Trend RenkoSwing Trading Strategy is built on Renko charts and designed for scalping. It uses standard Forex indicators from the MetaTrader 4 or 5 trading platform as signal sources and filters. The rules are straightforward, making it suitable for Forex beginners as well.

Input Parameters

To start trading and analysis, use the following parameters:

- Currency pairs: any

- Timeframe: Renko charts (M2 timeframe)

- Trading time: any

- Risk management: after calculating stop-loss, select a lot size so that risk is no more than 2-5% of the deposit per trade

Indicators Used

The following indicators provide signals for currency pair analysis:

- SMA (50) indicator – used to determine the higher timeframe trend and filter entry direction;

- ATR (60) indicator – used as a volatility filter;

- Stochastic indicator (14,3,3 or 15,4,4/15,5,5) – used to identify entry points;

- EMA (5) and SMA (8) indicators – moving average crossover used to determine entry and exit points.

Installing the Expert Advisor and RenkoSwing Strategy Template

- Unpack the archive with templates and indicators.

- Copy the expert to the MQL4 -> experts folder.

- Copy the template to the templates folder.

- Restart the terminal.

- Open the chart of the desired currency pair.

- Switch to the M1 timeframe.

- Enable “Auto-trading” mode.

- Attach the RenkoLiveChart_v3.2 expert to the chart (a happy face should appear in the top right corner). Leave expert parameters at default.

- Go to File -> Open Offline and select the chart of our instrument created by the expert for the M2 timeframe.

- Apply the RenkoSwing template.

