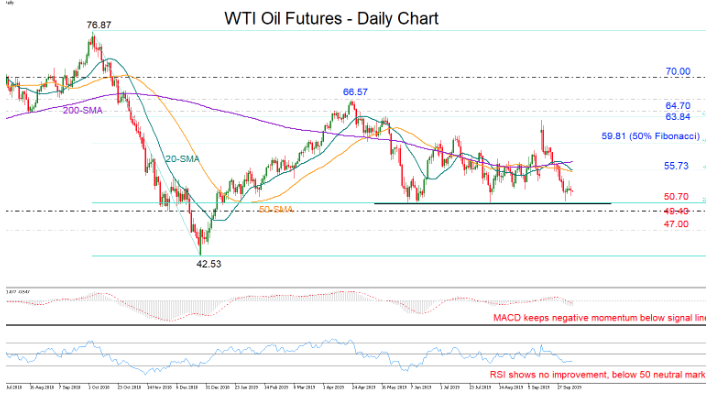

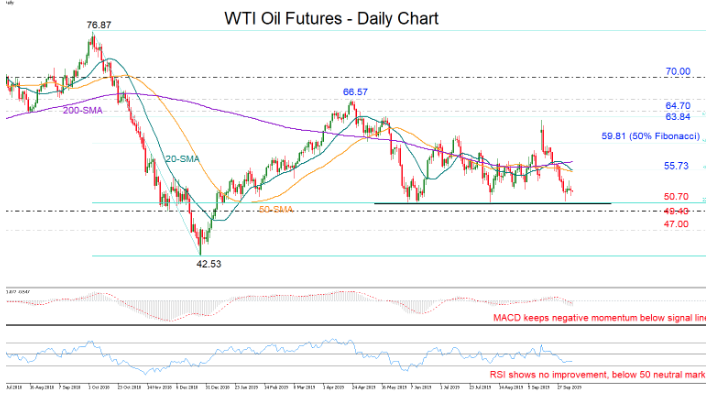

WTI oil futures for November delivery turned indecisive after failing to pierce the floor around the 23.6% Fibonacci of the downleg from 76.87 to 42.53 last week.

The short-term bias, though, remains negative as the price is trending below its moving averages, the RSI is showing no improvement below its 50 neutral mark, and the MACD keeps strengthening under its red signal line.

A breach of the 23.6% Fibonacci of 50.87 could initially stall near 49.40 and then around the 47.00 mark, but it would turn the neutral medium-term picture to a negative one. Additional losses may also retest the 1 ½ -year low of 42.53 and any violation of this would put the market back on a downtrend.

On the upside, the bulls would try to overcome the 38.2% and 50.0% Fibonacci levels at 55.76 and 59.81 respectively. However, only a decisive rally above the 63.84-64.70 area would keep buyers engaged, while a closing price above the 66.57 top could add more fuel to the bullish action, shifting attention straight to the 70.00 mark. The latter would also reactivate positive sentiment in the medium-term timeframe.

Summarizing, WTI oil futures could re-challenge the 50.87 key support as downside risks remain in play. Should the market clear that bottom, the bearish outlook would stretch to the medium-term timeframe too.