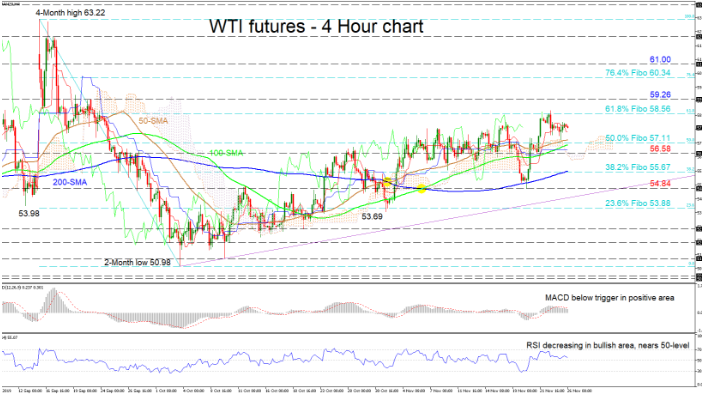

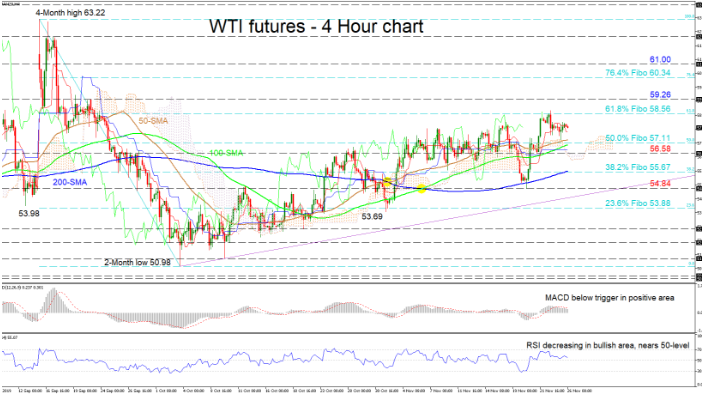

WTI oil futures have eased slightly off the 58.56 resistance, which is the 61.8% Fibonacci retracement of the down leg from 63.22 to 50.98, following the recent price appreciation from the bounce off the 200-period simple moving average (SMA).

The short-term oscillators reflect a stall in the positive momentum. The MACD, in the positive zone has slipped below its red trigger line, while the RSI is decreasing in the bullish region and is nearing the 50-level. However, as the price has found support from the 50-period SMA and the Ichimoku cloud, and the SMAs’ bullish stance is still intact, it seems that the commodity may continue to gain ground.

If buyers pick up, they initially could encounter the restrictive 61.8% Fibo of 58.56 and if overrun, may move to test the 59.26 resistance from September 23. Climbing above that, downside pressure from the 76.4% Fibo of 60.34 may halt the price from improving to test the 61.00 barrier.

Alternatively, if sellers steer lower, immediate hindrance could come from the Tenkan-sen line before approaching a more challenging support area around 57.11 to 56.58. This entails, the 50.0% Fibo, the 50- and 100-period SMAs, the Kijun-sen line and the swing low. Overcoming this, could drive the price to test another tough support at the 38.2% Fibo of 55.67 where the 200-period SMA also lies, before the swing low of 54.84 comes into focus.

In brief, oil has maintained its short-term bullish bias and a break above 59.26 would only strengthen it. However, if there’s a break below 53.69, it would turn the bias neutral-to-bearish.