RenkoSwing trading strategy template

RenkoSwing trading strategy template

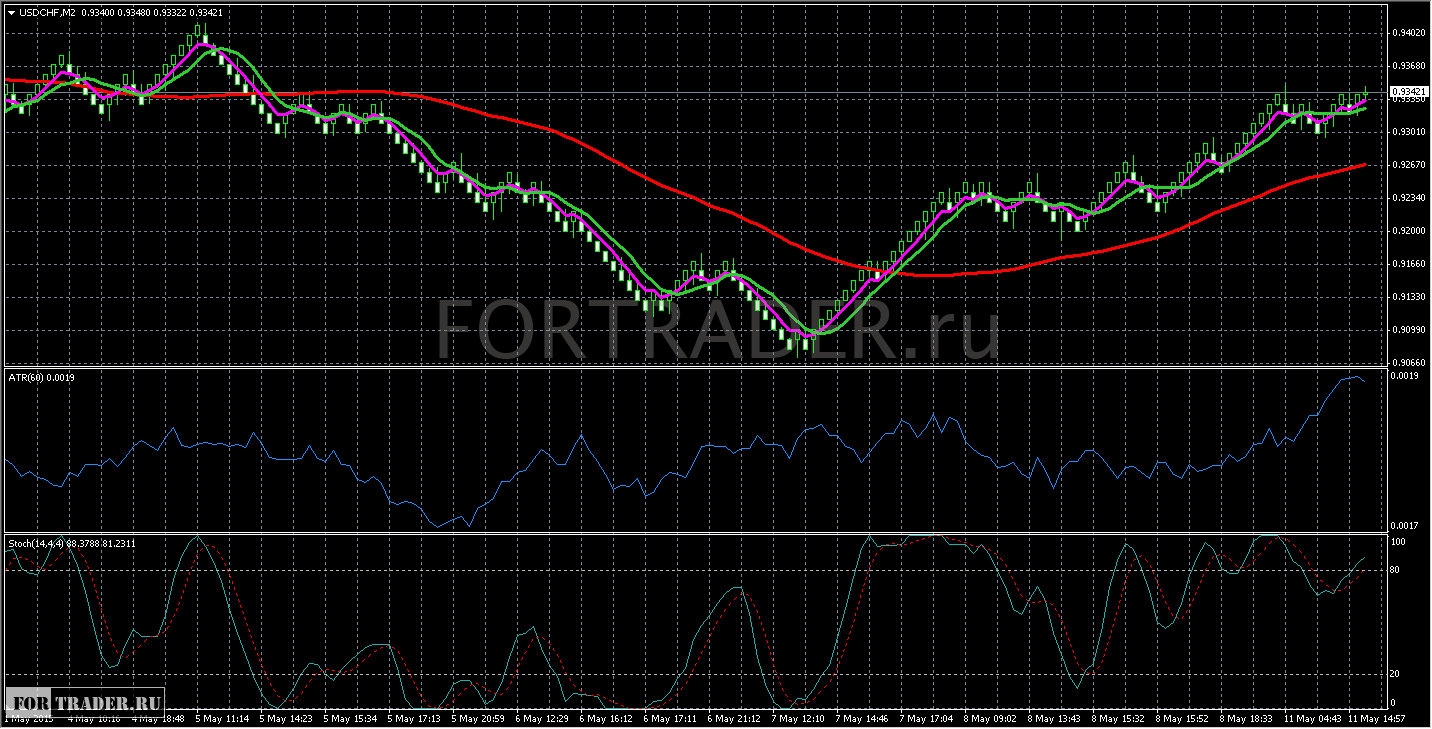

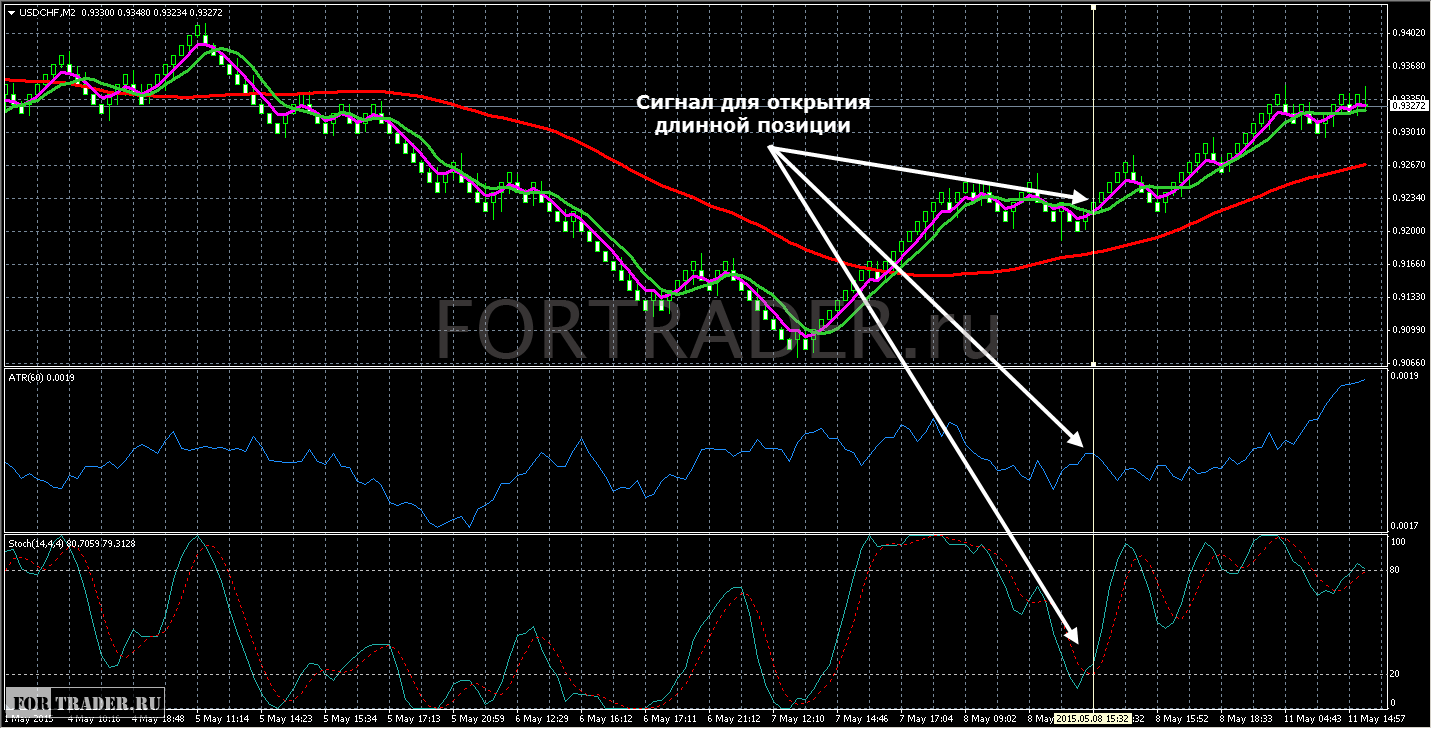

Buy Signals

To open a Buy trade, wait for the following signals:

- Price is above the red moving average.

- Blue Stochastic line exits the oversold zone.

- Purple moving average crosses the green one from below upward.

- ADR indicator shows the highest possible value (threshold level adjusted individually for each currency pair).

- Stop-loss placed below the nearest local low.

