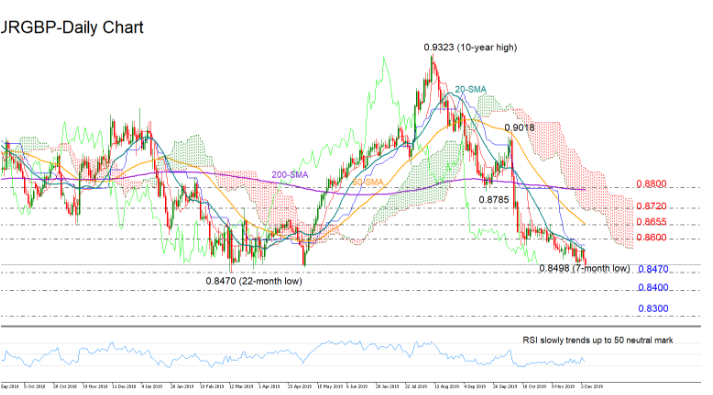

EURGBP started the month on the downside as buyers could not close above the 20-day simple moving average (SMA) that has been restricting upside corrections over the past four weeks.

The short-term bias is currently viewed as bearish-to-neutral as the RSI looks to be distancing itself from its 30 oversold mark to reach its 50 neutral mark, while in Ichimoku indicators, the red Tenkan-sen line is stabilizing slightly below the blue Kijun-sen.

On the downside there is a strong support between 0.8498 and 0.8470. Should the price fail to rebound within this area, the door would open for the 0.8400 round level, a break of which could then shift attention towards the 0.8300 mark.

In the positive scenario, a decisive close above the 20-day SMA and preferably above the 0.8600 barrier could bring a stronger obstacle near 0.8655 back into view. Moving higher and above the 50-day SMA, the bullish action could pick up steam towards 0.8720, where any violation would push resistance up to 0.8800.

Turning to the medium-term picture, the fourth-month old downtrend off the 10-year high of 0.9323 continues to keep the outlook negative, with the latest bearish cross between the 50- and the 200-day SMAs reducing the odds for an outlook reversal.

In brief, EURGBP is expected to trade bearish-to-neutral in the short-term, with traders likely waiting for a clear close above the 20-day SMA in order to place buying orders.