Market focus

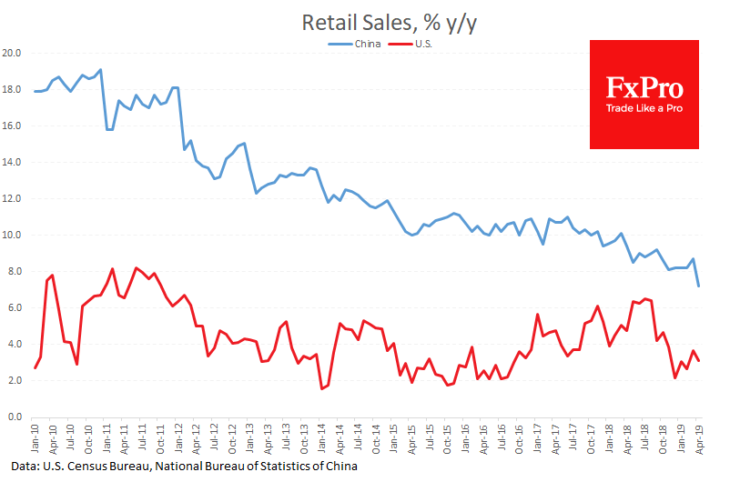

All the markets’ attention is focused on the U.S. & China Retail Sales and Industrial production. Despite the trade conflicts, very optimistic indicators are expected in both countries. In China, the annual growth rate of Retail Sales is expected to 8%, in the USA it could be 2.6%, also making a positive contribution to the GDP dynamics.

Despite this fact, world analysts and traders are increasingly waiting for the new measures of economic stimulus. As the FxPro Analyst Team said, at the moment, the political news definitely overshadowed the economical ones. Industrial production is attracting the investors’ attention, as it’s considered as an important leading indicator of business activity. The further decline can increase the demand for new measures to help the economy from the Central Banks and the governments.

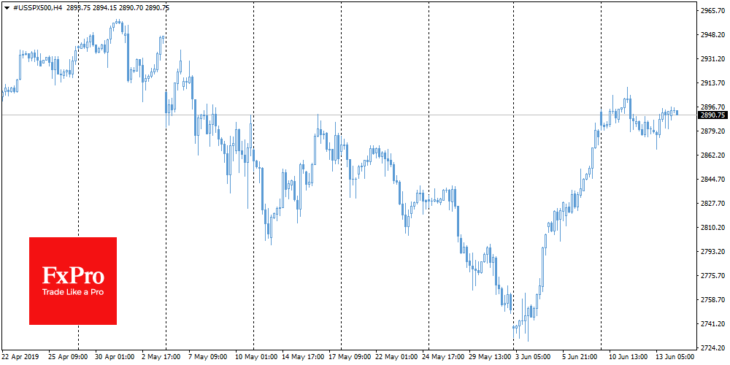

Stocks

US indices maintain their position after a gain of almost 0.5% the day before. This fact beat off the loss of the beginning of this week, and today’s growth, for the most part, is caused by hopes for an early easing of the Fed’s monetary policy. As expected, this will help the economy to overcome the slowdown. At the same time, the Chinese indices were in antiphase with the upward trend from the beginning of the week but then began to decline closer to the weekend.

