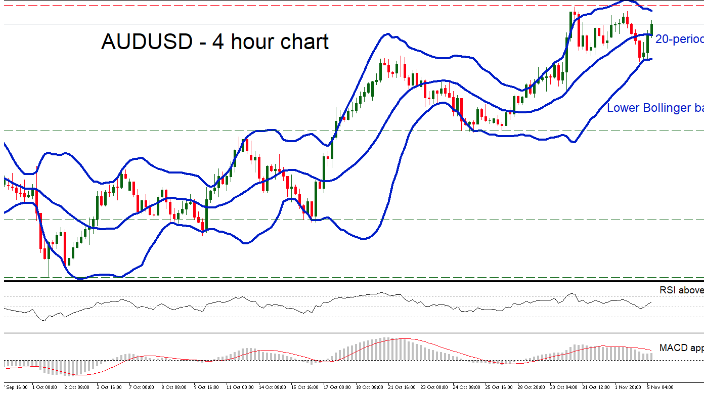

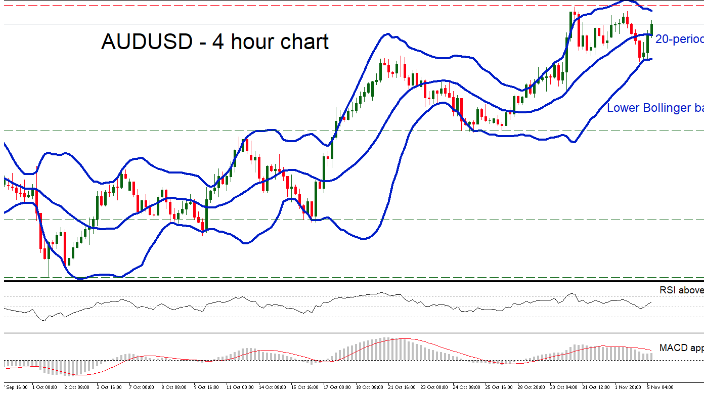

AUDUSD has been printing higher highs and higher lows since the beginning of October, with any pullbacks being capped by the lower Bollinger band on the 4-hour chart. The near-term outlook therefore seems to have shifted to positive, though a break above 0.6930 may be needed to cement that.

Short-term momentum oscillators concur with the bullish bias, as the RSI climbed above 50 and is pointing higher, while the MACD seems ready to challenge its red trigger line at any moment – an upward violation of which would be a bullish sign.

If the buyers stay in control and manage to overcome 0.6930, their next target may be the 0.7000 handle, marked by the inside swing low on July 17. Even higher, the July peaks around 0.7080 would attract attention.

On the downside, if the bears take the wheel and pierce below the lower Bollinger band and the 0.6875 zone, the next area to offer support may be the 0.6810 level. Another negative break could open the door for 0.6725, the October 16 trough.

In short, the near-term bias has turned positive, and a break above 0.6930 would reaffirm that.