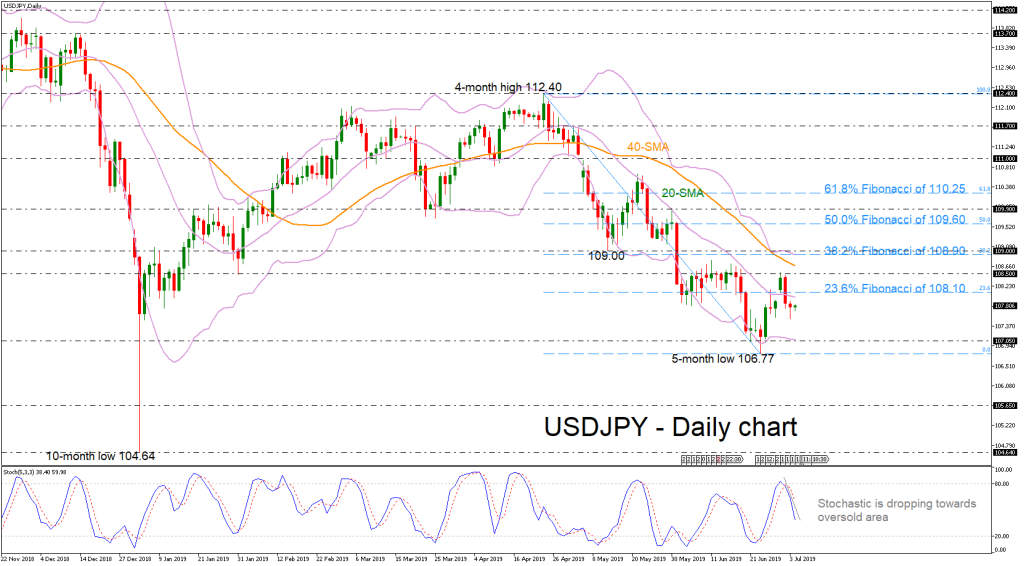

USDJPY held in losses over the previous couple of days, dropping back below the 23.6% Fibonacci retracement level of the downfall from 112.40 to 106.77 near 108.10 and the 20-day simple moving average (SMA). The negative bias in the near term is supported by the deterioration in the stochastic oscillator. The %K line of the stochastic is falling sharply towards oversold levels and posted a bearish crossover with the %D line.

If prices continue to head lower, support should come from the lower Bollinger band, which overlaps with the 107.05 barrier. A drop below this line would open the door for the five-month low of 106.77, while even lower the ten-month low of 104.64 comes into play, reinforcing the bearish bias.

However, should an upside reversal take form, immediate resistance will likely come from the 23.6% Fibonacci mark of 108.10, before touching the latest high of 108.50. A successful advance above this level would take the market until the 40-day SMA currently at 108.66 ahead of the strong resistance near the 109.00 handle, which encapsulates the upper Bollinger band and the 38.2% Fibo.

In the short-term, the outlook remains negative since prices hold below all the moving average lines after the decrease from the 112.40 hurdle.