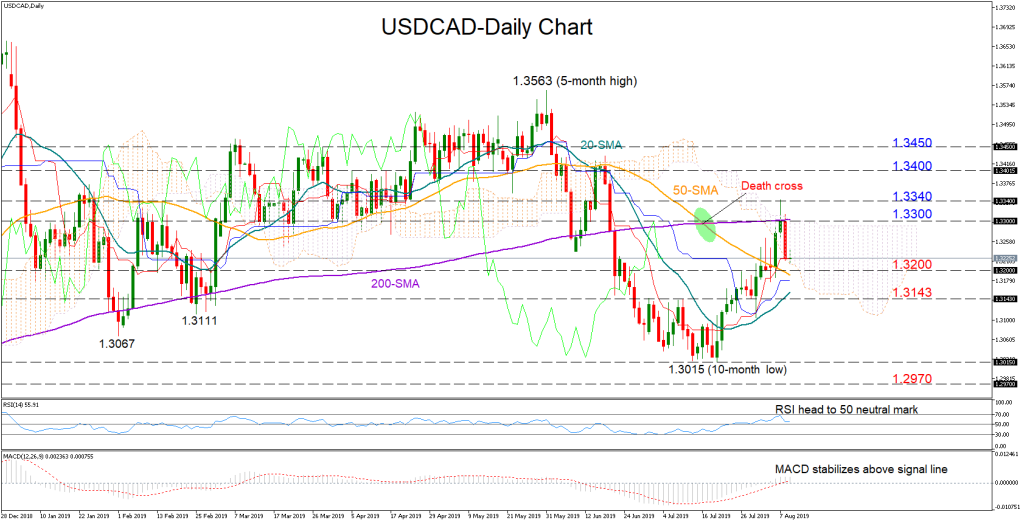

USDCAD got rejected by the 200-day simple moving average (SMA) and the 1.3300 level after an attempt to cross above the area and the Ichimoku cloud.

The pair immediately gave up most of its gains made this week on Thursday, with the technical indicators suggesting a bullish-to-neutral bias for the short-term. The RSI is slowing towards its 50 neutral mark, the MACD is losing steam above its red signal line, while the red Tenkan-sen is flattening above the blue Kijun-sen.

Nearby support could be found around the 1.3200 mark and the 50-day SMA, while a more aggressive downfall could hit a tougher support near 1.3143. If selling pressure persists, the spotlight will shift to the 10-month low of 1.3015, while slightly lower a former barrier around 1.2970 should be in focus as well.

On the upside, the bulls would retry to break the 1.3300 block and exit the Ichimoku cloud, whilst a close above 1.3340 may open the door for the 1.3400 number. Further up, the 1.3450 congested zone could also limit upside movements.

In the three-month window (medium-term), USDCAD continues to hold in a downward move and only a climb above 1.3400 would officially resume a neutral profile. However, the increasing distance between the 50- and the 200-day SMAs, which produced a bearish cross in mid-July, reduces the odds for an outlook reversal.

Summarizing, USDCAD is expected to record a bullish-to-neutral session in the short-term, whilst the medium-term outlook may stay negative.