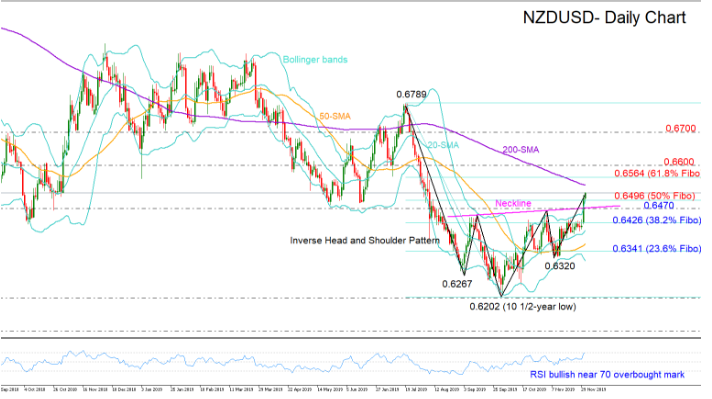

NZDUSD run significantly above the neckline of the bullish inverse head and shoulder formation it has created around the 10 ½-year low of 0.6202 on Monday.

The short-term bias is now looking cautiously bullish as the price is currently fluctuating around the upper Bollinger band and the RSI is looking ready to pierce above its 70 mark, both indicating that the market is likely trading near overbought waters.

The 50% Fibonacci of 0.6496 of the downleg from 0.6789 to 0.6202 is the nearest support area to keep in mind if selling pressure returns to the market. A break below that barrier would shift attention straight to the neckline of the bullish formation around 0.6470, where any forceful break lower would reduce confidence over an up-trending market. Slightly lower the 38.2% Fibonacci of 0.6426 could also stop downside corrections ahead of the 23.6% Fibonacci of 0.6341.

In the positive scenario, an extension above the 200-day simple moving average (SMA) could meet immediate resistance near the 61.8% Fibonacci of 0.6564. Moving higher the 0.6600 psychological level may apply some pressure before attention shifts to the 0.6700 handle.

Summarizing, NZDUSD looks cautiously positive in the short-term after forming a bullish inverse head and shoulder pattern. A rebound off the 0.6470 neckline followed by additional higher highs and higher lows would confirm the start of an uptrend.