- Trade ceasefire propels stocks and dollar higher, sends safe havens lower

- Oil rejoices on trade truce and OPEC agreement

- ISM manufacturing PMI today may be crucial for Fed expectations

Risk sentiment lifted as Trump & Xi decide to restart trade talks

The pivotal meeting between the American and Chinese leaders concluded with the two sides agreeing to restart trade negotiations and hold off on imposing any new tariffs ‘for the time being’. What stood out was that the US also agreed to roll back some of its restrictions on tech giant Huawei, in what seems to have been the ‘price’ for getting Beijing back to the negotiating table.

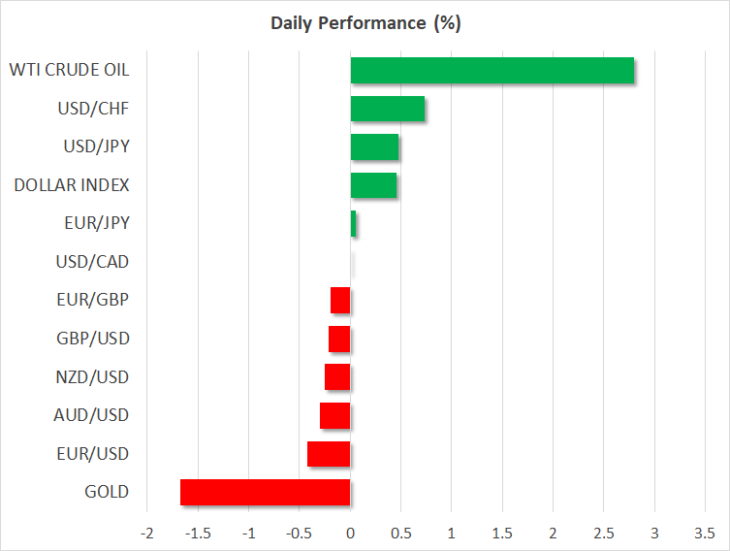

The result was a classic risk-on reaction in markets, with futures tracking the major US stock indices pointing to a ~1.0% higher open today, something that would bring the likes of the S&P 500 and the Dow Jones to fresh all-time highs. Beyond equities, the other major winner has been the US dollar, as the trade truce was seen as lowering the odds for the Fed to cut rates aggressively in the coming months. On the opposite side of the ‘risk spectrum’, safe-haven assets like the Japanese yen and gold are on the retreat.

Overall, while the resumption of negotiations is clearly a positive step, the big picture hasn’t changed. The two nations remain far apart on key issues, including intellectual property protection and an enforcement mechanism, implying that the road to any deal will probably be full of twists. Hence, this ceasefire may keep risk sentiment and the dollar supported for now, but it’s unlikely to be enough to ‘turn the tide’ and reverse the bigger trends that have developed in recent weeks – for instance, that of a stronger yen.

Oil celebrates trade truce, looks to OPEC summit

Crude oil opened higher on Monday, with WTI crossing above the crucial $60/barrel handle as investors reassessed the demand outlook following the optimistic trade signals. That wasn’t all, though, as the latest headlines suggest that Russia and Saudi Arabia agreed to extend the OPEC production cuts, painting a brighter supply picture as well.

Russian President Putin said he agreed with the Saudi Crown Prince, adding that the length of the extension hasn’t been decided yet, but will probably be either six or nine months. Attention now turns to the OPEC meeting that will commence today in Vienna. A nine-month extension of the current output cuts is likely needed to push oil prices higher from here.

Manufacturing PMIs coming up

As for the economic data today, the most important releases left on the calendar will come from the UK and the US.

In Britain, the manufacturing PMI for June is due. As usual though, the pound is likely to respond more to politics than economics. In that sense, the focus remains on the Tory leadership race, and any Brexit-related comments from the two remaining candidates.

In the US, the ISM manufacturing survey will be among the final major pieces of data ahead of the Fed’s July meeting, and could therefore be crucial for the dollar. Traders have scaled back some of the easing bets following the trade truce, with the implied probability for an aggressive 50bps cut this month having declined to ~15%. A solid ISM print could add more credence to the narrative that the Fed won’t cut so aggressively, and thereby help extend the current recovery in the dollar.