Throughout the history of market trading, nothing fundamentally new has been invented – it all boils down to the classic principle of “buy low, sell high.” This principle applies across all financial markets and asset types.

Cryptocurrency trading is no exception in this regard. However, the unique nature of digital assets has introduced several additional errors typical to crypto trading. Here, we present five of the most common mistakes traders make when dealing with Bitcoin and altcoins in the cryptocurrency market.

Contents

- Mistake #1: Falling Victim to Buying Without Reason

- Mistake #2: Incorrectly Set Price

- Mistake #3: Wrong Wallet or Wrong Cryptocurrency…

- Mistake #4: Trading Cryptocurrencies with Low Liquidity

- Mistake #5: Fanatical Trading

- Conclusion

Mistake #1: Falling Victim to Buying Without Reason

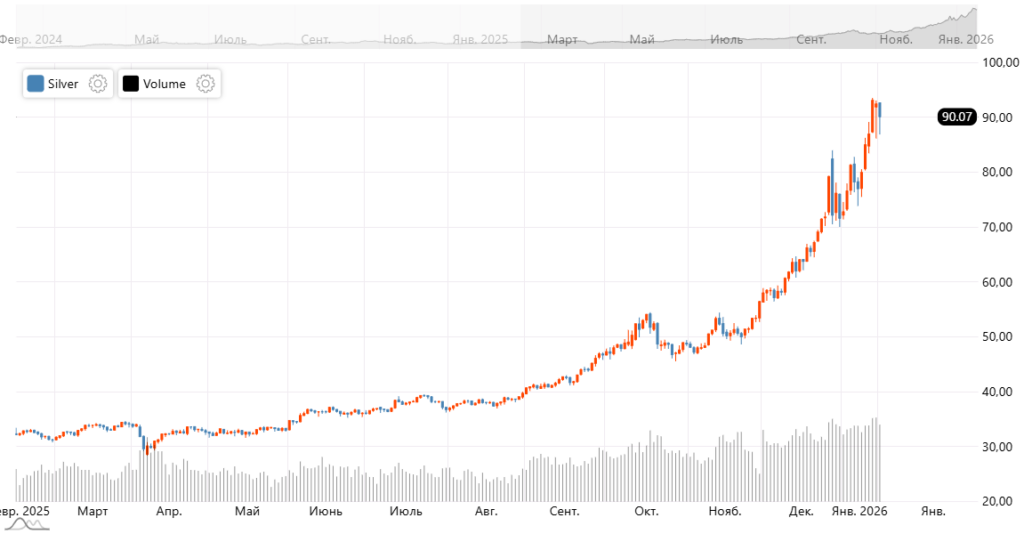

The Pump and Dump scheme has long been known in markets, but the rise of cryptocurrency trading has given it a new lease on life. While participants in traditional stock, currency, and commodity markets are strictly regulated and monitored, many mid-tier crypto exchanges operate without oversight, allowing scammers to operate freely.

Often, novice crypto traders fall prey to this scheme. At some point, a speculator sees a rapidly rising candle on the chart of a cryptocurrency like SuperPuperCoin. Expecting quick profits, they open a buy position. Usually, this happens just before scammers start taking their profits.

The trader’s joy over apparent gains is short-lived – after entering the position, the coin’s price reverses sharply because the upward momentum is no longer supported, leading to a rapid decline. Instead of quick profits, the trader suffers an equally quick loss.

This is the first critical mistake – buying a cryptocurrency during a sharp price surge without any clear, justified reasons. Of course, sometimes a trader might get lucky by entering mid-move and exiting before the reversal, but this is rare in day trading. More often, the trader becomes a victim of Pump and Dump, and their money ends up in the scammers’ pockets.

Mistake #2: Incorrectly Set Price

Traders accustomed to currency market quotes can be overwhelmed by the numbers on crypto exchanges.

Because digital assets often have very different decimal places and number formats, the second mistake is inattention. When trading cryptocurrencies, it’s easy to misplace a decimal point or miscount zeros.

To avoid costly errors, always double-check the orders you are about to place.

Mistake #3: Wrong Wallet or Wrong Cryptocurrency…

Currently, there are over 5,000 types of coins, including Bitcoin and its four forks that include “Bitcoin” in their names. For inexperienced users, it’s easy to confuse similar tickers.

Common cases include sending Ethereum to an Ethereum Classic wallet or confusing Bitcoin Cash (BCH) with Bitcoin Gold (BTG) or Bitcoin Diamond (BTD).

If the exchange or wallet has responsive support, recovery might still be possible. However, even then, the time spent trying to recover lost funds is frustrating and detracts from trading.

This mistake also includes risks from computer viruses that can replace wallet addresses during withdrawals, a broader security issue in the crypto space.

Mistake #4: Trading Cryptocurrencies with Low Liquidity

Crypto exchanges offer trading in hundreds of digital assets, but not all are equally profitable. Experienced traders recommend starting with coins that have relatively high trading volumes.

The value of a cryptocurrency depends on demand. Popular coins have buyers pushing prices up.

Simply put, if there are no buyers at the current price, sellers must lower their price to stimulate sales. Buying an UnknownCoin at $1 and selling it at 75 cents is hardly profitable. Liquidity is what gives a cryptocurrency its price; without it, it’s just a crypto oddity.

Mistake #5: Fanatical Trading

Many novice traders on currency markets suffer from this “sin,” but crypto trading amplifies it due to much higher volatility compared to traditional currency pairs.

Even after securing a 20% profit, it’s hard to resist opening another buy position when the price continues to rise. However, crypto market volatility often plays tricks – a confident rise can quickly turn into a sharp fall, turning a 20% gain into zero or even losses.

Another variant is holding a promising coin with a 25% profit, expecting a 150% rise. While this approach fits long-term trading, it means part of your deposit is “frozen” in one trade and can’t be accessed immediately. Taking profits by closing and reopening positions during corrections is more reasonable, but frequent trades incur commissions that eat into profits.

Conclusion

Cryptocurrency trading offers great interest and many opportunities for profit, making it impossible to ignore. Everyone makes mistakes; only those who do nothing never err.

We sincerely hope that learning from the experiences of traders who lost money on these mistakes will help you avoid them and enjoy profitable and positive crypto trading.