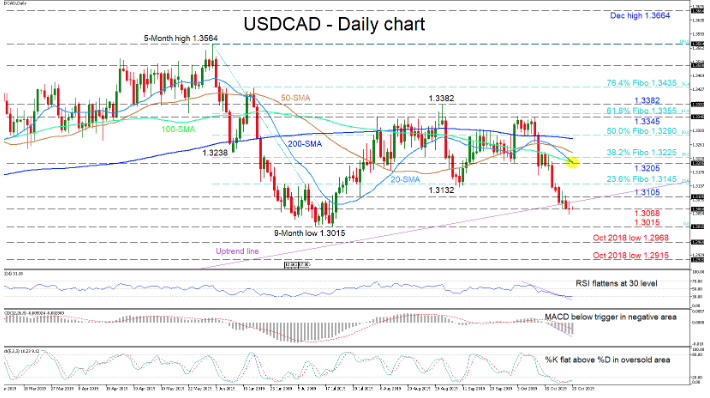

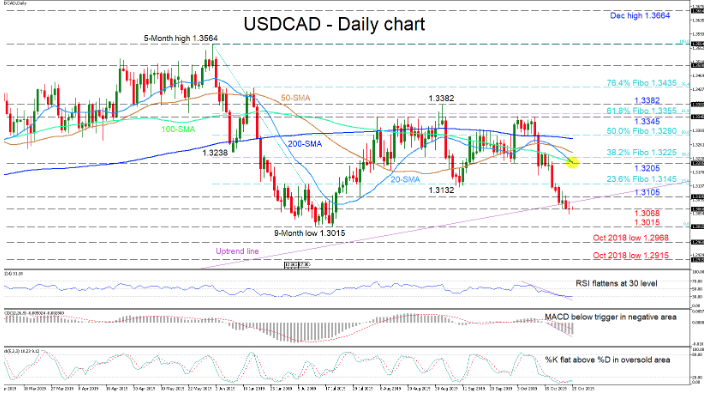

USDCAD came to a stop at the 1.3068 support coming from the swing low of February 1, after breaching the uptrend line drawn from 2017’s low. Sellers have kept the price below the trendline and therefore further declines are on the table, something also backed by the downward slopes of the 20-, 50- and 100-day simple moving averages (SMAs).

The short-term oscillators reflect some easing but remain bearish suggesting more losses could unravel. The MACD has smoothed slightly but is still some distance below its red trigger line in the negative zone. The RSI has turned flat at the 30 level, while in the stochastics — despite the bullish crossover in the oversold region – the %K has flattened above its red %D line. Moreover, backing the negative picture is the nearing bearish crossover of the 100-day SMA by the 20-day one.

Below the uptrend line, if the sellers manage to penetrate below the limiting support of 1.3068, the nine-month low of 1.3015 could challenge the bears. A violation of the 1.3015 trough could reflect a bearish shift in the medium-term bias with the October low of 1.2968 and 1.2915 respectively, testing this view.

To the upside, buyers would need to push the price above the 1.3105 resistance to encourage optimism. Above this, the 1.3145 resistance level, which is the 23.6% Fibonacci retracement of the down leg from 1.3564 to 1.3015, could hinder further gains to the tougher 1.3205 area — where the 20- and 100-day SMAs lie. Moving higher, the 50.0% Fibo of 1.3290 could test the bulls as it is where the 200-day SMA is located.

Summarizing, the short-term bias remains bearish. However, a break below 1.3015 would reinforce the negative outlook, while a close above 1.3105 could return a neutral-to-bullish bias.