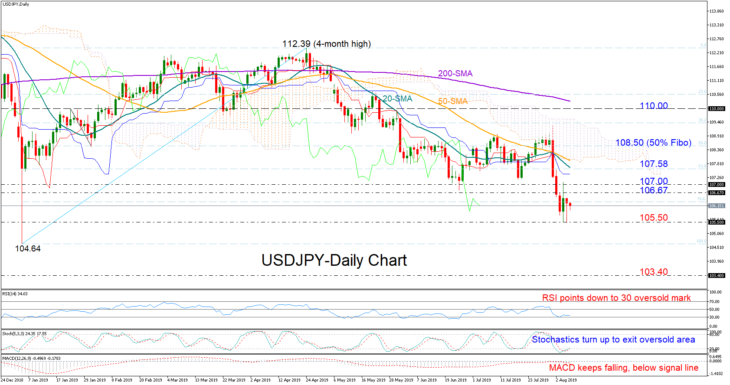

USDJPY put brakes on the sell-off near the key 105.50 area twice this week and turned to consolidation.

Trend signals remain bearish as the market action continues to take place well below simple moving averages (SMA) and the Ichimoku cloud, whilst the momentum indicators suggest that the next move in the price could be bearish-to-neutral. The MACD keeps strengthening downwards and under its red signal line, the RSI points towards its 30 oversold mark, whereas the Stochastics are sloping upwards after creating a bullish cross below the 20 oversold mark.

Immediate resistance to upside corrections could be detected within the 106.67-107 territory. Slightly higher, the 61.8% Fibonacci of 107.58 of the upleg from 104.64 to 112.39 and the 20-day SMA could also block the path upwards, while further up, the bulls must overcome the 50-day SMA to reach the 50% Fibonacci of 108.50.

In the negative scenario, where the market breaks below the 105.50 level, the spotlight will turn to the strong January 3 low of 104.64. In case the number proves easy to get through, support could be next found close to 103.40.

Meanwhile in the medium-term picture, the outlook has turned even more negative following this week’s slump and only an aggressive rally above 110 could change the view to neutral.

Summarizing, the short-term bias is currently seen as bearish-to-neutral, while in the medium-term timeframe the market continues to hold a bearish profile as long as the price keeps trending under 110.