Managing your own investments requires significant time commitment – not all investors can afford this luxury. For this reason, many choose to entrust their funds to professional fund managers for investment management. To select the right fund manager for equity investing, there are three key principles to follow.

Principle #1: Return on Investment

The primary responsibility of a fund manager entrusted with your capital is to generate profit. However, the returns should align with the investment strategy that you find most suitable for your needs.

For example, suppose an investor prefers an aggressive investment strategy:

- Compare the bank interest rate with the fund manager’s annual returns over several years to determine the return premium, then decide whether it meets your expectations.

- Check whether the manager outperforms a “buy and hold” strategy using stocks from the index composition.

- Compare the manager’s return changes with the dynamics of the Moscow Exchange total return index, which can be found on the official website.

If the manager’s returns are lower than the index dynamics, this is not necessarily a reason to reject them. It’s quite possible that their risk level is lower, meaning smaller drawdowns.

Principle #2: Risk-to-Return Ratio

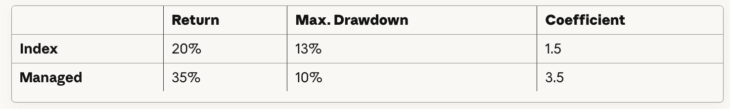

Next, compare the manager’s maximum drawdown with the index’s maximum drawdown for the same period, then calculate the risk coefficient by dividing returns by maximum drawdown. This will clearly show whether the manager’s risks are higher or lower than the index.

The calculations show that for every 1% of risk, the index generated 1.5% returns, while the manager generated 3.5%. Consequently, investing with the manager was more profitable than investing in the index.

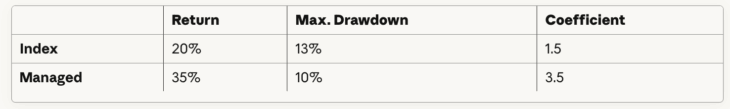

As mentioned earlier, a manager’s returns may be lower than the index due to lower risks. For example, it could look like this:

Despite the manager’s lower returns, their risks are also lower. For investors who take a conservative approach, such a manager would be an excellent choice.

Principle #3: Fee Structure

Don’t forget that fund managers don’t work for free – they charge management fees. Typically, the fee is paid annually and consists of a percentage of assets under management plus a percentage of profits earned. In addition to management fees, there is also income tax – for residents, this amounts to 13%.

Therefore, your final profit will be calculated as:

Investor’s Profit = Manager’s Returns – Management Fees – Income Tax

In conclusion, selecting a fund manager is a decision that requires careful consideration if you want to generate profits while saving time.