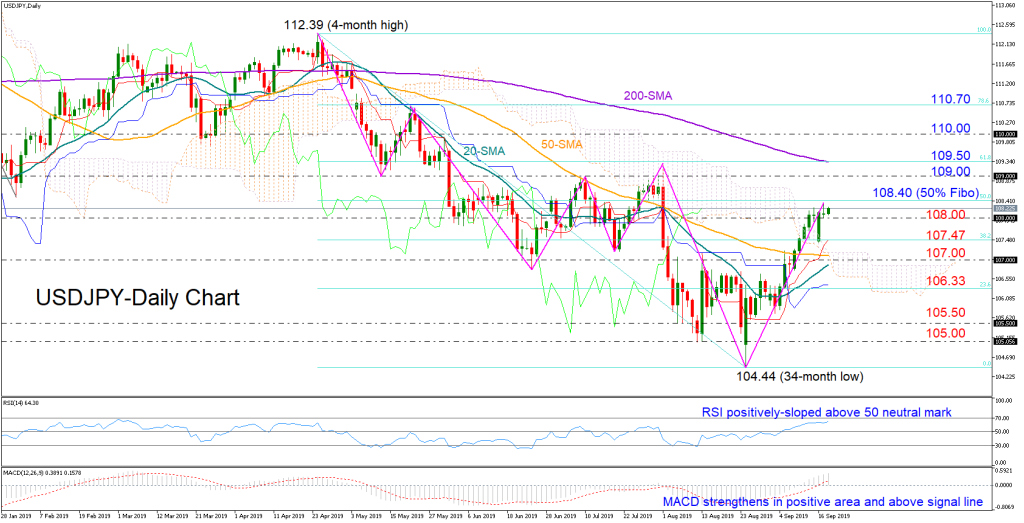

USDJPY has finally revived some bullish power, spiking above its shorter-term simple moving averages (SMA) and the Ichimoku cloud to reach one-month highs slightly above the 108 level.

Technically, the market could retain positive momentum in the short-term as the RSI, the Tenkan-sen and the MACD all point upwards in the bullish area.

The 108.40 handle, which is the 50% Fibonacci of the downleg from 112.39 to 104.44, is currently in sight and any significant step above this mark may likely bring a more important barrier between the 109.00 level and the 200-day SMA in the spotlight. Another break higher would scrap the downward pattern from the 112.39 peak and push resistance up to 110, while further up the 78.6% Fibonacci of 110.70 should be the next level to watch.

In case of a downside reversal, the 38.2% Fibonacci of 107.47 could provide nearby support before attention turns to the 107.00 round-level. A steeper decline would put the pair back into the August neutral zone while a takeout of the 23.6% Fibonacci of 106.33 could open the door for a drop to the 105.50-105.00 area.

Meanwhile in the three-month window, the bearish outlook switched to neutral following the rally above 107.00. The sentiment could further improve if the price manages to successfully overcome the 110 number.

Summarizing, USDJPY is likely to maintain its bullish appetite in the short-term, though in the medium-term an upturn above 110 is required to restore positive sentiment.