1. Economics has two main branches – microeconomics and macroeconomics

Microeconomics deals with customers, incomes, prices, profitability, and so on. Macroeconomics deals with the economy as a whole, interest rates, Gross Domestic Product (GDP), and other concepts covered in newspapers under the “economy” section. Microeconomics is more useful for managers, while investors primarily monitor macroeconomics.

2. The law of supply and demand – the foundation of economics

Whenever the supply of a good increases, its price decreases, and whenever demand for a good grows, the price increases. Thus, when there is excess wheat production, food prices should fall, and vice versa. For example, in Russia, during a buckwheat shortage, the price of this product rose by 400-500% until the market was saturated with a new harvest.

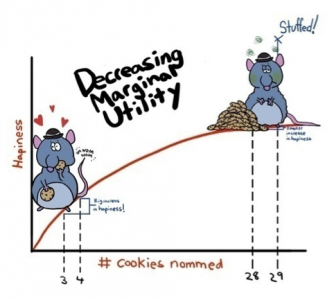

3. Marginal utility

Whenever the quantity of something increases, the possibilities for its use diminish. For example, an additional 10,000 rubles to your monthly salary of 30,000 rubles will make you happier than when you earn 1 million a month. This is widely used in product pricing.

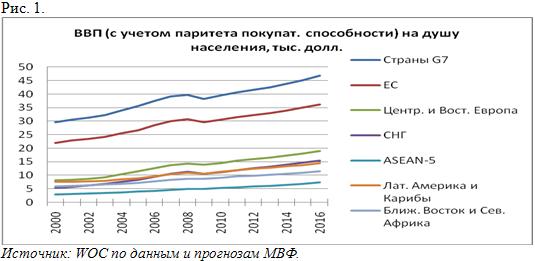

4. Gross Domestic Product (GDP)

GDP is the main measure of the economy’s size. It equals the sum of all people’s incomes or the sum of the market value of all goods and services produced in the country. For example, the world’s largest economy, the USA, has a GDP of about 14 trillion dollars. This means that every year, goods and services worth 14 trillion dollars are produced in the USA.

5. Economic growth rates

Economic growth is usually measured by GDP growth rates, growth rates per capita, and growth rates of production in key economic sectors. Economic growth rates are calculated based on data from the previous and current year, in percentages.

6. Inflation

You have probably noticed that prices for most food products are higher now than in previous years. Inflation (measured in percentages) is the “economic scale” showing how much goods and services have increased in price overall compared to the previous year. In developed countries, annual inflation is about 2%, meaning the average price of goods and services rises by 2% each year. In Russia, official data shows inflation at 6% this year. The fundamental role of central banks is to adjust inflation and keep it at a low level (but not negative).

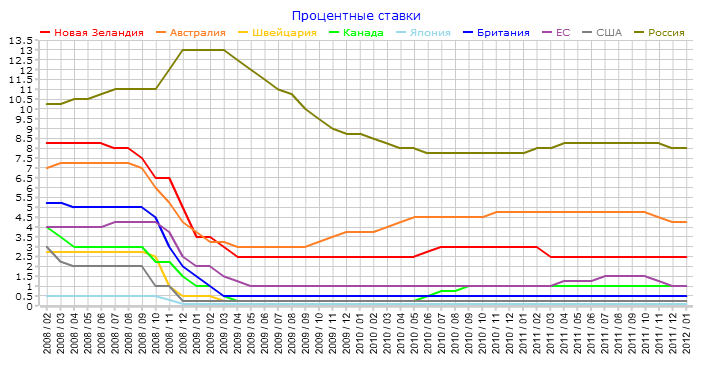

7. Interest rates

When you lend money to someone, you expect to get it back plus additional income. This income is called interest. The interest rate determines the income you will receive. Short-term interest rates are usually set by the central bank. In the US, it is currently close to zero, in Russia – 8.25%. Long-term interest rates are set by the market and depend on the inflation level and long-term economic prospects. The mechanisms used by central banks to manage short-term interest rates are called monetary policy. High interest rates benefit investors, while low interest rates benefit end consumers. For example, a mortgage in developed EU countries will cost no more than 3% per year, since the average interest rate in developed European countries is no more than 2%.

8. How interest rates, inflation, and economic growth are interconnected

There is an inverse relationship between interest rates and economic growth, and a direct relationship between interest rates and inflation levels. Thus, when you raise the interest rate, inflation usually increases. One good news, one bad. Therefore, there is certain tension in society when interest rates are announced. In the US, short-term interest rates are set by the Federal Reserve System (Fed), and this is the main economic news in the country.

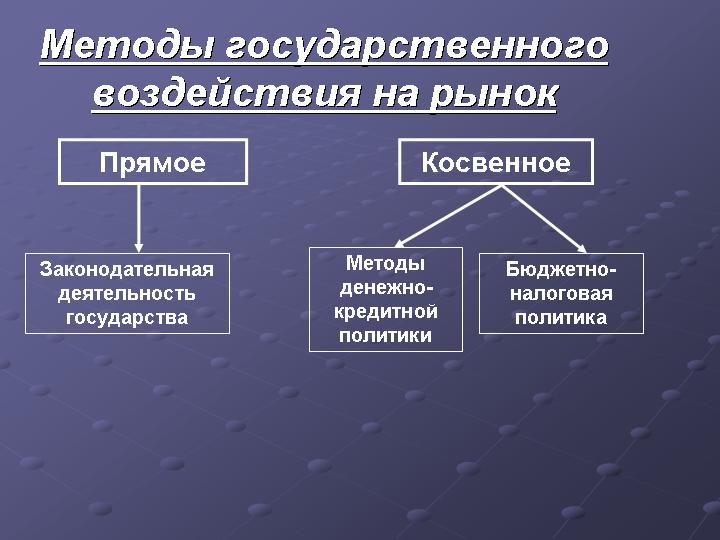

9. Fiscal policy

The government can influence the economy to a greater or lesser extent by regulating the country’s budget expenditures. One form of budget expenditure regulation is fiscal policy. If the government spends more, it can lead to increased demand, and thus to price growth. Price growth leads to inflation acceleration. Inflation, in turn, forces the government to increase spending. Thus, governments try to spend more during periods of low growth rates and low inflation, and cut spending during periods of high growth rates and high inflation.

10. Economic cycles

Market economies tend to rise and fall with a cycle of about 7 years. At the beginning of the cycle, there is rapid growth, then a peak, followed by contraction leading to recession (a period of negative growth and/or rising unemployment), and finally, recovery.

11. Opportunity cost

When you engage in any activity, you usually compare it to the best alternatives. For example, when you’re struggling with a project on Friday evening, you probably think more than once: “Maybe it’s time to do somethin