Example of a long trade

Example of a long trade

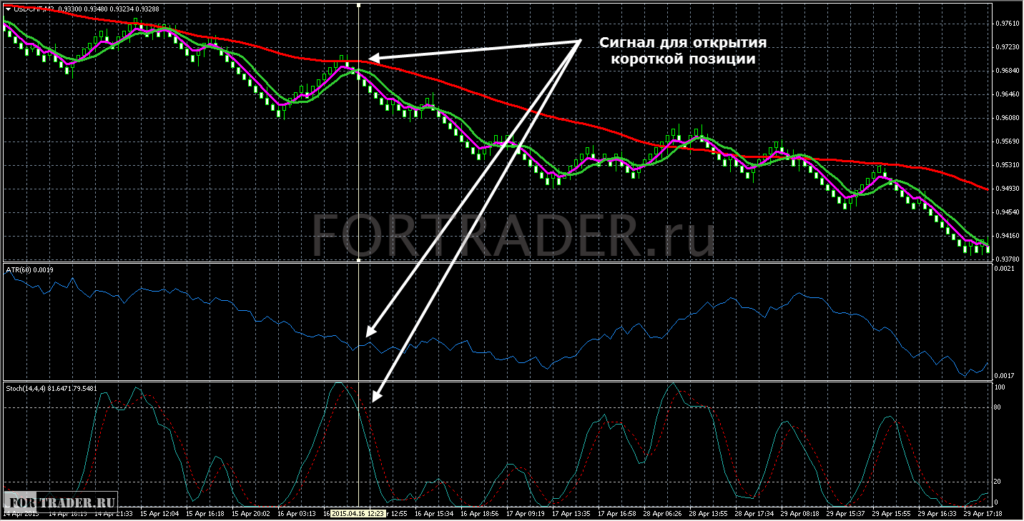

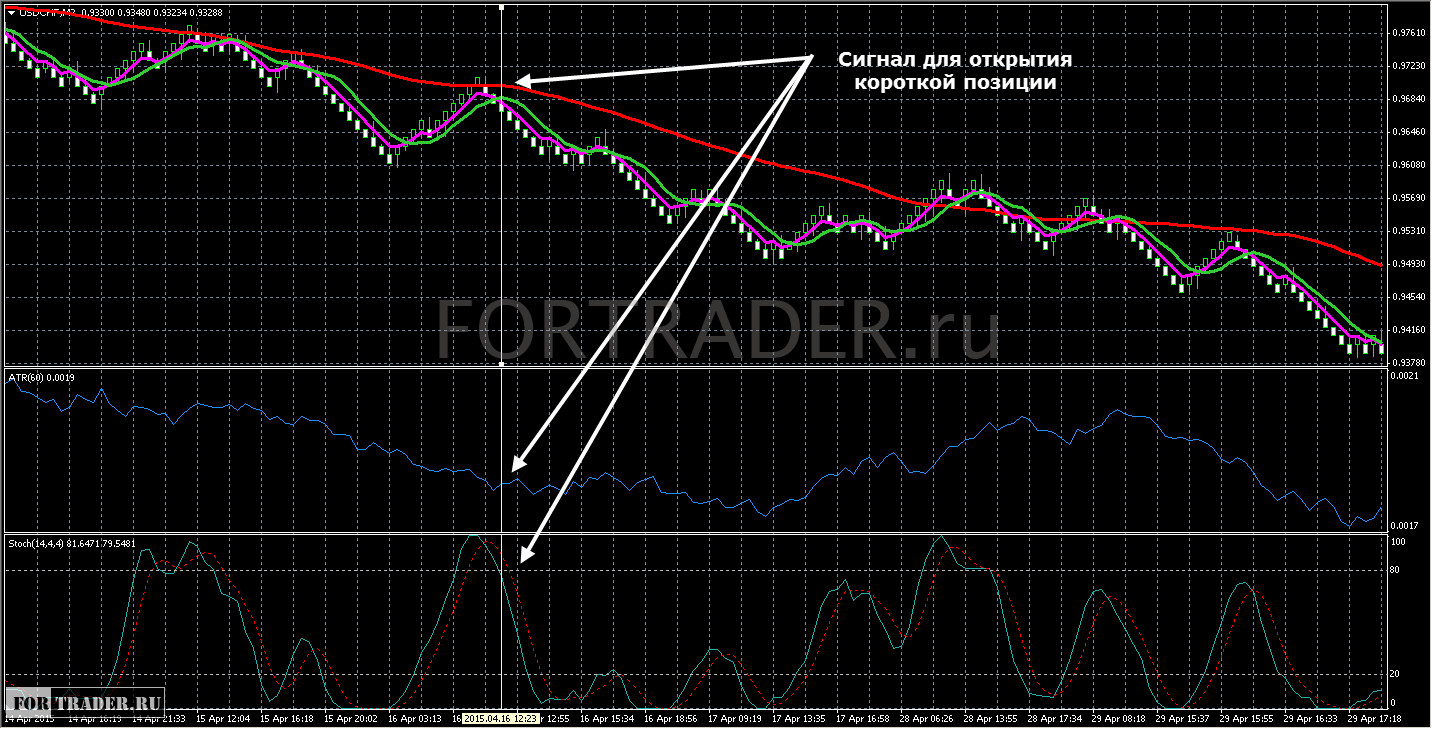

Sell Signals

For a Sell trade, the indicators should show:

- Price is below the red moving average.

- Blue Stochastic line exits the overbought zone.

- Purple moving average crosses the green one from above downward.

- ADR indicator shows the highest possible value.

- Stop-loss placed above the nearest local high.

Example of a short trade

Example of a short trade

Conclusions

Renko charts primarily smooth out price noise fluctuations, though this indicator combination and entry rules can also be applied to standard price charts.

The positive aspect is the professional, almost academic selection of indicators for entry signals and filtering. Using standard, simple indicators is not a drawback. On the contrary, all “super” indicators are based on standard trend indicators, oscillators, and similar tools. The strategy’s simplicity does not imply low effectiveness.

Strategies like RenkoSwing are a treasure for traders who like to customize them. There are many optimized versions of the standard indicators used here. Replacing a classic indicator with a better modification will undoubtedly improve the RenkoSwing strategy’s effectiveness. Nothing prevents adding or replacing indicators with those the trader prefers.

The only noticeable drawback is the individual ADR indicator threshold level, which must be set for each currency pair. This may challenge beginner traders without sufficient Forex experience.

Download templates and indicators