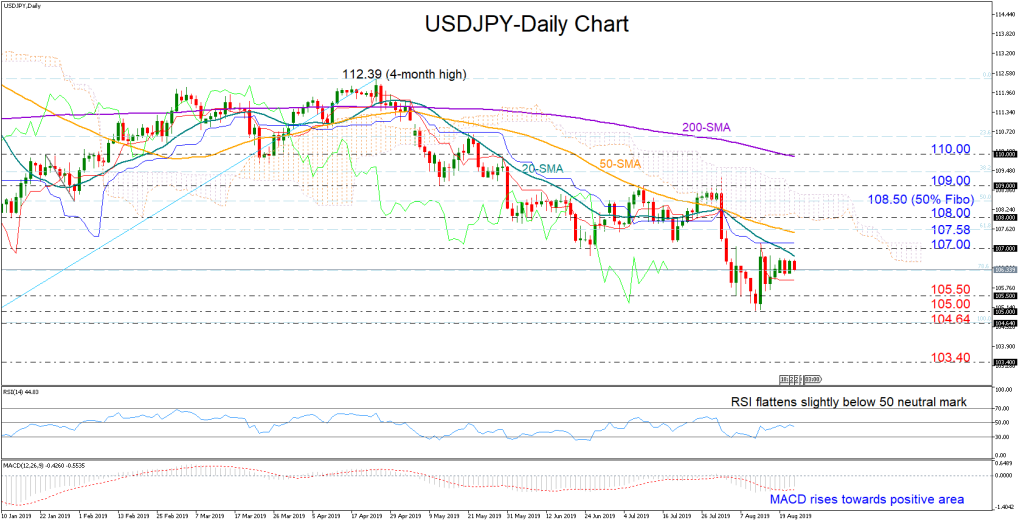

USDJPY has been in a quiet and narrow trade this week, moving sideways within the 106.00 area but below its downward-sloping simple moving averages (SMA) and the Ichimoku cloud – a negative trend signal.

In momentum indicators, the red Tenkan-sen continues to flatten below the blue Kijun-sen, while the RSI has also somewhat stabilized after strongly rebounding from the oversold territory, both suggesting a neutral-to-bearish bias for the short-term. The MACD, however, keeps improving in the negative area, increasing hopes for a supported market.

The pair could attract positive traction above the 107.00 mark and reach the 50-day SMA which is currently slightly below the 61.8% Fibonacci of 107.58 of the upleg from 104.64 to 112.39. Should the bulls pierce the bottom of the Ichimoku cloud, a bigger challenge could emerge between the 50% Fibonacci of 108.50 and the 109.00 mark.

On the downside, the 105.50-105.00 region remains in the spotlight as any step below that line could give the leading role to the bears, bringing the crucial 104.64 trough back into view. Breaking that floor, traders could next watch at 103.40, a key barrier during 2016.

Meanwhile in the medium-term picture, bearish conditions remain in place, with the market holding a negative pattern below the 110.00 level.

In brief, USDJPY is likely to extend the sideways direction in the short-term and hold bearish in the medium-term.