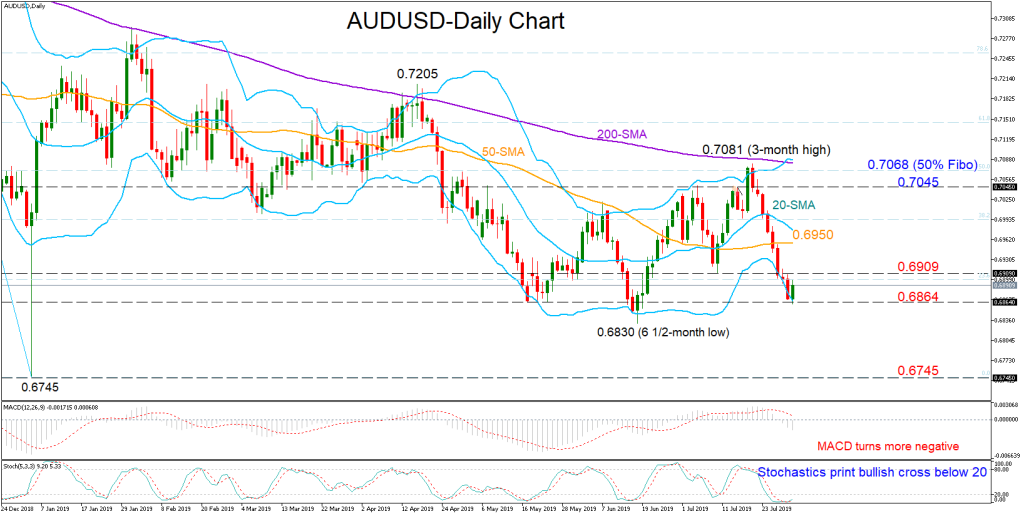

AUDUSD bears got exhausted near the key 0.6864 support level early on Wednesday, with the fast-Stochastics pointing to a price reversal as the green %K line has already crossed above the red %D line in the oversold territory and seem to be turning higher.

The fact that the price has been repeatedly touching the lower Bollinger band in the past few sessions is also an indication that upside corrections may soon take place. The MACD, however, has yet to show any sign of improvement, reducing chances for a considerable recovery.

Should the bulls overcome resistance around 0.6909, where the 23.6% Fibonacci level of the 0.7392-0.6745 downleg is also placed, the 50-day simple moving average (SMA) currently at 0.6950 could be the next target. Piercing the middle Bollinger band and the 38.2% Fibonacci, the price could pick up steam towards the 0.7045-0.7068 area, which includes the 50% Fibonacci.

Otherwise, if negative momentum resumes, with the pair falling under 0.6864 and more importantly well below the June 6 ½ -month low of 0.6830, support could run towards 0.6745, the lowest mark registered in more than a decade.

In the medium-term picture, AUDUSD is in a range within the 0.7200-0.6830 boundaries. The neutral outlook is likely to stay in place as long as the 50-day SMA holds in a sideways move below the 200-day SMA.

In brief, AUDUSD is likely to recoup some losses in the very short-term, while in the medium-term, the risk remains neutral.