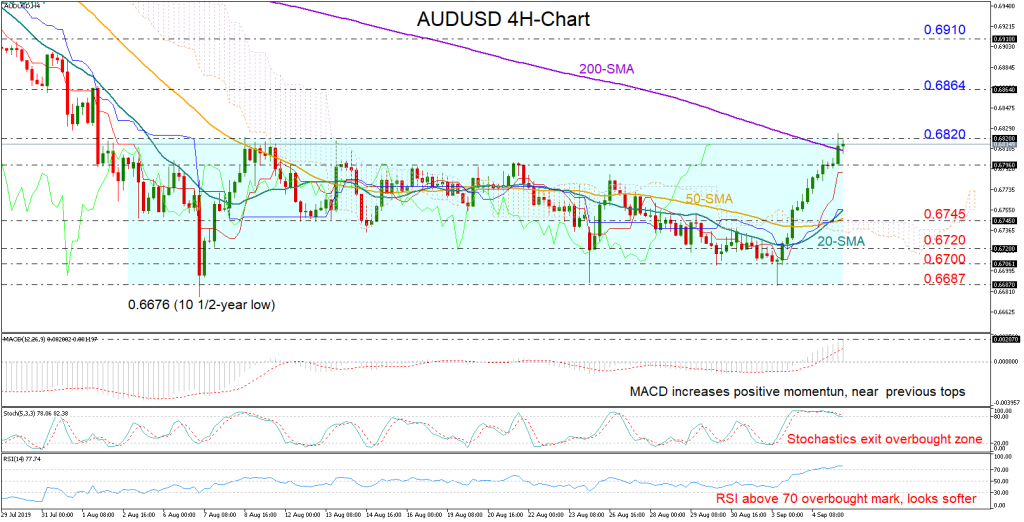

AUDUSD is positioned at a crucial point in the four-hour chart. The pair closed marginally above the 200-period simple moving average (SMA) and managed to pierce the upper boundary of its one-month old range early on Thursday before pulling downward slightly.

The MACD cautiously suggests a bullish bias for the short-term as the indicator is still in the positive direction but, near former peaks. The RSI, however, seems to be slowing down above its 70 overbought mark and the fast-Stochastics have already started to turn lower in overbought zone – both increasing the odds for a downside correction.

A decisive rally above the 0.6820 ceiling could ease worries of a backward move and shift attention towards the 0.6864 resistance level. Beyond the latter, traders could look at 0.6910, while higher 0.6960 could be another barrier to watch.

Alternatively, a sharp decline below 0.6796 could activate more selling, with the price heading down to meet the 0.6745 handle, where the 50-period SMA happens to lie at the moment. Breaking lower and under the 0.6720-0.6700 region, the spotlight will turn to the recent troughs around the 0.6687 mark and the 10 ½-year low of 0.6676.

In brief, the recent rebound in AUDUSD is currently viewed as fragile, as the market looks to be trading in overbought waters. Yet, should the price extend comfortably beyond the 0.6820 critical point and the 200-period SMA, violating the sideways move, buying confidence could strengthen further.