USDRUB fell another 3.1% last week, reaching 75.46 on the OTC market—levels seen in July 2025. The dollar rate is now attempting a slight recovery, currently at 76.3.

Attention was focused on trilateral talks in the UAE last week. No agreements emerged, but some military experts suggest, based on indirect signs, that something significant may have begun. I tend to agree with the view that this might just be a stage fixation for now.

With no concrete information or resolution, stock prices remain largely unaffected. The MOEX Index rose 1.6% last week and is slightly correcting at the start of this week.

Year-to-date, nearly all sectoral indices are positive, except for oil and gas. Power Utilities and Metals & Mining have performed best, gaining 7.6% and 8.6% respectively. The Consumer sector is near zero, while others range from 1.7% to 3.3%. Overall, things look decent so far.

Buy Signal for the MOEX Index

On the daily chart, the MOEX Index has broken above 2750 points, which, as I noted previously, is a buy signal. However, it’s better to wait for a breakout and close above 2800 points, as the 2750 breach could be false. The market is consolidating amid uncertainty over interest rates and potential talks.

Prices for Metals and Oil

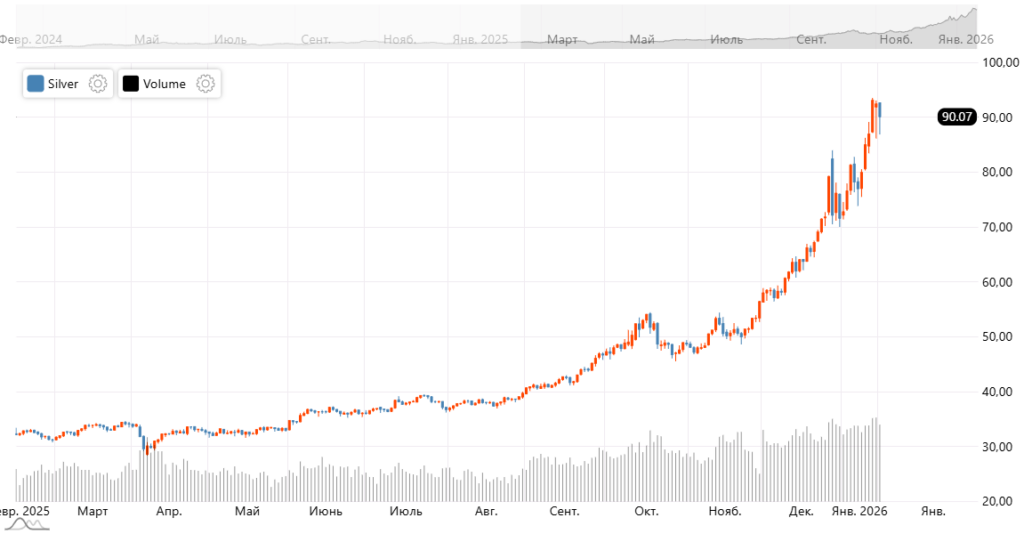

The top news is the surge in silver prices. Remarkably, it has risen nearly 150% in 2025 and over 50% year-to-date. What’s driving this?

The obvious thought is speculation, fueled by a FOMO effect. However, objective factors like metal shortages also play a role—though this is debatable.

Gold has surpassed $5000 per troy ounce. In my view, the next target is $5400-5500, from where a correction might begin. Yet, there’s a chance this level will be breached easily too. We’ll find out soon.

Oil prices have broken above $65/bbl. The market anticipates a major war in the Middle East involving Iran, potentially removing up to 3 million b/d of oil (about 3% of global demand), which would certainly impact rates.

That’s all for now. Have a great work week.