Friday intraday returns of the Asian shares swayed around zero as Powell comments on Thursday delivered chilling influence on risk assets and was basically spent, investors turned their focus on Chinese trade and money aggregates data while fresh Trump threats to impose sanctions against China could start to override Powell’s optimism.

Chinese exports are expected to post contraction in June against the background of shrinking global demand and measures of US retailers to offset tariffs and prepare for new sanctions. Market anxiety can be tempered with data on credit expansion in China, which release is due on Monday. Previous episodes of sharp increase in the volume of new loans led to a rally in risky assets in China also bringing some buoyancy for the stock markets abroad.

It’s possible that deteriorating manufacturing and foreign trade indicators in the second quarter prompted policymakers to grab “low-hanging fruit” – seeking benefits from short-term monetary stimulus instead of solving long-term structural problems (such as blossoming shadow banking sector and rising number of corporate debt defaults). According to the consensus forecast, the volume of new loans in China could grow from 1,180 billion in May to 1,675 billion yuan in June; exports will show negative growth of 0.6%; imports will continue to shrink at a rate of -4.6%.

The Singapore economy, which is notable for its very high average GDP growth rates (one of the so-called “Asian Tigers”), grew in the second quarter at the lowest pace in a decade amid declining demand for electronics for the sixth consecutive month. Exports’ growth rate tumbled to the lowest level for three years.

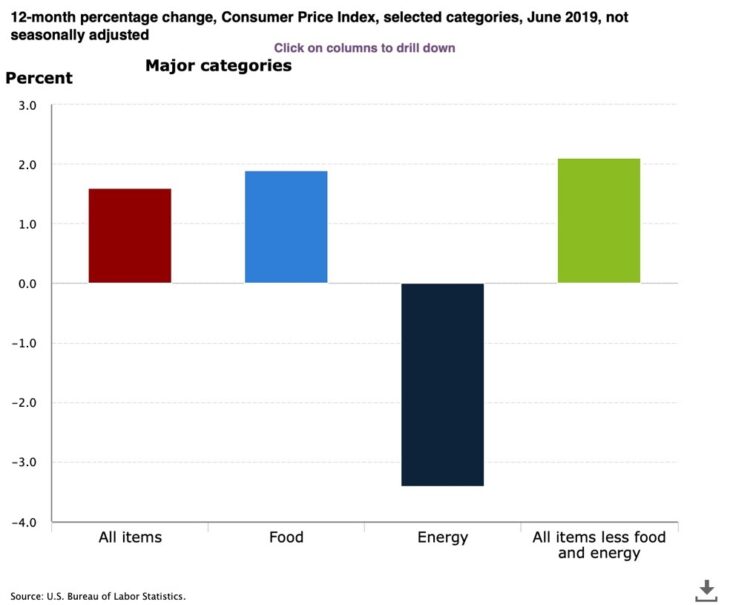

The rate of consumer inflation in the US in June was a small but pleasant surprise for the Fed, as decline in the energy inflation component was offset by robust growth of prices of clothing, food, used cars, housing and medical care. The CPI index excluding fuel and food increased by 0.3% MoM in June, making it the best month since January 2018.

ECB June meeting Minutes showed that the policymakers share the main topic of concern with their Fed colleagues: heightened trade uncertainty. Eurozone macroeconomic data inspire less optimism than the United States, but officials seem to be more concerned about the cooling inflation expectations of firms and households. Potential stimulus measures include extending / strengthening forward guidance, lowering rates, more favorable TLTRO terms for banks, and renewing QE.

If the ECB policy stance will lean more and more towards QE, implied gap in the intensity of stimulus between ECB and Fed can easily lead to permanent bearish mood in EURUSD trade. Same as it was in 2013-2014. The minutes also showed that policy decisions will mostly hinge on dynamics of market-based inflation expectations, activity in manufacturing, tariff threats for both the Eurozone and to a lesser extent for China as for the key trading partner. Trump reported on Twitter on Thursday that he was disappointed with China, not honoring their promises to increase purchases of agricultural products, hinting that the fragile truce concluded at the G-20 summit in Osaka is in jeopardy.