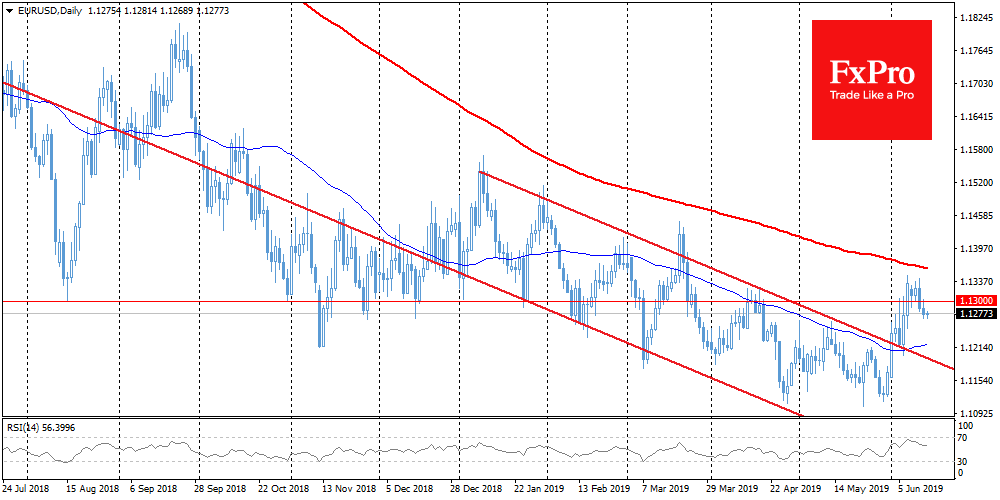

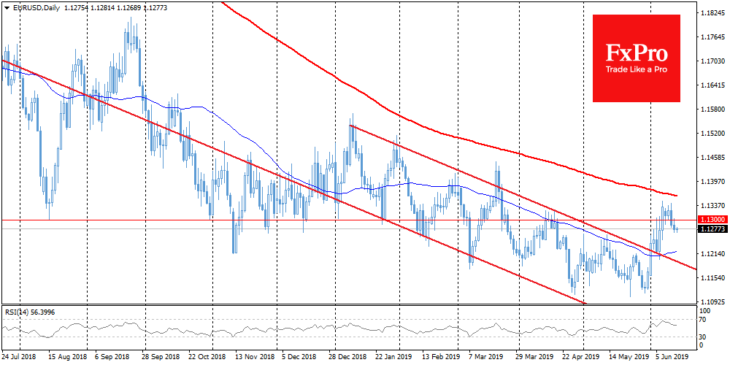

EURUSD

The euro is developing a decline as well, dropping on Friday morning to 1.1270 USD. Bears pressure was strong enough to deploy a single currency, not allowing EURUSD to hold positions above 1.1300. Further pressure opens up the opportunities to decline to the 1.1200 area, where the 50-day moving average is underway.

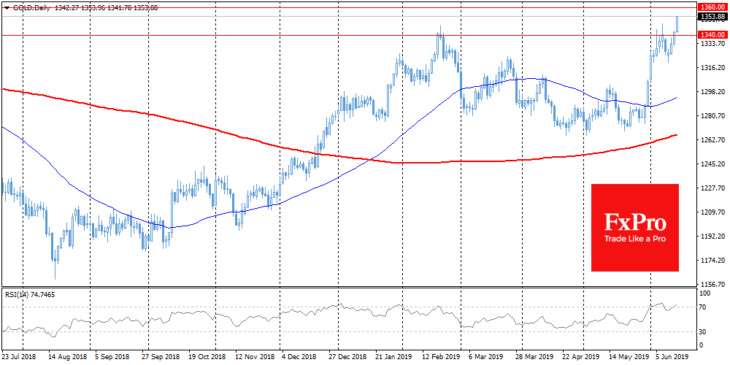

Gold

Gold continues to be in demand, returning to the peak levels of last week at $1355 and re-testing this year highs. On Friday, traditionally, market participants desire to take profits and close their positions that can turn into another test for the bulls. Nevertheless, it is worth to remember the global desire to get away from risky assets as it still provides tangible support for Gold.

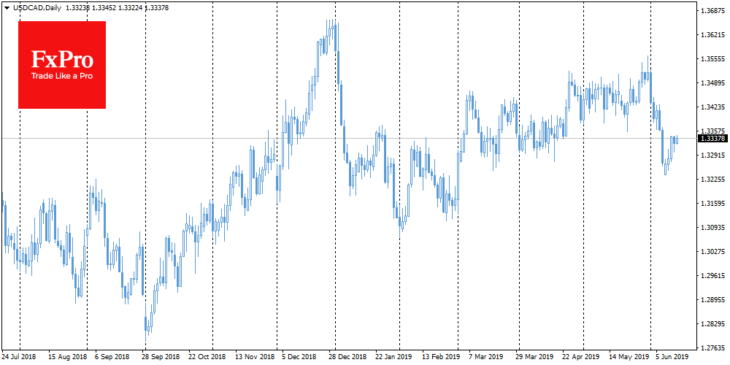

Chart of the day: USDCAD

The USDCAD pair turned towards growth after a sharp drop at the start of the month. This movement is only partly due to the weakening of Crude oil prices and can hardly be explained by the data, which for the most part came out strong enough. Canadian labour data has comfortably exceeded expectations, in contrast to the disappointment of those in the US. Purchases in the USDCAD pair can be a signal of pull in the dollar, which is demonstrated by American investors. This behaviour may be an indicator of a wider turn of the dollar to growth as well as to other key currencies.