- US employment data today will be crucial for Fed rate-cut expectations and dollar

- Canadian jobs figures also due, as loonie touches new 2019 high

- In Europe, bond markets continue to price in QE, but euro snoozes

US payrolls may dictate how deep Fed cuts in July, dollar’s path

After a relatively quiet session on Thursday, both in terms of market moves and news flow, the spotlight will fall on the US employment data today. Markets are still pricing in a ~25% probability for a ‘double’ rate cut of 50 basis points at the Fed’s upcoming meeting, so any significant surprises in these data could be crucial in shaping expectations for that event, and by extension for the dollar.

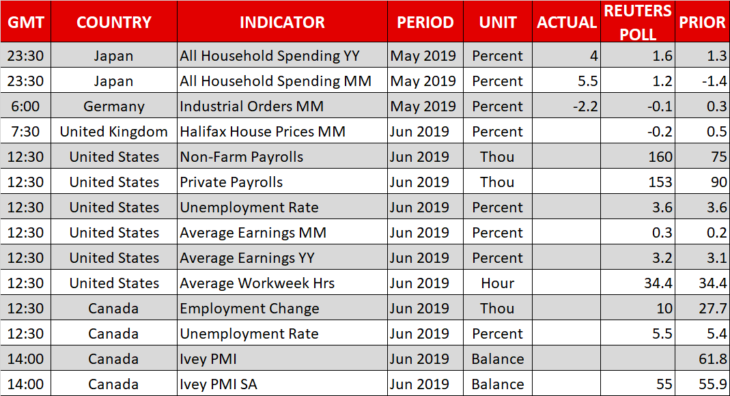

Forecasts point to a solid report overall, with nonfarm payrolls expected to clock in at 160k in June, the unemployment rate to hold steady at a 3.6%, and average hourly earnings to accelerate slightly to 3.2% in yearly terms from 3.1% earlier. If the actual prints meet expectations, that would likely calm some nerves about a weakening labor market and thereby prompt investors to trim some of their Fed easing bets, lifting the dollar but pushing stocks lower.

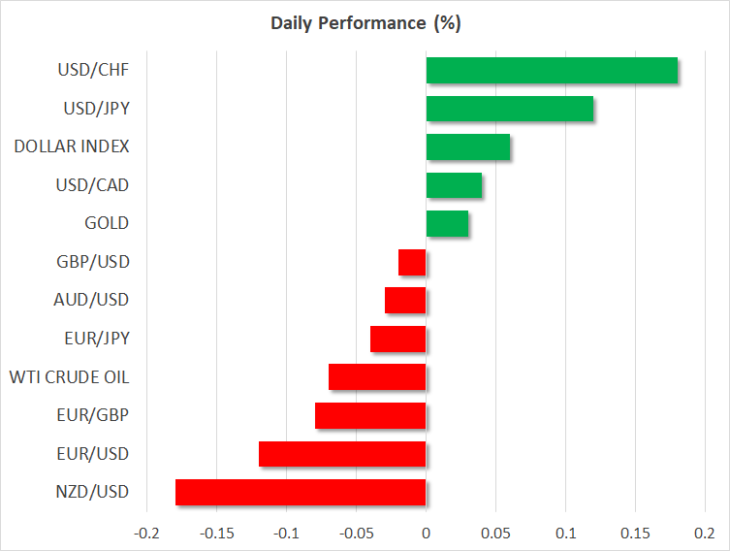

Even in this case though, any relief rally in the greenback – and any retreat in equities – may prove relatively short lived. The bigger picture remains that of a weakening dollar if central banks indeed start easing as aggressively as markets expect, by virtue of the Fed having much more room to cut rates than any of its peers. In this environment, an outperformer may be the yen, as the BoJ already has in place the most aggressive stimulus program globally, and therefore has almost no space to ease further.

Canadian jobs data also due, as loonie soars to year highs

Canada’s jobs figures for June will hit the markets at the same time as the American prints. Expectations are for a relatively soft set of data, with the unemployment rate forecast to tick up to 5.5% from a four-decade low of 5.4%, and the net change in employment to decline, but remain in positive territory.

While a weak batch of data may hurt the loonie on the news, keep in mind that the jobs market has been on a tear, so one soft month after such a streak seems natural. Indeed, the Canadian economy has been an oasis of strength lately, which means the BoC may be among the few major central banks that won’t cut rates soon – perhaps alongside the Bank of England. The bottom line is that as long as the Fed-BoC policy divergence narrative holds, the broader outlook for the loonie remains bright.

Euro snoozes even as bond markets price in ferocious QE

The main story yesterday was that the yield on German 10-year bonds fell below the ECB’s deposit rate of -0.40% for the first time. While the move didn’t carry through into the FX arena, with the euro trading mostly flat, it still highlights that investors are snatching up all the European bonds they can find, confident that ‘ECB President Lagarde’ will not hesitate to hit the QE button when the time comes.

The key reason the euro has not moved in the face of falling European interest rates, is that US rates have collapsed by even more lately, narrowing the spread in Europe’s favor. In this sense, relative rate differentials argue for a higher euro/dollar in the longer-term, if both the Fed and ECB bring out the ‘bazookas’ again.