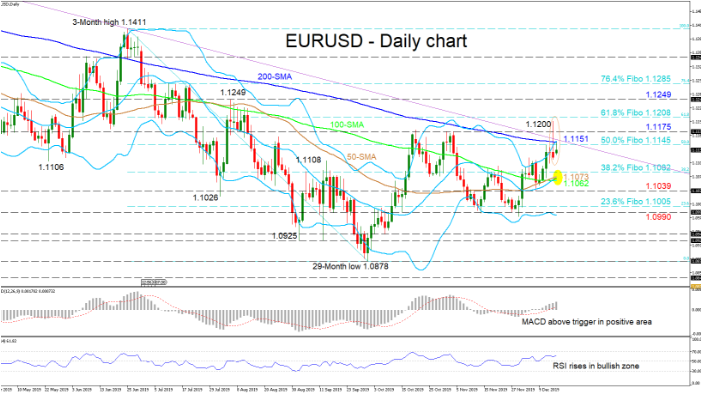

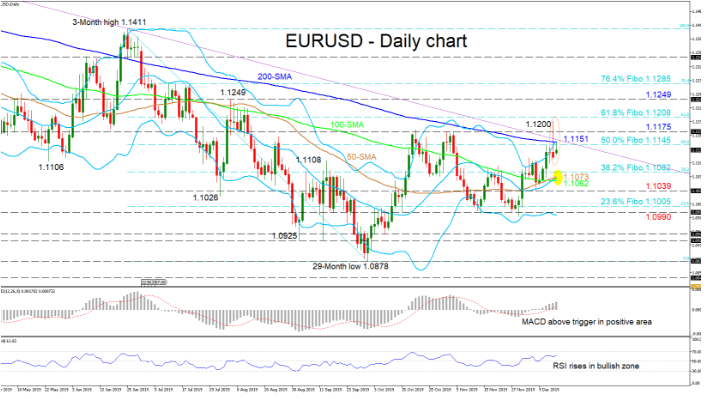

EURUSD’s attempts to climb above the downtrend line are finding significant downside pressure around that area of 1.1145, which is the 50.0% Fibonacci retracement of the down leg from 1.1411 to 1.0878 and where the upper-Bollinger band and 200-day simple moving average (SMA) also reside. The pair seems to be struggling with the 1.1145 to 1.1208 region of resistance, which may now have been reinforced by the shooting star.

The short-term oscillators suggest that positive momentum is improving. The MACD has distanced itself above its red trigger line in the positive region, while the RSI is advancing in the bullish territory. The false break by the candle formation could suggest that the pair may consolidate or even readjust with the larger negative outlook, also reflected in the downward sloping 200- and 100-day SMAs.

If sellers re-emerge, initial resistance could be seen at the 38.2% Fibo of 1.1082 followed by the 1.1073 to 1.1062 area, where the mid-Bollinger band, 50- and 100-day SMAs are located. Overrunning that, the nearby swing low of 1.1039 could interrupt the test of the 23.6% Fibo of 1.1005 and troughs at 1.0990, around the lower-Bollinger band.

To the upside, buyers would need to overcome the fortified mark related to the 50.0% Fibo of 1.1145, the 200-day SMA coupled with the upper-Bollinger band at 1.1151 and the downtrend line. Managing this, the nearby high of 1.1175 and 61.8% Fibo of 1.1208 could cap further gains towards the 1.1249 high from August 6 and 76.4% Fibo of 1.1285.

Summarizing, the short-term bias is cautiously positive. Moreover, the current picture leans to the pair realigning with the bigger negative picture.