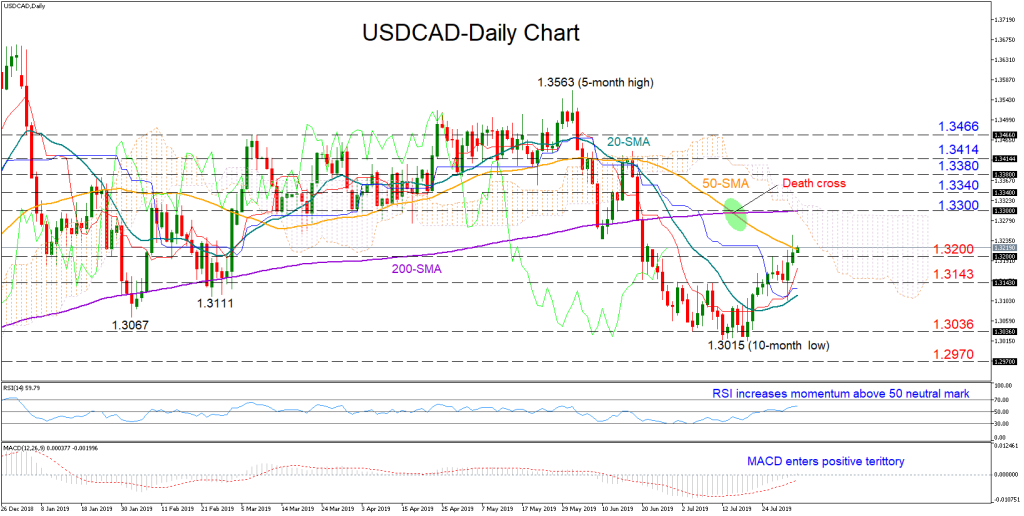

USDCAD has been building an upward trajectory over the past three weeks and is currently searching for a daily close above the 50-day simple moving average (SMA).

The short-term bias is viewed positive at the moment as the RSI is gaining momentum above its 50 neutral mark and the MACD is strengthening above its red signal line and in the bullish area.

Traders, however, could wait for the pair to jump above the Ichimoku cloud and the 1.3300 level to raise faith on the recent bullish action. Should the market accomplish such a move, resistance could emerge within the 1.3340-1.3380 area, while a steeper rally may also stall in the 1.3414-1.3466 zone.

Alternatively, a backward flip under the 1.3200 level could stop near 1.3143 before the focus turns to the 20-day SMA currently at 1.3114. Even lower, the bears should push harder to breach the 1.3036-1.2970 territory.

In the three-month window, USDCAD maintains a bearish mode as long as it holds under the 1.3400 number. Meanwhile, the bearish cross between the 50- and the 200-day SMA decreases the odds for an outlook reversal.

In brief, USDCAD is facing a bullish bias in the short-term, while in the medium-term picture the status remains bearish