- Euro drops after German PMIs suggest recession ahead – but there may be good news there too

- Trump’s trade remarks dampen risk appetite

- Oil prices jump on reports Saudi output may be offline for longer

Euro reels as preliminary PMIs paint a gloomier picture

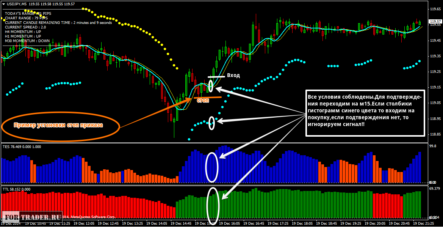

The single currency is on the back foot early on Monday, following the release of the preliminary French and German PMIs for September, which signaled that more pain lies ahead for the European economy. All the figures missed their forecasts, but standing out the German composite index, which fell below 50 for the first time in six years, indicating that the euro area’s largest economy is now in contraction.

Considering that Germany already contracted in Q2, today’s numbers effectively increase the risk of another negative quarter in Q3, which by definition would constitute a technical recession. It seems that the malaise in manufacturing – owed to trade and Brexit worries hitting exports and investment – has started to spread to the much larger services sector as well.

All the gloom aside though, are today’s numbers really a blessing in disguise for the euro area, in the form of raising the odds for a major fiscal stimulus package? Remember that the only major European economy with any real fiscal space is Germany, and Berlin has been adamant that it will only open the spending taps if a recession hits. With a recession – at least a shallow technical one – now looking all but inevitable, this may be exactly what’s needed to jolt politicians into action. Make no mistake, any credible signals for a major German fiscal package could be a game changer for the battered euro.

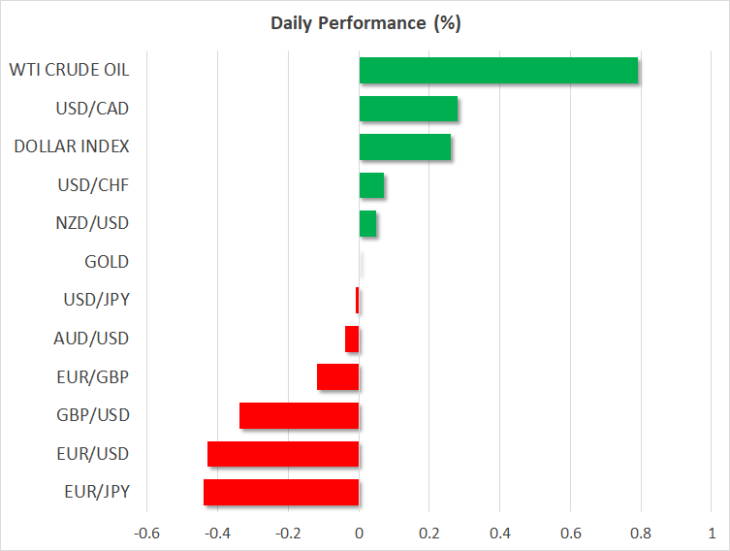

Risk aversion creeps back as markets get jittery about trade

Global risk sentiment was dealt a blow on Friday, with stocks coming under selling pressure while safe havens such as the yen advanced, after the Chinese delegation visiting the US for mid-level trade talks cancelled a scheduled trip to US farms. The officials decided to return to Beijing earlier than planned, which markets interpreted as a signal that the trade talks failed to bear fruit.

Casting more doubt on the prospect of a breakthrough next month, were some remarks by President Trump that he isn’t “looking for a partial deal” and that he doesn’t “need” a deal at all before the 2020 election. Coming on top of recent reports that top US negotiator Lighthizer sees little prospect of an ‘interim’ deal in October, Trump’s lack of urgency tempered optimism even further, eliciting a rotation away from trade-sensitive currencies like the aussie and kiwi.

Where to now in the trade war? A comprehensive agreement remains a theme for the distant future, and admittedly, even a ‘limited’ deal seems unlikely for now given Washington’s absence of enthusiasm for one. This suggests that nothing concrete may come from the October negotiations, which would ultimately leave markets disappointed. That said, the pattern heading into the last few rounds of talks has been both sides striking a calmer tone and playing up hopes for a breakthrough, so risk sentiment could remain supported before the two camps actually meet.

Oil prices lifted by reports about Saudi production

In energy markets, crude oil prices are higher to kick off the week, following reports that repairs to the damaged Saudi Arabian oil facilities may take much longer than previously expected. Tensions in the Middle East remain extremely high, and the fact that the US is deploying more troops to the region should not be overlooked.

For markets, the possibility of more escalation may keep a floor under oil prices for now, even if the risk of an all-out military conflict remains relatively low, given Trump’s recent remarks that he would “like to avoid” war with Iran.