 3–5% of capital should be allocated per trade. But how much is that in pips?

In the simplest case, when calculating 5% of your deposit, multiply your deposit amount by 0.05. For example, if you start trading with $1,000 and plan to trade EUR/USD, perform the following calculations:

- With a leverage of 1:100, your deposit is $1,000 * 100 = $100,000

- One lot in dollars: 100,000 EUR * 1.3205 = $132,050

- Maximum possible lot: $100,000 / $132,050 (step 2) = 0.757

- 5% per trade: 0.757 * 5% = 0.037 lot

It’s better to round down to the minimum, so 0.03 lot.

There are other ways to calculate lot size for a trade, and there are many online services that can do it for you with one click. However, it’s very important to understand how it works yourself.

Lot on the Stock Exchange

For example, the minimum purchase size on an exchange is 10 shares. This means a trader or investor cannot buy 9 or 11 shares. They must buy either 1 lot = 10 shares or 2 lots = 20 shares.

Such a lot on the stock market is called a full lot. Usually, the number of shares in a full lot is divisible by 10, so a full lot is sometimes called a “round” lot.

Nevertheless, investors on the stock market can sometimes buy or sell shares in quantities that do not make up a full lot. Many exchanges, in addition to standard lots, also allow incomplete and unpackaged lots according to their rules.

Incomplete Lot

For example, the exchange decides to increase the standard lot size from 1 to 10 shares. An investor has 27 shares. They can only participate in trading by offering 20 shares (2 full lots), while the remaining 7 shares cannot be traded in the usual mode.

To allow investors to trade such quantities, the exchange offers a “Incomplete Lot” trading mode. This is where the investor can sell the remaining 7 shares.

Unpackaged Lot

An unpackaged lot is a trading lot with a size different from the standard. All 27 shares from the example above can form one unpackaged lot. The only condition is that exchange regulations allow the formation of lots of this size.

On the stock market, the size of a trading lot depends on two factors:

- the price of the company’s shares;

- the liquidity of the company’s shares.

The more expensive the shares, the smaller the trading lot size.

Learn more about lots on the stock market

You Might Also Be Interested In

- What is slippage and re-quotes on Forex?

- Forex broker models: “Dealing desk” and interbank

- Money Management on Forex: simple capital management rules worth a fortune

- When does a Margin Call or “Morzhov Kolya” occur?

- $10,000 or 10,000 cents: standard and cent accounts in your terminal

- Leverage and trading risks: does size matter?

- Forex broker verification: a way to delay profit withdrawal or protect client investments?!