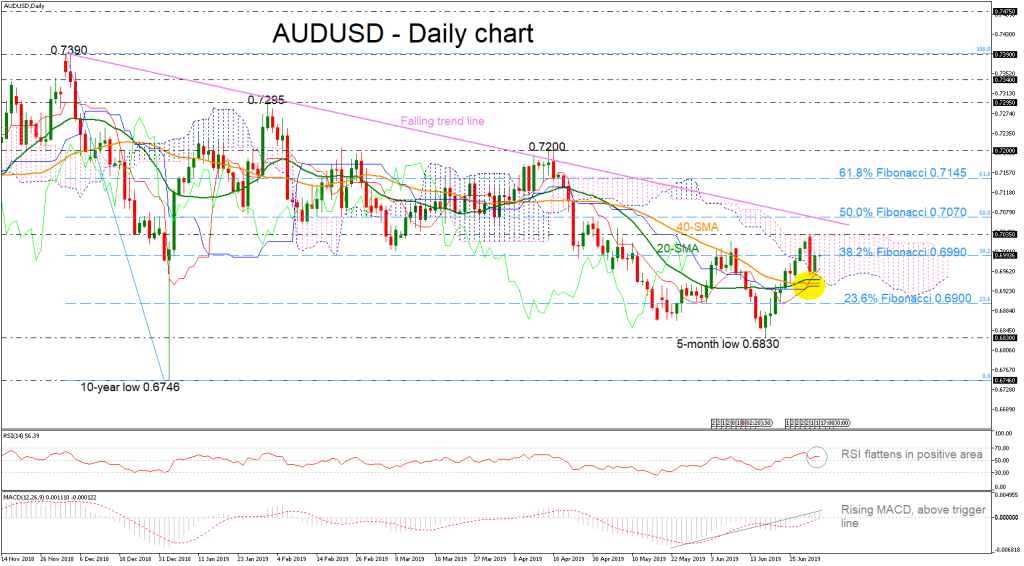

AUDUSD is flirting with the 38.2% Fibonacci retracement level of the downleg from 0.7390 to 0.6746 slightly below 0.7000 and is holding inside the Ichimoku cloud. The pair remained above the 20- and 40-day simple moving averages (SMAs) which are flattening as the price is developing within a sideways channel of 0.6830 – 0.7035 in the short-term.

From the technical point of view, the RSI is flattening in the bullish territory, while the MACD is rising above trigger and zero lines, suggesting a possible upside rally.

In case of more gains, the pair needs to overcome the 38.2% Fibonacci of 0.6990 to meet a key barrier around the 0.7035 resistance, taken from the latest high, near the upper surface of the Ichimoku cloud. The 50.0% Fibonacci mark of 0.7070 could act as resistance too as it overlaps with the falling trend line before a more important battle starts near the 61.8% Fibo of 0.7145.

On the other side, if the price declines below the SMAs, support to downside movements could be initially detected around the 23.6% Fibo of 0.6900. Clearing this area, the next stop could be at the five-month low of 0.6830.

In the short-term picture, the sentiment turned slightly neutral to bullish after the price rebounded on the 0.6830 support. Traders should wait for a jump above the six-month descending trend line before initiating positive positions.