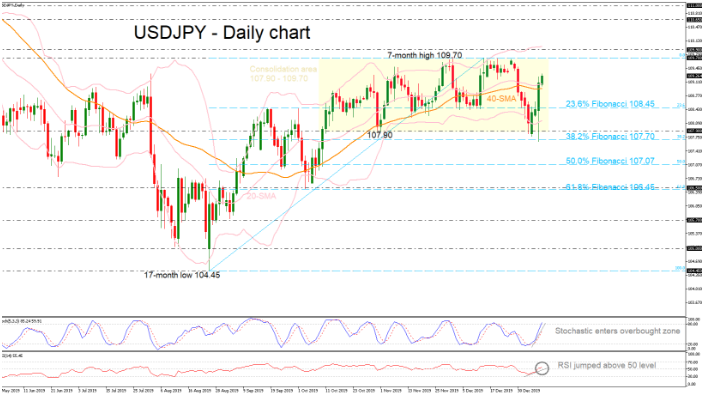

USDJPY ended the day in green after the sharp sell-off on Wednesday, erasing intraday’s losses and surpassing the mid-level of the Bollinger Band (20-day simple moving average) and the 40-day SMA as well. The price rebounded on the 38.2% Fibonacci retracement level the of upleg from the 17-month low of 104.45 to the seven-month high of 109.70, near 107.70.

The momentum indicators are pointing to a positive bias in the very short-term with the RSI just above the 50 level and the stochastic oscillator jumping in bullish territory. However, the pair is still trading within a squeezing Bollinger band channel, confirming the trading range 107.90 – 109.70 over the last three months.

In the event of an aggressive break above the 109.70 resistance and the upper Bollinger band near 109.90, USDJPY could hit the next barrier of 110.65, identified by the peak on May 2019. Clearing this zone, the 111.00 handle, taken from the inside swing bottom on April 2019, could attract attention.

On the other hand, in case of losses and a fall beneath the SMAs, the price should see the 23.6% Fibonacci of 108.45 and the lower Bollinger band line of 108.15. A drop below these levels would touch the significant 107.90 support and further downside pressures below the 38.2% Fibo of 107.70 as well, would reinforce the bearish structure towards the 50.0% Fibo of 107.07.

However, for a resumption of the longer-term uptrend, USDJPY would need to beat the seven-month high of 109.70.