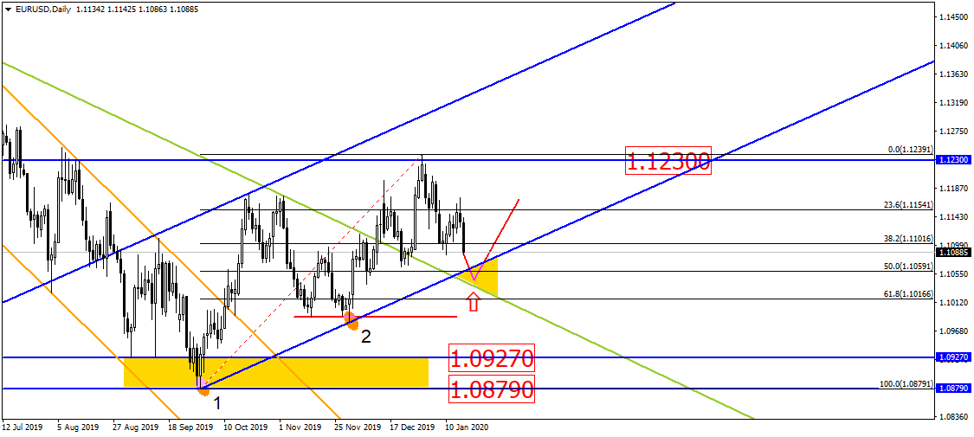

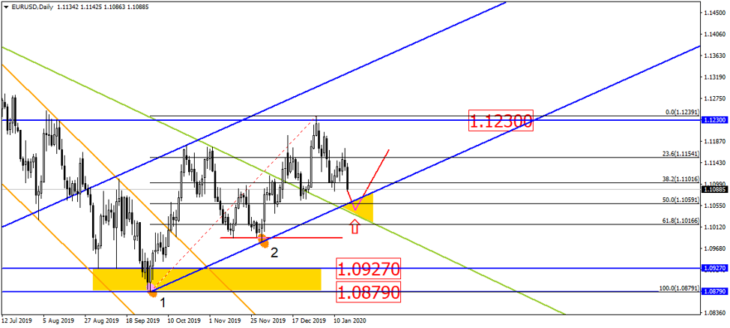

The currency pair EUR/USD is approaching the uptrend and the middle point of the last move (50% Fibonacci). From this point the it could be assumed that the currency pair is likely to jump:

The latest reports by COT CFTC show that large operators significantly decreased their short positions on European currency – indicating a possibility of the Euro jumping:

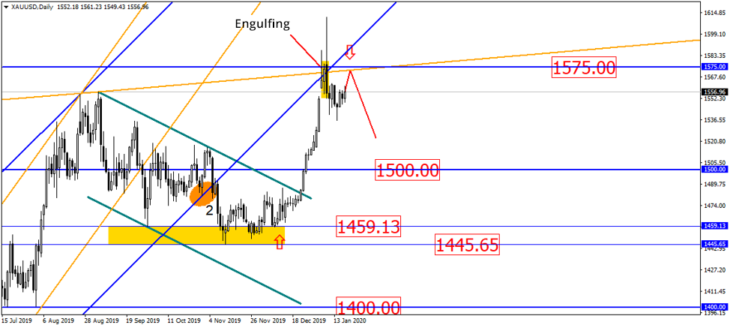

In the daily chart, gold is approaching the middle point of engulfing, that is, the 1575.00 level. Away from this level, the asset’s price could likely pull. Moreover, there is a long-legged candle on the weekly chart. It resembles a shooting star that is touching the resistance:

Australian dollar is approaching the uptrend that has formed on the daily chart. Away from this trend the asset might potentially pull. Here we should rely on the candlestick formations to avoid false breakouts:

Let us remind you that this material is provided for informative purposes only and cannot be considered as a direct go ahead to implement transactions in the financial markets. Trading in the financial markets is very risky.