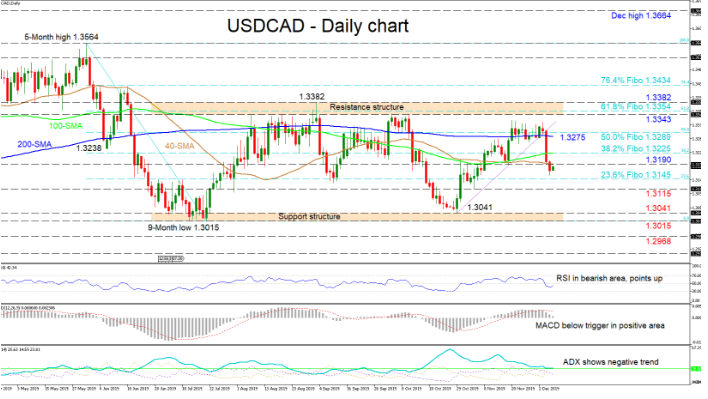

USDCAD looks to be pushing lower with sellers trying to form a clear-cut direction. The recent ascent from 1.3041 failed to reach the resistance structure and sellers reversed the price back down from the 1.3289 area — which is the 50.0% Fibonacci retracement of the down leg from the 1.3564 to 1.3015 — and below the swing low of 1.3190.

The short-term oscillators reflect mixed signals with the MACD indicating strengthening negative momentum, while the RSI, in bearish territory is slightly improving. The flat simple moving averages (SMAs) are also not giving any evident direction. Moreover, the ADX displays a weak negative trend.

If sellers reemerge, initial support could come from the 23.6% Fibo of 1.3145 ahead of the 1.3115 low from November 5. Steering lower, the support structure of 1.3041 to 1.3015 could restrict further declines towards the 1.2968 swing low from October 2018.

To the upside, pushing above the 1.3190 resistance where the 40-day SMA also lies, buyers would then tackle the 38.2% Fibo of 1.3225 coupled with the 100-day SMA. Ascending past this level too, the 200-day SMA at 1.3275 and neighboring 50.0% Fibo at 1.3289 could challenge the bulls. If buyers persist, the confining resistance structure of 1.3343 to 1.3382 — which also encompasses the 61.8% Fibo of 1.3354 — may deny further appreciation of the pair towards the 76.4% Fibo of 1.3434.

Overall, the short-term is bearish, while the medium-term bias is still range bound between 1.3382 and 1.3015. A break-out of the upper or lower boundaries would expose the next direction.