The markets will be in a holiday liquidity shortage on Monday as Britain and the US will be offline. The week looks to be promising and event filled especially for the US Dollar. The economic news that will come out are not market moving for the US dollar, much less so than for its data sensitive counterparts. Especially the Euro which is the most sensitive out of the G7 currencies to publications of economic data.

There are very few assets that have outperformed US equities in the last 10 years. Currently US indexes have managed to hold off from the next fall from their respective support levels. Such a break would allow for continuous falling to the next support level which is quite far away. The current reversal was quite substantial in the month of May and now markets are in for a period of stability.

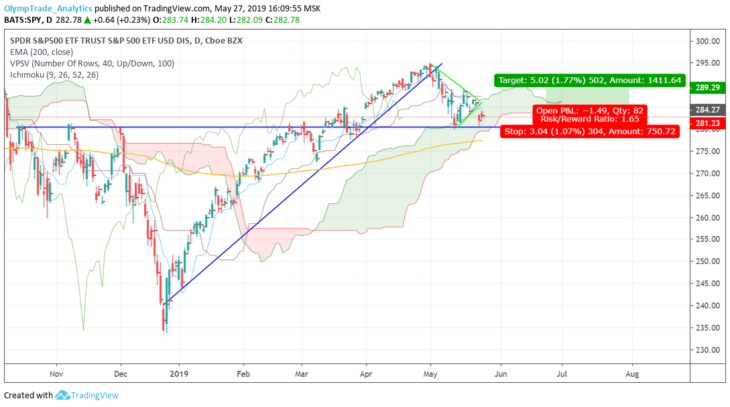

S&P 500

Today we are looking for entry points in US indexes. It is preferable to trade the S&P 500 over the DOW for several reasons. The S&P is more liquid, represents more of the market, has a larger demand on its derivatives (Emini, SPY) but it also lacks the ability to hold the price above 2900. All year this year, the S&P has severely outperformed all its market counterparts included in the All World Composite Index. It is the preferred risk-on asset but it also has the most to lose.

Currently the environment is uncertain. We see a break to the upside much more probable than a bearish breakdown which will pull the world markets into a downward spiral. A move to the upside followed by a range is what is most likely to happen this week. The closer we get to record highs that we saw at the beginning of the month the harder it will be for price to stay there. Just as a break down below 2800 would also be very difficult to open and keep. For this week we see a bit of stability, speaking from a technical point of view.

There are a few fundamental issues in the world today that could lead to a change in market conditions: tradewars, Brexit headlines, negative Bond yields, and the Iranian armed conflict. Amplitude of market volatility could be high from any of these risk events, but commitment of follow-through is not expected. Global growth across the world is stifled by the risk of recession. Many central banks have expressed warnings around this matter. The Fed, the Bank of England, the Bank of Japan, and the ECB have all expressed this concern, calling it an external risk that could enter their economies and become a local problem. US treasury yields are expected to keep falling and the S&P 500 should be range bound.

For the S&P price has dipped into the ichimoku cloud and respected the level of 2800 (280 on the SPY). From here price could go either way. The bounce from this level is somewhat peculiar as we see a gap and fall candlestick pattern two days in a row. A buy position could be opened at the price level of 2840 (284) if it is a clean break, but if price gaps over this level it is wise to wait for a correction and buy at the close of the day if similar market conditions present themselves. A buy position would be considered invalid if price drops down below 2800(280). A short position can be opened when we see a close of the day below this level, but we recommend to wait for a retest.