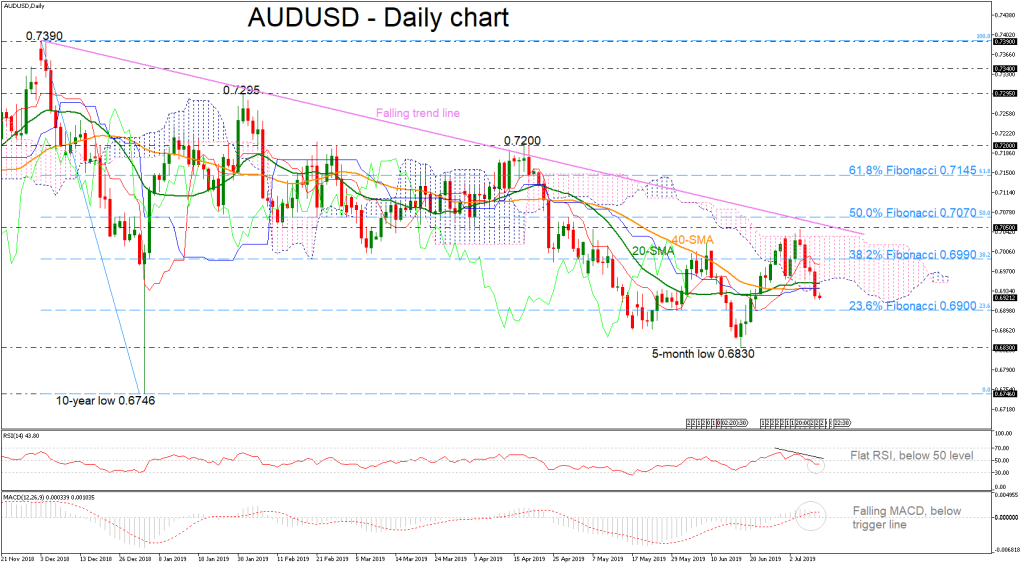

AUDUSD has lost its short-term positive momentum over the last four days after the bounce off the 0.7050 resistance barrier. The market could retain the downward movement as the RSI dropped beneath the 50 level but is flattening and the MACD oscillator is weakening below the trigger line and near the zero line.

Should the pair stretch south, the 23.6% Fibonacci retracement level of the downleg from 0.7390 to 0.6746 near 0.6900 could be the immediate support level, slipping beneath the Ichimoku cloud and the short-term moving averages. A significant step lower could bring the bearish sentiment back into play, sending the price probably towards the five-month low of 0.6830. If the sell-off extends, attention could then turn to the ten-year low of 0.6746.

On the other side, the 20- and 40-simple moving averages (SMAs) and the lower surface of the Ichimoku cloud may halt upside movements. However, if traders continue to buy the pair, the price could rise until the 38.2% Fibo of 0.6990, while steeper increases could also touch the 0.7050 peak.

Looking at the bigger picture, AUDUSD has been trading within a falling trend over the last seven months and is expected to hold bearish in the short term as well.