Very often, the Internet is flooded with ads selling traders a profitable advisor. According to the seller, a trader who buys it will double their deposit by at least 100% in just one month. Usually, the proof is a flashy strategy tester report from MetaTrader. Let’s discuss whether such promises are trustworthy and what a trader should really spend their money on.

Fantastic Profits

Such an advisor is often offered to traders as a compiled file for MetaTrader without the source code, leaving no way to influence the robot’s trading. The price for this “pig in a poke” can reach $500 or even more. Let’s consider how much a trader might earn by buying such a robot and running it on a live account.

Suppose the initial deposit is $500 with 1:100 leverage. The purchased advisor doubles the amount in a month, then doubles it again the next month, making the deposit $2000. After 6 months, the trader would have $32,000! It’s easy to calculate that after a year, the deposit would grow to $2,048,000. Not bad, right?

Even if the advisor delivers only half the promised profit (i.e., 50% per month instead of 100%), the deposit would still grow from $500 to $64,000 in a year! That’s a huge sum. And what if you start not with $500 but with $5,000 or $10,000? The numbers become dizzying.

There Is No Profitable Advisor — Only a Scammer

The question arises: why sell such a profitable advisor for only $500? Why doesn’t the seller trade with it themselves?

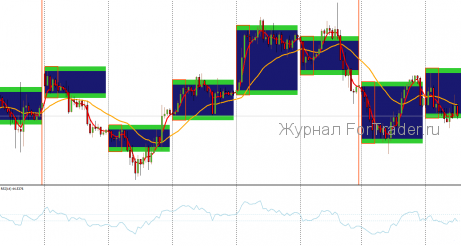

The answer is simple: there is no profitable advisor, only a scammer who skillfully presents inexperienced traders with beautiful backtest reports from MetaTrader. The seller profits from selling the advisor itself. It’s very likely that the seller has no real connection to trading but simply took any suitable advisor, optimized it for historical data, created an attractive report in the terminal, and sells this “Grail” to traders who cannot see through the scam.

Never buy such advisors! In these cases, you are always buying a backtest report, not a robot that will generate future profits. Any complaint will be met with excuses like market changes or that everything evolves, and so on…

More believable are test results showing 100% profit per year. Imagine the advisor really doubles the deposit in a year. Investing $10,000 now would make you a millionaire in 7 years. How much would such a trading system cost? And why sell it if you can turn $10,000 (the price of a domestic car) into millions? The answer is again obvious: the trading system sold to traders cannot consistently deliver such profits. The seller understands this and tries to make as much money as possible from sales during the peak performance of the robot.

What a Trader Should Spend Money On

It makes sense for a trader to buy an advisor whose performance can be observed before purchase on a demo account, or better yet, on a live account. For the seller, this is easy: just open an account, run the robot, and publicly share its performance statistics. Any trader can verify its functionality and decide to buy. This is the most honest way to sell.

Even if the purchased advisor does not bring the promised profit, it will not be due to seller fraud (provided the advisor executes the same trades as the one on the seller’s demo account, which remains active to attract other buyers). However, its price will likely be quite high. Why? Because it’s not cheap. Consider how much a small factory costs and compare that to the profit it generates annually. How is an advisor different from such a factory? By buying a ready-made option, the trader acquires a tested business that generates profit. And that costs a lot.

It also makes sense for traders to buy various original indicators or scripts that simplify trading. In this case, no profit is promised, but the trader gains additional tools for working in the Forex market.

Furthermore, traders should consider commissioning advisors from MQL programmers based on their own trading strategies. This automation simplifies routine tasks and helps quickly test or adjust strategies to the market. Whether the advisor will be profitable depends on the system the trader implements.

Traders may also benefit from buying various literature if it seems useful. Even if the book turns out mostly useless, some ideas or thoughts may still be interesting and helpful for trading.

Only one thing makes no sense for a trader — buying a ready-made advisor that shows profits in MetaTrader’s strategy tester, no matter how impressive the report looks.

Next time someone offers you a ready-made advisor, be smarter and ask yourself: why are they trying to sell you a hen that lays golden eggs?